On-chain data shows that bankrupt crypto lender Voyager Digital appears to be selling its assets through Coinbase Exchange, according to Lookonchain.

The blockchain sleuth reported that Voyager received at least $100 million in USD Coin in the last three days.

The on-chain investigator added that Voyager has been sending different crypto assets to the crypto exchange since February 14. Some of the assets include Ethereum, Shiba Inu, SushiSwap, Chainlink, and others. Cumulatively, these assets are valued at over $100 million.

Lookonchain added that the lender currently holds $631 million worth of crypto assets — mostly in ETH, USDC, and SHIB.

Voyager Previously Moved 250 Billion Shina Inu Tokens

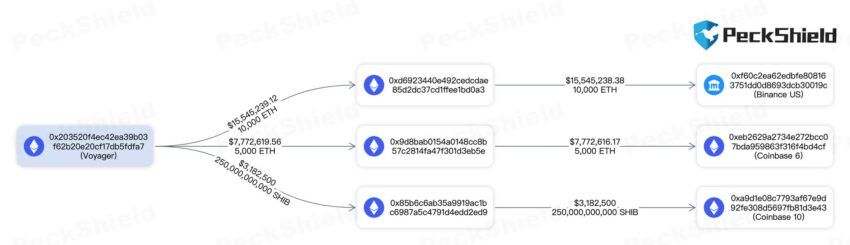

Blockchain analytical firm Peckshield reported on Feb. 16 that Voyager had sent $28.7 million worth of assets to Coinbase and Binance.

According to the firm, the lender sent 250 Billion units of Shiba Inu tokens alongside 15,000 ETH tokens to the exchanges. It added that Voyager had received 105,000 units of ETH from bankrupt exchange FTX in September 2022.

Voyager – Binance.US Deal Under Scrutiny

Voyager was one of the several crypto firms that collapsed in 2022. The lender filed for bankruptcy in July, citing volatile market conditions.

The lender is currently in the middle of a potential sale to Binance.US for $1 billion. The deal is facing opposition from the US Securities and Exchange Commission (SEC) and other regulators.

The SEC claims that Binance.US has not shown whether it can complete the transaction in compliance with federal securities law.

The regulator doubts Voyager’s ability to complete its planned asset restructuring through Binance’s acquisition. There are also concerns about whether Voyager can repay some of its debtors’ assets after its bankruptcy.

Besides the SEC, another regulator that opposes the deal is the US Federal Trade Commission (FTC). The commission said it was investigating Voyager’s actions that constituted deceptive and unfair marketing of cryptocurrency.

However, despite the opposition, Binance.US said the deal would progress. The exchange added that customers should expect an email about the next steps.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.