Creditors of crypto broker Voyager Digital are racing to get their funds withdrawn from the platform. The total sum transferred out since withdrawals were reopened has crossed $250 million.

Bankrupt crypto firm Voyager has seen over $250 million withdrawn from its platform since enabled withdrawals on June 23. The platform is working on recovering assets to pay creditors as much as possible.

Voyager Sees Outflow of $250.4M

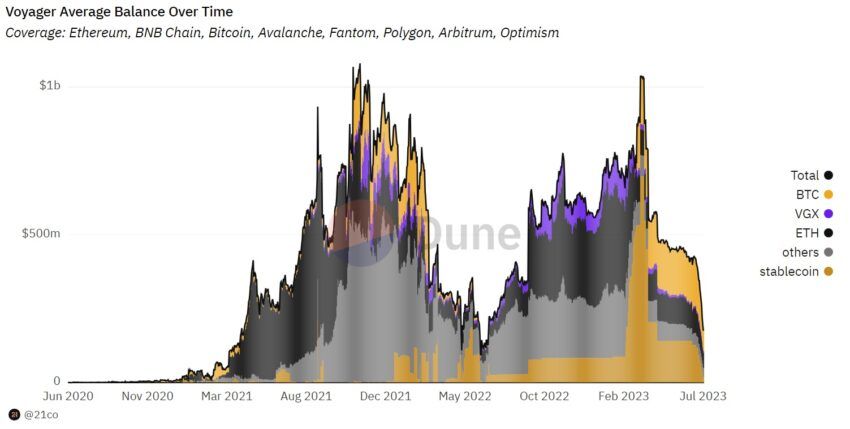

On the day Voyager reopened withdrawals, it had a total balance of $426.8 million, and it currently stands at $176.4 million.

Its current holdings consist of $69 million in BTC, $50.99 million in ETH, $18.56 million in USDC, $15.7 million in SHIB, and a smattering of other tokens. BTC and ETH make up 68% of its holdings.

A look at the transaction history shows that multiple transactions crossed $1 million. Voyager is not hosting the withdrawal period indefinitely, however, with investors scrambling to get what they are owed as quickly as possible.

Voyager Enables Withdrawals for 30 Days

There has been some positive news in the Voyager case, as the company enabled withdrawals on June 23.

The app is open for crypto transfers for the approved 30-day period. It asked users to transfer their in-kind recovery from the app as soon as possible.

Voyager was expected to be acquired by FTX, but the meltdown of the crypto exchange disrupted the deal. Take a look at our guide on FTX and the downfall of this once-biggest crypto exchange to learn more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The distributions will be 35.72% of what is fully owed. Meanwhile, Voyager is working on recovering assets to pay off its creditors as much as possible.

This might be a tough task, as the crypto contagion has affected entities that owe Voyager, including Three Arrows Capital, which owes $650 million to the former.

Creditors’ Legal Fees Reach $16.5M

There have also been updates regarding the creditors dealing with the Voyager bankruptcy. The latest legal fee that these entities will have to pay crosses $5 million, bringing the total sum to about $16.5 million. The creditors have hired the McDermott Will & Emery law firm.

The latest charge of $5.17 million for the third interim fee period between March 1, 2023, and May 18, 2023. The creditors are in a protracted process to claw back their funds, which has hit a few hurdles.

Voyager has attempted to be sold. Binance recently attempted to purchase the broker, but it ended up walking back on the deal.

FTX also bid on Voyager, making headlines when it was first revealed. FTX also pulled out after it went through its own bankruptcy.

Alameda later sought to recover $446 million from Voyager.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.