The Sui (SUI) price broke down from a long-term horizontal resistance area on May 8 but has since regained its footing and made a comeback attempt.

Despite the ongoing bounce, numerous levels are left to clear for the SUI trend to be considered bullish. Will the price manage to clear them, or will momentum fade, leading to the continuation of the decrease?

Sui Descent Accelerates After the Breakdown

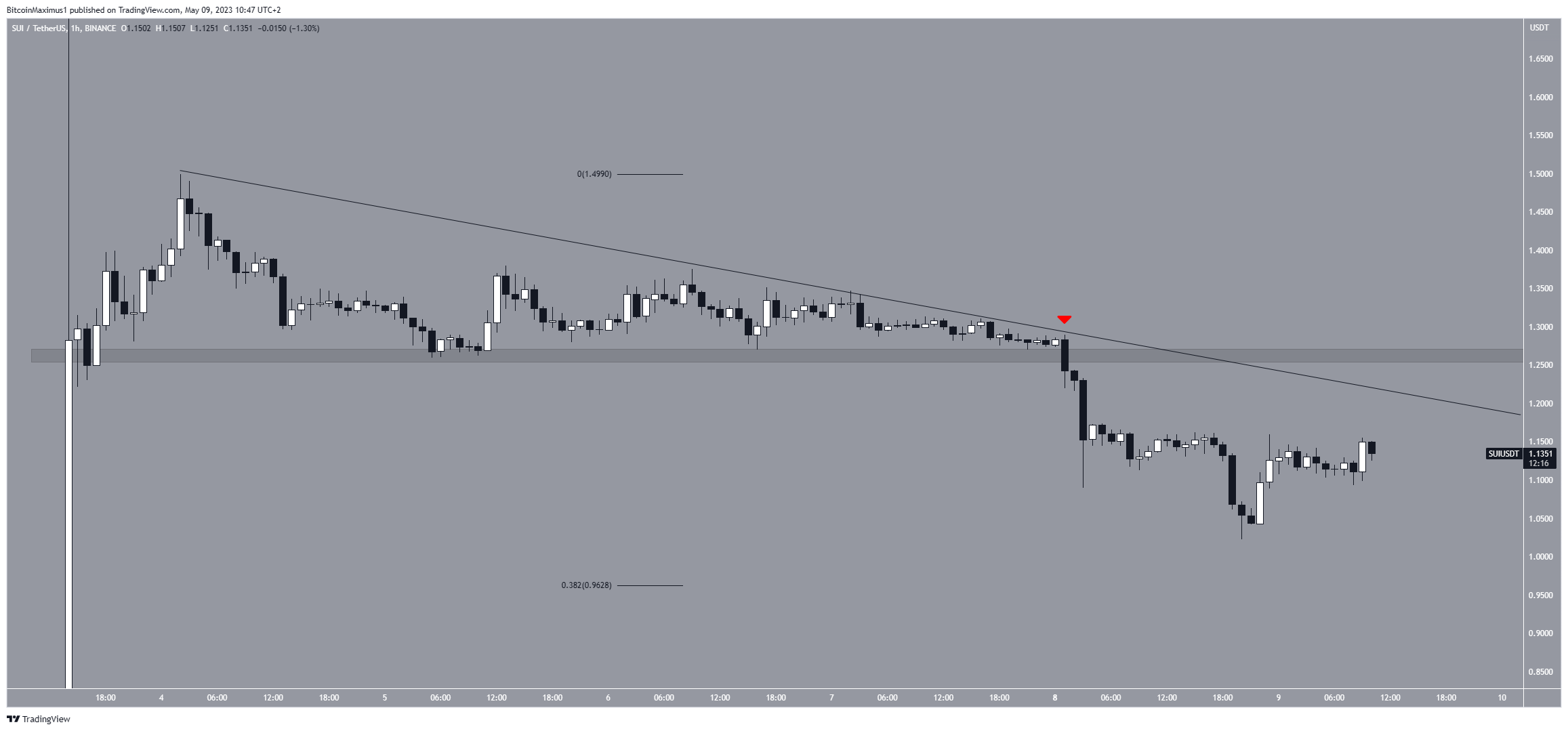

The SUI price has fallen below a descending resistance line since May 4. More recently, the line caused a rejection on March 8 (red icon). At the time, the line was very close to the $1.25 horizontal support area.

So, the rejection caused a breakdown from the area and accelerated the rate of decrease. This led to a minimum price of $1.02 on the same day. While the price has bounced since it still trades below the resistance line.

The closest support area is at $0.96, created by the 0.382 Fib retracement support level.

Fibonacci retracement levels operate on the principle that after a significant price change in one direction, the price will retrace or revisit a previous price level before resuming in its original direction.

On the other hand, the closest resistance is at $1.20, created by the aforementioned descending resistance line.

SUI Price Prediction: Incoming Relief Rally?

The technical analysis from the short-term 30-minute chart explains the ongoing relief rally. The RSI generated a bullish divergence (green line) before the increase.

The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

A bullish divergence is an occurrence in which a price decrease is not supported by a momentum decrease. As a result, it often results in sharp upward movements. The fact that the RSI is now above 50 solidified the validity of the relief rally.

Currently, the SUI price is attempting to break out from a short-term descending resistance line. Due to the aforementioned RSI readings, it is likely that it will be successful. If that happens, an increase to the long-term resistance line at $1.20 is likely.

However, a drop to the previously outlined $0.96 support level is expected if the SUI price fails to close above the resistance line.