The pro-CBDC World Economic Forum (WEF) believes that responsible regulation and sustained experimentation will secure crypto’s future in the global economy.

In a report published on Jan. 2, 2022, the global body said that the involvement of traditional banks like JPMorgan with crypto will mature the asset class into “responsible, always-on” internet finance.”

WEF Predicts Institutions Will Establish Crypto in the Mainstream

The WEF slammed regulators for not acting decisively to prevent the 2022 meltdowns that caused the crypto winter. Comparing the winter with the dot-com bubble crash, the WEF conceded that crypto’s bear market helped root out speculation and placed the industry on a sure footing with established institutional players.

While not endowed with decision-making authority, the WEF wields significant influence on the policymakers, politicians, and business leaders who converge on its annual event in Davos, Switzerland.

So far, its crypto outlook has focused much on policy and sustainability issues. The COVID-19 pandemic preceded an initiative by the body to coordinate global spending on equality and sustainability.

However, several crypto companies promoted the industry aggressively at the 2022 WEF summit. Circle CEO Jeremy Allaire and XRP boss Brad Garlinghouse spoke on regulations and the future of remittances.

WEF Bedfellow IMF Predicts 2023 Recession

While recently commending the U.S. for its tax infrastructure and inflation reduction acts, the International Monetary Fund’s managing Director Kristalina Georgieva said that one-third of the world would experience a recession next year.

She is hopeful that the strength of the U.S. Labor Market will help the world overcome the recession.

Unlike the WEF, the IMF is mandated by the United Nations to promote international coordination of monetary policy, financial stability, and international trade. It also shares the WEF’s sustainability goals and has previously criticized cryptocurrency mining as a tool for avoiding sanctions.

The IMF’s Georgieva has previously spoken at WEF events, with both bodies supporting central bank digital currencies (CBDC).

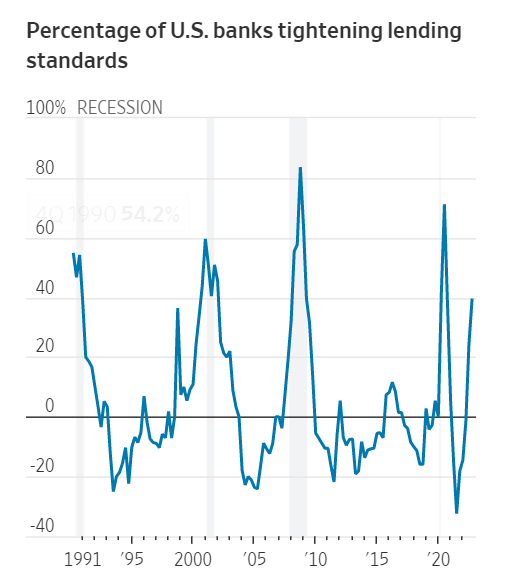

Several major U.S. banks surveyed by the Wall Street Journal agree that dwindling pre-pandemic savings and a declining housing market point to a “mild” 2023 recession in the U.S. Americans have depleted savings accrued before the pandemic from $2.3 trillion to $1.2 trillion. Banks have also tightened lending policies, a move which has accompanied previous recessions.

Forecasts predict that the Fed will cut interest rates by the third or fourth quarter. This could mean that riskier assets will finish the year slightly higher.

Could Bitcoin’s Monetary Network Prove a Crucial Lifeline?

However, some see potential in Bitcoin’s decentralized network and may leverage the blockchain to help companies survive a downturn.

In a recent Twitter Spaces, Michael Saylor said that software maker MicroStrategy could soon empower enterprises with tools on the Bitcoin Lightning Network. Saylor is MicroStrategy’s executive chairman and head of the company’s Bitcoin strategy.

The Lightning Network is a payment network that uses smart contracts to orchestrate payments between nodes according to cryptographic rules.

Payments on the Lightning network are faster than traditional Bitcoin payments and are limited only by the internet speed. The channel’s payments are aggregated to post a final balance of the main Bitcoin network.

Free from the shackles of exchange rates, companies could also charge website visitors Bitcoin for frequenting their site.

Strike was an early proponent of the Lightning Network, allowing companies to use its application programming interface (API) to integrate Bitcoin payments. Strike offered remittance services to Argentina and El Salvador using the Bitcoin network.

With recessions set to cause notable job losses, wider implementation of Strike’s API could allow low-cost remittances that could help Argentina. In addition, MicroStrategy’s enterprise efforts could promote faster settlement times for international B2B transactions.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.