US-based investment rating firm Weiss recently released its updated list of cryptocurrency project ratings — based on factors like adoption, technology, and risk. Only four received a rating high enough to be considered a ‘buy.’

Weiss has long been a leading independent rating agency in the United States. It has traditionally been focused on rating financial institutions like banks and credit unions, as well as investment options like stocks, exchange-traded funds (ETFs) and mutual funds.

At the end of January of this year, the firm released its first foray into cryptocurrency ratings, publishing a list of 93 cryptocurrencies with a market cap over $5 million. Only five received a ‘buy’ rating, as indicated by a ‘B-‘ or above by its own standards. (It should be noted that the Weiss system ratings fall on a scale of A at the top, down to E, and additionally includes (+) and (-) to provide more clarity.)

Currently, Weiss has awarded no cryptocurrencies a grade in the A tier.

Weiss caught a bit of criticism for its list, mostly due to the fact that it gave Bitcoin a C+ rating — even though it was, at the time (and still is), the top-ranked cryptocurrency in the market in terms of name recognition, market cap, and longevity.

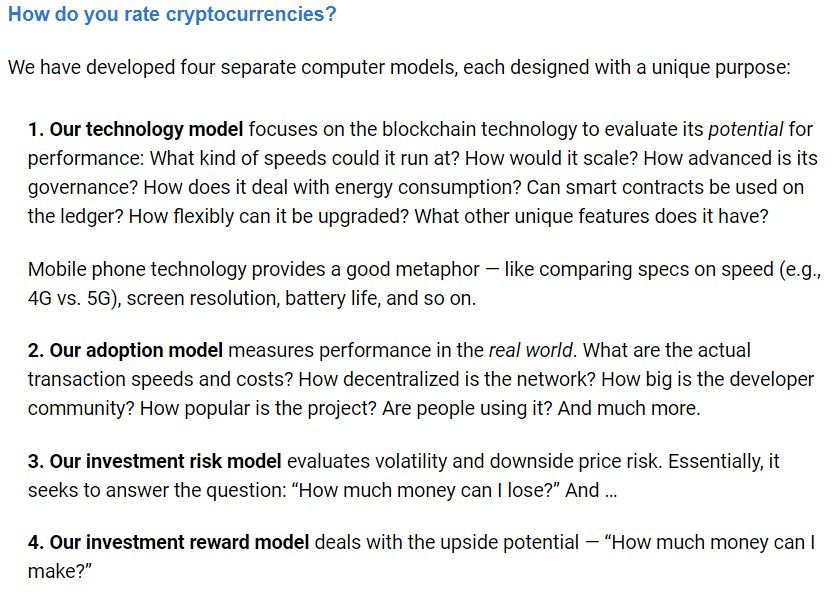

Weiss hit back by clarifying its model, coming to a conclusion based on four factors:

In hindsight, a large majority of the ratings from January became irrelevant amid the market-wide correction — which knocked nearly every cryptocurrency back 70-95 percent from their all-time highs at the end of 2017.

Weiss’s list has recently been updated to include 111 cryptocurrencies and is available for a paid premium on its website.

It did, however, publically name its top four picks which received a rating of ‘B-‘ or better.

In hindsight, a large majority of the ratings from January became irrelevant amid the market-wide correction — which knocked nearly every cryptocurrency back 70-95 percent from their all-time highs at the end of 2017.

Weiss’s list has recently been updated to include 111 cryptocurrencies and is available for a paid premium on its website.

It did, however, publically name its top four picks which received a rating of ‘B-‘ or better.

Getting Good Grades

In its latest update, Weiss crowned Ripple (XRP), EOS (EOS), Stellar Lumens (XLM) and Cardano (ADA) with a rating of ‘B-‘ or better. While all four are well-known projects in the cryptocurrency and blockchain space, not everyone is going to agree with Weiss on its selection. A good number of investors and enthusiasts consider both Ripple and EOS to have centralized governance models, and therefore cannot even truly be called cryptocurrencies. The ratings should be taken with a grain of salt, as the market is still young and unpredictable. Projects rise and fall quickly in the cryptocurrency space — not to mention that decreases in market prices will often stifle investors interests in adoption and ownership. Do you agree with Weiss’ buy-rated cryptocurrencies? What cryptocurrencies top your list of digital assets to buy? Let us know your thoughts in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored