Today, Bitcoin price broke above the $28,000 mark to reach a 9-month high. Still, the influx of BTC on exchanges and escalating miner costs underscore the need for caution.

Bitcoin Rally May Hit the Breaks

Bitcoin has experienced a 30% price surge in the past week. Still, on-chain metrics suggest that the price of BTC may retrace towards $24,500 despite this.

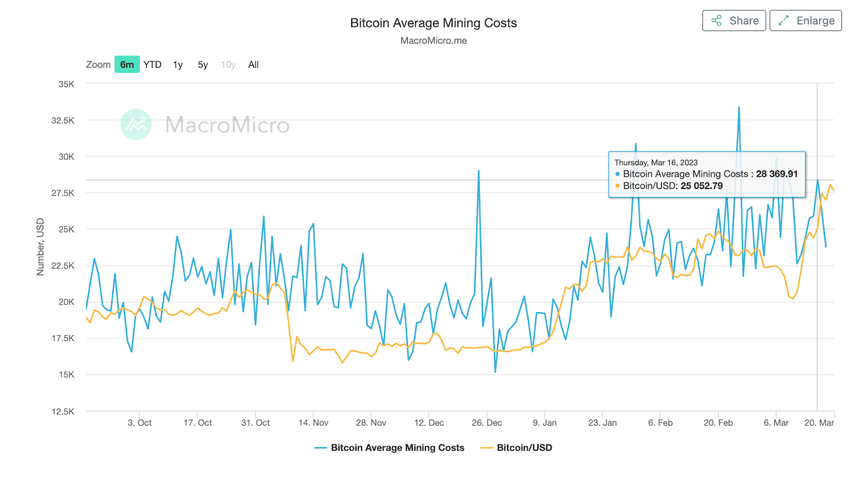

The average cost of mining Bitcoin has risen faster than the price in the past month, according to the economic data analysis platform MacroMicro.

In the 30 days that preceded March 20, mining costs peaked at $33,000 per block, while BTC prices only reached $28,500. The disparity means miners have accumulated losses in the past month, despite the recent price rally.

Notably, Bitcoin price rose above average mining costs by approximately $3,000 on March 18. However, the surplus could soon disappear if new miners join the network in the coming days to profit from the rising prices.

The current price rally could see miners sell more tokens to offset some of their past losses. And with approximately 10% of the total BTC circulating supply in miner reserves, sell pressure from the Bitcoin node operators could have a significant bearish pull on the price of BTC.

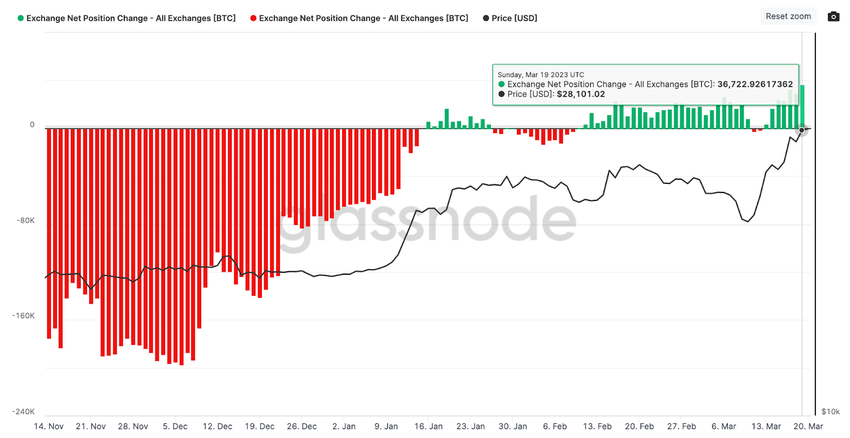

In another cautionary bearish trend, BTC holders have recently accelerated the influx of tokens on exchanges, according to leading blockchain intelligence firm Glassnode.

BTC deposits on exchanges have consistently exceeded withdrawals. In the last seven trading days, the supply of Bitcoin on exchanges has increased progressively from 3,895 BTC on March 13 to more than 36,700 BTC deposited at the close of March 19.

Typically, when exchanges deposits outpace withdrawals for an extended period, it could mean that BTC holders increasingly position themselves for short-term trades and profit-taking opportunities.

If this theory holds, a sell-off will likely trigger BTC price retracement in the coming weeks.

BTC Price Prediction: A Dip Below $25,000

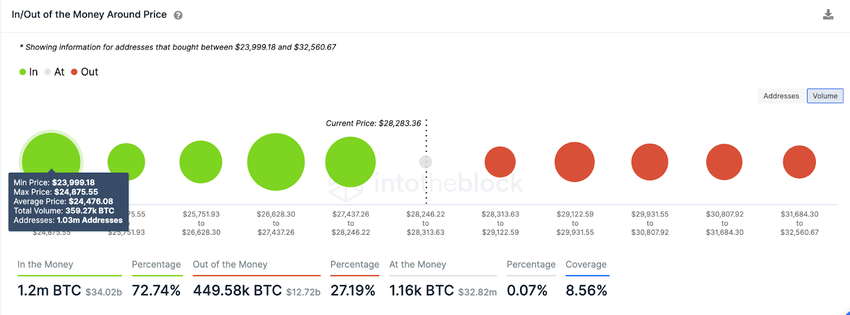

Looking closely at the In/Out of Money at Price (IOMAP) data compiled by IntoTheBlock, $24,500 seems a likely destination for BTC.

The IOMAP chart partitions existing Bitcoin addresses by comparing their average purchase price to the current prices. As of March 20, more than 72% of Bitcoin holders are in profit. This could mean there is considerable room for network-wide profit-taking.

If Bitcoin enters a bearish trend, $27,000 will be the first stop, as the 307,000 addresses that purchased 346,000 units of BTC could offer considerable support. Still, if this demand barrier cannot hold, a sharp decline toward $24,500 can be expected. Here, around 1 million Bitcoin addresses bought 360,000 tokens.

To invalidate the pessimistic outlook, Bitcoin price would have to climb above the $29,500 mark, where 345,000 addresses had previously purchased 130,000 BTC. Moving past this resistance wall could trigger an upswing to $32,000, where a cluster of 237,000 addresses may look to sell some of their 74,000 BTC.