This week, the crypto world refocused on the impacts of several major events that will soon unfold. Beleaguered crypto exchange FTX was allowed to liquidate an estimated $3.4 billion in cryptocurrencies, while a new report from K33 Research argued the market is underestimating the positive impact a Bitcoin spot exchange-traded fund (ETF) approval could have.

The green light for FTX liquidation stirred anxiety among stakeholders, while K33 researchers say the approval of spot ETFs could portend higher buying demand.

Across the globe, Tykhe Capital introduced PRINCE, Hong Kong’s first tokenized security representing a share of real estate ownership. At the same time, BeInCrypto speculated on the amount of Shiba Inu (SHIB) needed to become a millionaire if SHIB reaches previous bull-market highs.

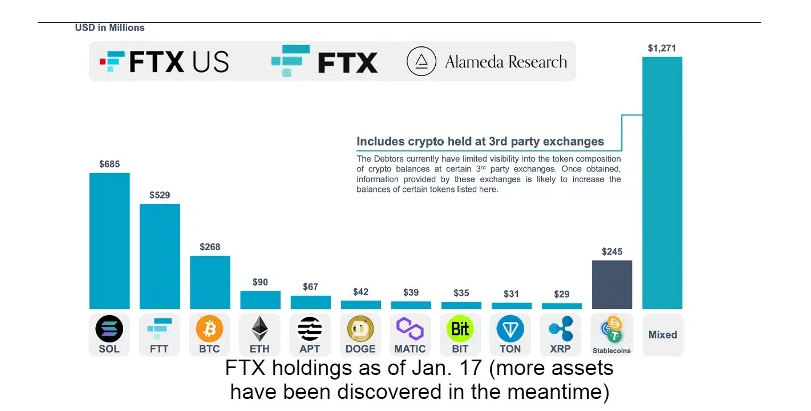

Markets Concerned Over Billion-Plus Altcoin Dump Amid Thin Markets

IntoTheBlock suggested that the impending FTX liquidation might dampen recent increases in the prices of Ethereum and Solana. The looming uncertainty led to a 5.1% price dip in SOL over the weekend.

The exchange holds $685 million worth of Solana, a significant portion of its assets.

But not all market participants are sounding the alarm. The mass selloff failed to materialize, and FTX’s court documents revealed it would sell its crypto in weekly tranches of $100 million and, occasionally, $200 million.

The exchange’s proprietary token, FTT, makes up $529 million of the assets to be liquidated. Its limited liquidity and market depth raises questions about whether FTX’s liquidations will succeed.

FTX has embarked on legal maneuvers to recoup assets amid its bankruptcy proceedings. It has filed a clawback lawsuit to recover $21 million from LayerZero, an omnichain interoperability platform. It also is demanding $13 million from LayerZero’s Chief Operating Officer Ari Litan.

Read more about the FTX collapse here.

Tokenization Can Improve Liquidity in Hong Kong Real Estate Market

Earlier this week, Tykhe Capital launched the first ever real estate fund security token in Hong Kong, in a move that could catalyze real-world asset tokenization.

Designed for professional investors, the PRINCE token aims to raise HK$100 million. Pending regulatory approval investors can trade the asset on the secondary market throughout the trading day.

Hong Kong is exploiting the global trend to move more assets to the blockchain. Its standing as a financial hub could see it accelerate global real estate tokenization.

Tokenization democratizes investment and improves traditionally illiquid markets such as real estate. Ripple’s Managing Director Brooks Entwistle affirms this emerging trend,

“There is no question that digital currencies are going to be a part of the landscape going forward.”

PRINCE’s success could also pave the way for tokenized real estate funds that could be part of a diversified portfolio. However, the lack of regulation may slow adoption.

Real estate tokenization is a new frontier, demanding novel regulatory frameworks. Still, PwC Hong Kong partner Duncan Fitzgerald sees tokenization as unlocking significant investment potential.

“These opportunities include innovative programmable securities, cash flow advantages through the atomic settlement of trades, and enabling investment in otherwise illiquid assets through fractionalization.”

Learn more about asset tokenization here.

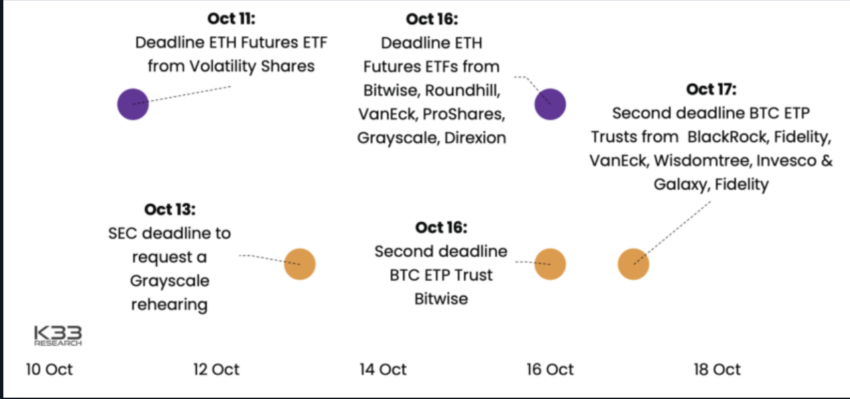

Inflows After Bitcoin ETF Approval Could Reach 30,000 BTC

Amid the FTX gloom, K33 Research suggested there was a significant disconnect between market sentiment and the potential benefits the approval of a spot Bitcoin exchange-traded fund could offer. They believe that the market dramatically underestimates the impact of US BTC and also futures-based ETH ETFs.

The company predicts that spot Bitcoin ETFs will attract over 30,000 BTC in new money within their first 10 trading days. These inflows could push the price of Bitcoin beyond $42,000 in the first 100 days after the approval.

How Much SHIB to Buy to Become a Millionaire

The Shiba Inu (SHIB) meme coin continues to captivate investors. Currently trading 90.6% below its all-time high, many are speculating on the amount of SHIB needed to become a millionaire in the next bull run.

BeInCrypto offered the following formula to calculate how much SHIB you would need to buy now to become a millionaire when the price reaches its previous peak of $0.00008616:

Number of SHIB = Target Amount/Expected Price

Given that the target amount is $1 million and the expected price is $0.00008616so , you would need to buy around 11.6 billion SHIB, which costs around $93,947 at the asset’s current price.

Learn more about the SHIB project and its recent developments here.

This Week’s Top Altcoins Gainers

Leading altcoin gains this week is the HiFi Finance token, which rose a massive 122.9% to $2.61. BeInCrypto’s technical analyst Valdrin Tahiri says the token could fall to $0.75 if rejected by its current resistance level.

STORJ gained 37.4% after clearing a critical resistance at $0.32 yesterday. MTL, the third largest gainer, broke out from a long-term triangle support line, rising 27.4% to just below the $1.60 horizontal support level.

Find out more about altcoins in handy explainer here.

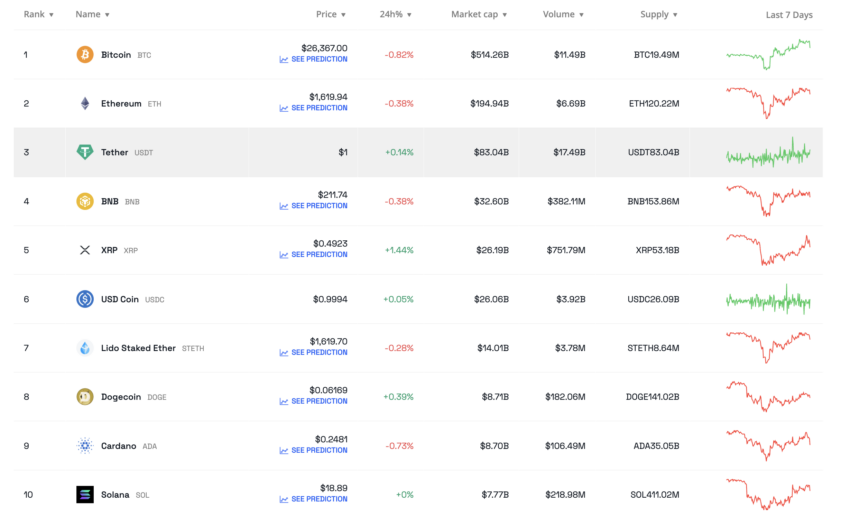

Trending This Week on Crypto Social Media

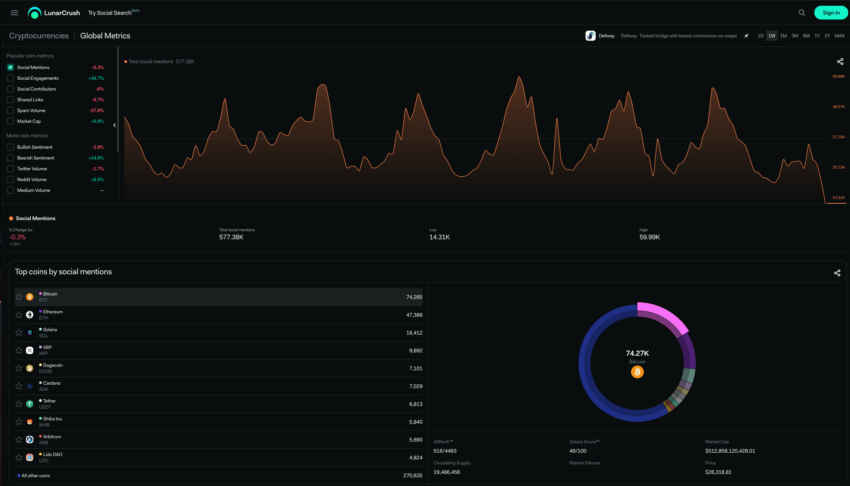

According to crypto metrics on LunarCrush, Bitcoin was the most talked about cryptocurrency on social media this week, with 74,614 mentions. It was followed by ETH, with 47,617, and SOL, whose involvement in the FTX case may have increased its prominence in online discourse.

Sentiments around the overall health of the crypto market were 13.4% more bearish 13.4% compared with last week.

Got something to say about the developments in crypto this week or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.