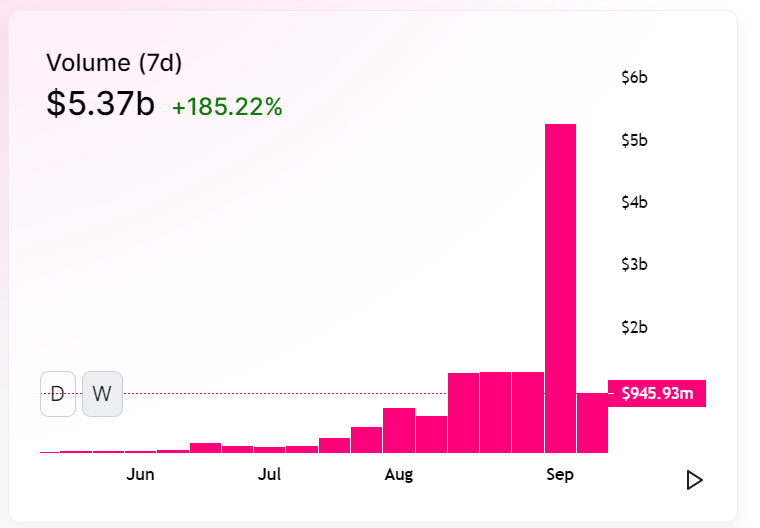

Crypto exchange derivatives increased in August, as did trade volumes on less-risky exchanges. After this week’s 10% drop in the bitcoin (BTC) price, many are wondering if the pain is over.

This month’s data suggest that at least the volatility is here to stay. If there’s one thing derivatives traders like, it’s volatility. Volatility means there are dramatic price changes. Dramatic price changes mean there are profit opportunities.

Besides shorting the VIX volatility index, there are not many ways to make money in a steadily growing market, aside from diversified investing. For some traders, that’s far too boring.

Enter February March… July, August

All that changed in February when Bitcoin and crypto in general, came to a bloody fall. As the pandemic ramped up, so too did crypto holders as they bailed into fiat and stable coins. But few could have predicted not only the recovery of bitcoin’s price, but a surge to touch a multi-year high. This occurred because of institutional investment, DeFi, DEXs, and other reasons. But, at the end of this run-up in August, the derivatives market started to shine.

Comparing Apples to Apple Futures

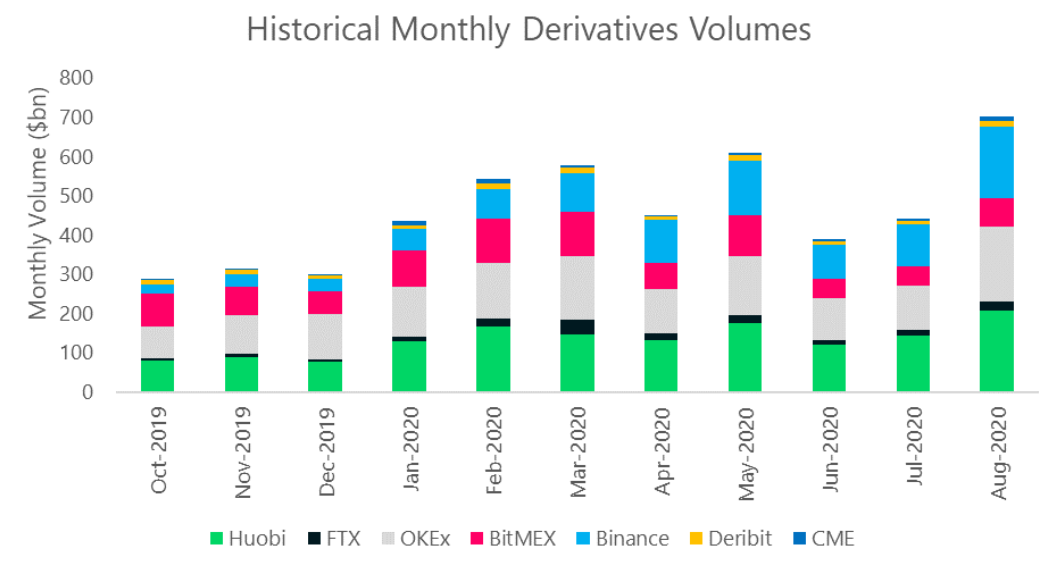

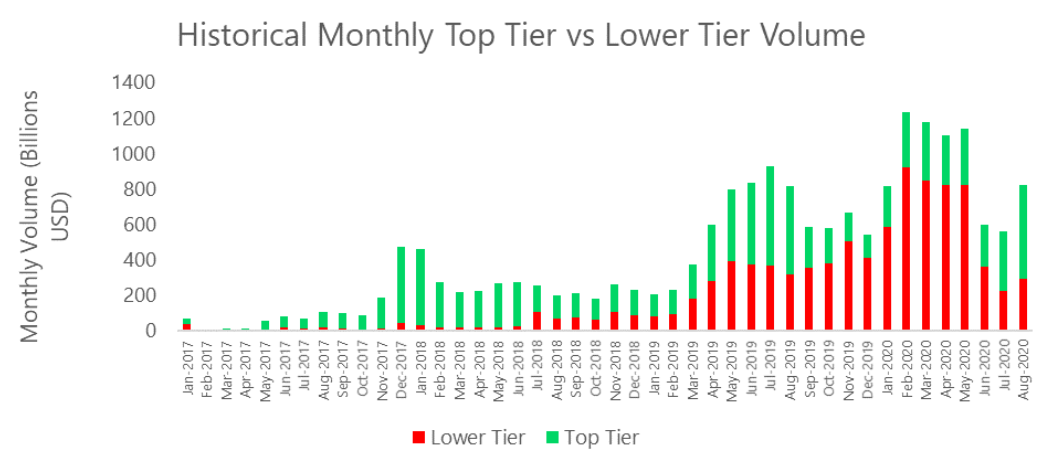

Though trading volume did increase significantly in August, so too did derivatives markets disproportionally so, according to analysis from CryptoCompare. Derivatives volume in August increased faster than spot markets in crypto, accounting for 40% of the market. Binance derivatives markets alone increased by 74% in August.

Safe Exchanges

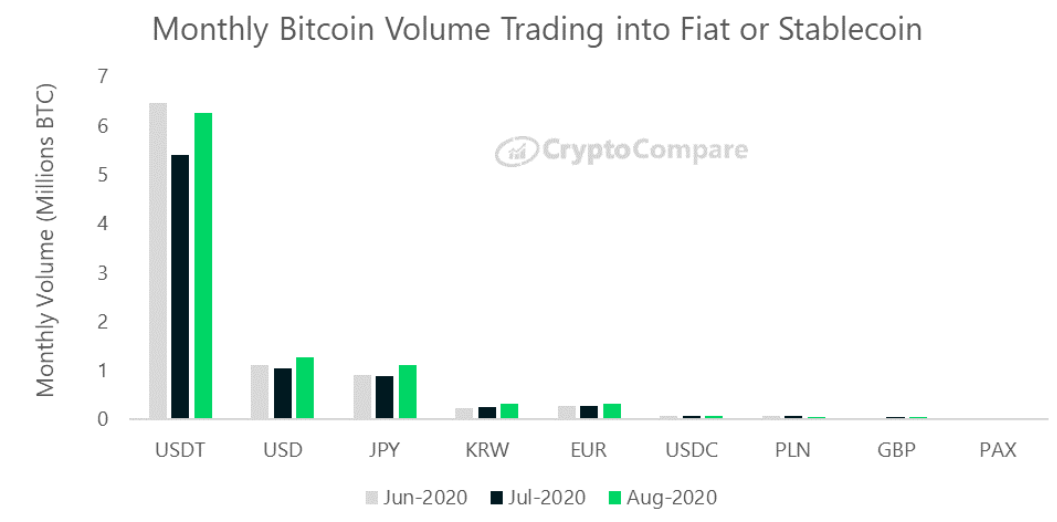

Last month once again saw a retreat from crypto into to fiat or stablecoins. Nevertheless, the amount of money stashed in stablecoins in March, April, and May 2020, dwarfs this increase. Furthermore, most of this was transferred into USDT. A move into the most liquid of stablecoins suggests that traders are using this money as dry powder, and not for rent checks.

Institutional Crypto Perspectives

The CME futures help to give some perspective of where the market is. Since CME is highly regulated, it’s a relative measure of institutional interest. CME crypto futures increased 55.7% in August, above 200,000 contracts. This is in line with unregulated exchanges. Overall, the picture this data paints is that both independent and institutional investors expect volatility. With money moving into USDT, and crypto moving to higher-tier exchanges, it looks like the exciting times are not over yet. However, the next major price action may be relatively tame. Nonetheless, if a dark horse comes along, like a sudden adoption of an ETH scaling feature or spot exchange interface for Uniswap, it could ramp up a new alt season and get crypto lovers dreaming sky-high again.Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Harry Leeds

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

Harry Leeds is a writer, editor, and journalist who spent much time in the former USSR covering food, cryptocurrencies, and healthcare. He also translates poetry and edits the literary magazine mumbermag.me.

READ FULL BIO

Sponsored

Sponsored