Crypto news: And we kick off this week with the news every XRP maximalist has been waiting for. After more than two years of legal wrangling, Ripple won a (partial) victory in a legal action brought by the Securities and Exchange Commission (SEC).

In a landmark victory, New York judge Analisa Torres ruled that the XRP token is not a security, but only in regards to programmatic sales on digital asset exchanges.

Ripple Wins. For Now.

However, the federal judge also ruled partly in favor of the SEC by saying that XRP is a security when sold to institutional investors, as it met the conditions set in the Howey Test.

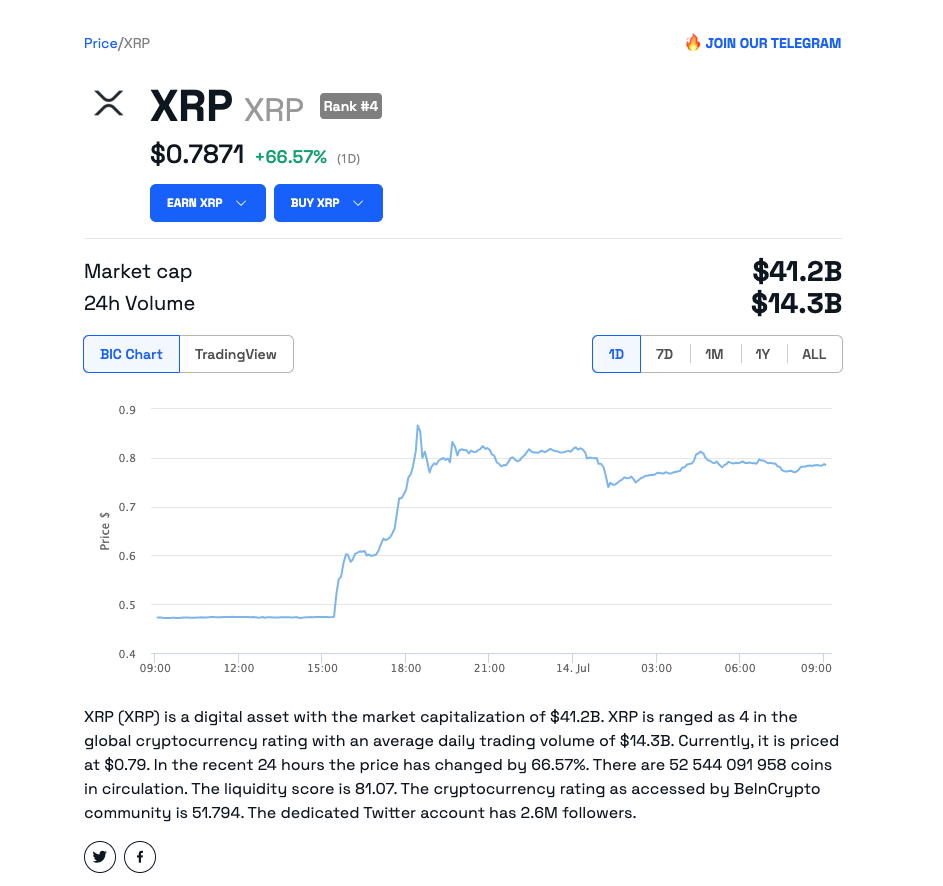

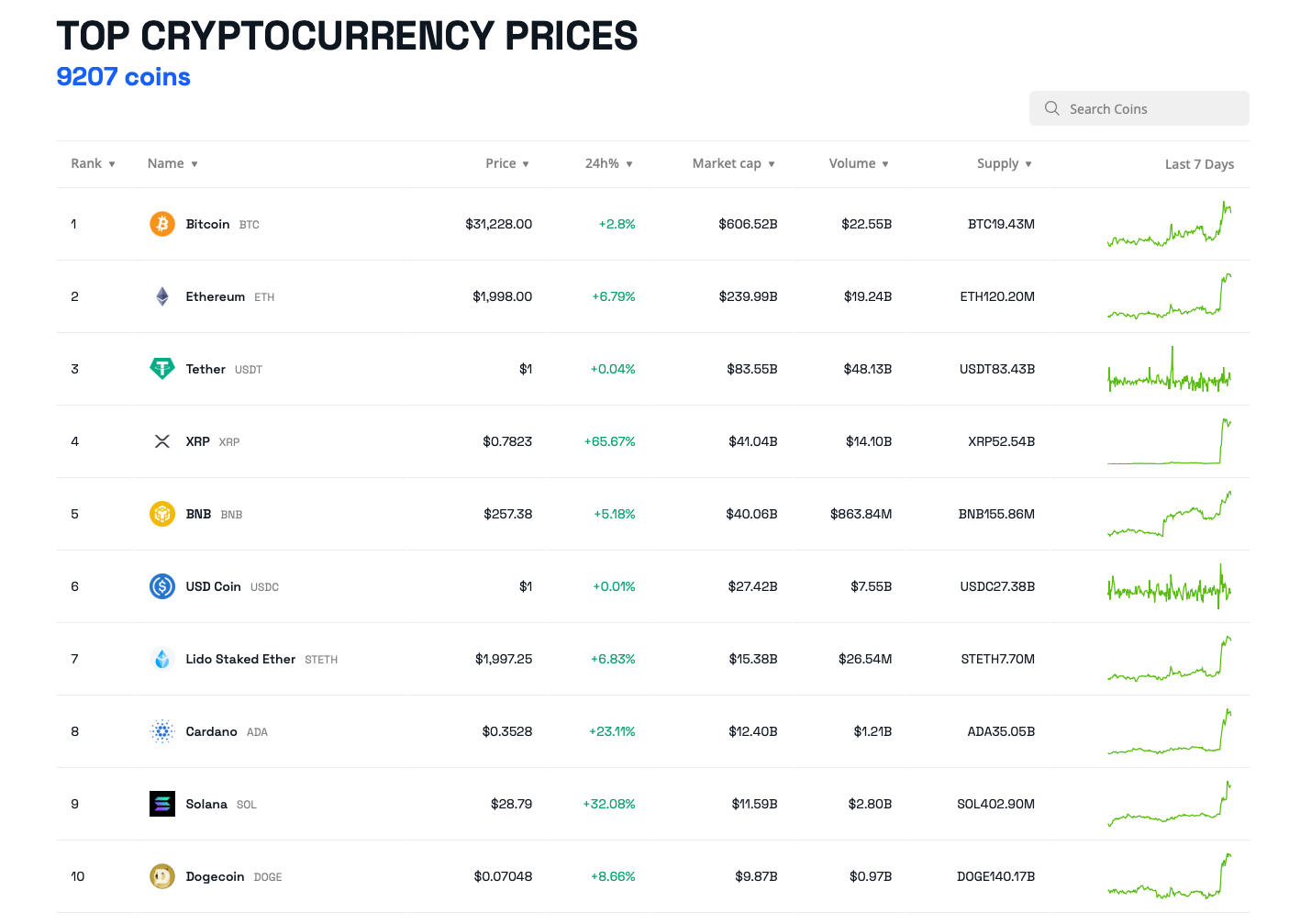

The news saw XRP price nearly double, surging to $0.93 before falling back to $0.78 by press time. The saga has been ongoing since December 2020 when the SEC sued Ripple and its two chief executives, Brad Garlinghouse and Chris Larsen, claiming the company was offering an unregistered security in XRP.

But the SEC’s response met with derision from the crypto community. In a statement, the commission said:

“We are pleased that the court found that XRP tokens were offered and sold by Ripple as investment contracts in violation of the securities laws in certain circumstances”

Paradigm’s Chief Legal Officer Katie Biber claimed that the statement had “vibes of a young campaign hack spinning on bad facts, vs a powerful government agency expected to tell the truth.”

While XRP has largely come out victorious in the lawsuit, there are some caveats. The ruling did state that Ripple’s institutional sales of XRP constituted an unregistered offering and sale of investment contracts.

As such, it violated Section 5 of the Securities Act. Some see the case as a partial victory for Ripple, and there could be some more legal challenges ahead for the company.

On the whole, however, it has been a strong showing for Ripple, and both Coinbase and Kraken have relisted XRP following the ruling.

Our writer Bary Rahma says the news marks a seminal moment as Ripple’s ability to uphold the legality of its XRP sales against the SEC solidifies the resilience of the crypto market.

So what exactly is the Howey Test? Click here to learn more.

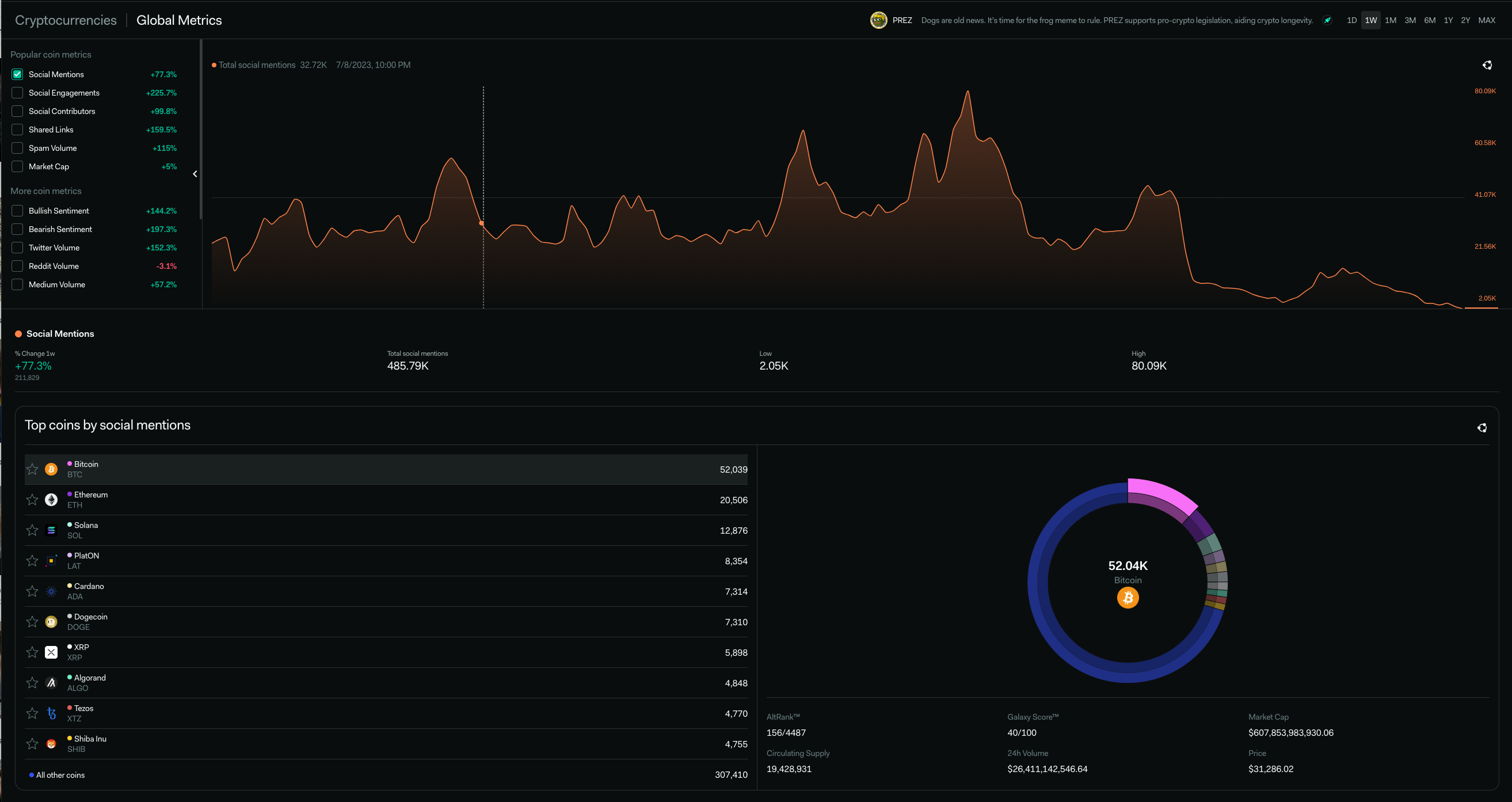

Crypto – Socially Speaking

Release the Kraken!

In other SEC-related news, Kraken and Bitstamp have indirectly benefited from Coinbase and Binance’s woes. Kraken’s US crypto trading volumes has grown to 29%, while Bitstamp, another international exchange with a US presence, has seen its slice of American volumes increase to 9%.

The SEC recently filed lawsuits against Coinbase and Binance for offering unregistered securities and violating business registration requirements. As a result, Coinbase’s share of US crypto trading volumes has fallen from 62% in January to 51% by June 18.

Binance.US, the American arm of the global exchange, has seen its market share shrink to about 1.15% since March. Meanwhile, Binance CEO Changpeng Zhao recently denied claims Binance was losing executives en masse after the lawsuits. After failing to secure a license from Dutch regulators, the exchange recently offloaded its Dutch clients to a rival.

Crypto Coin News

Scammer Takedown

In other Kraken news, a crypto call center scam was taken down after the exchange enlisted help from crypto YouTuber Kitboga to expose a scam. In a video posted to his YouTube channel, Kitboga details how he teamed up with the cryptocurrency exchange to catch the scammers and bust their operation.

The premise of the attack was pretty simple. A popup was designed to look like a real security alert. But instead of warning users about a threat to their computer, it asked them to call a fake hotline. At the other end, fraudsters posing as cybersecurity experts manipulated callers into making payments, handing over login credentials, or even control of their devices.

Prior to contacting the scam call center, Kraken helped Kitboga set up a fake account that would appear to the hackers as if it contained a large amount of Bitcoin. Under the pretense that they were working to protect his coins, the con artists requested that their victim initiate a withdrawal request that would drain the account of all its funds.

However, the Kraken sting worked to gather data on multiple crypto wallets used by the call center operators. This kind of information is extremely useful in the battle against crypto crime. Kraken was able to share wallet addresses with other exchange operators to freeze assets, closing the net on the perpetrator’s crypto laundering operation.

Another One Bites the Dust

We said farewell this week to decentralized finance protocol Algofi, another victim of the crypto winter. The project contributed more than 50% to Algorand’s total value locked (TVL). Algofi announced the shutdown of its platform and put it in withdrawal-only mode.

The team wrote on Twitter:

“Going forward we are no longer able to provide the support necessary to maintain the protocol at the high standards which we believe the community deserves.”

The decision has left the community speculating on the future of ALGO as more than 50% of TVL will eventually be withdrawn.