After reversing a three-month downtrend, VeChain (VET) managed to reach a new all-time high price on Jan. 6.

While a short-term rejection could occur, VeChain is expected to eventually resume its upward movement toward new all-time highs.

VeChain Scores New All-Time High

The weekly chart shows that VET has finally moved above the $0.022 area, which had been acting as resistance since July 2020. On Jan. 6, VET reached a new all-time high price of $0.032.

After the breakout, VET validated the level as support in the form of a very long lower wick (shown with the green arrow in the image below) and has been moving upwards since.

Technical indicators in the weekly time-frame are bullish and support the continuation of the upward move.

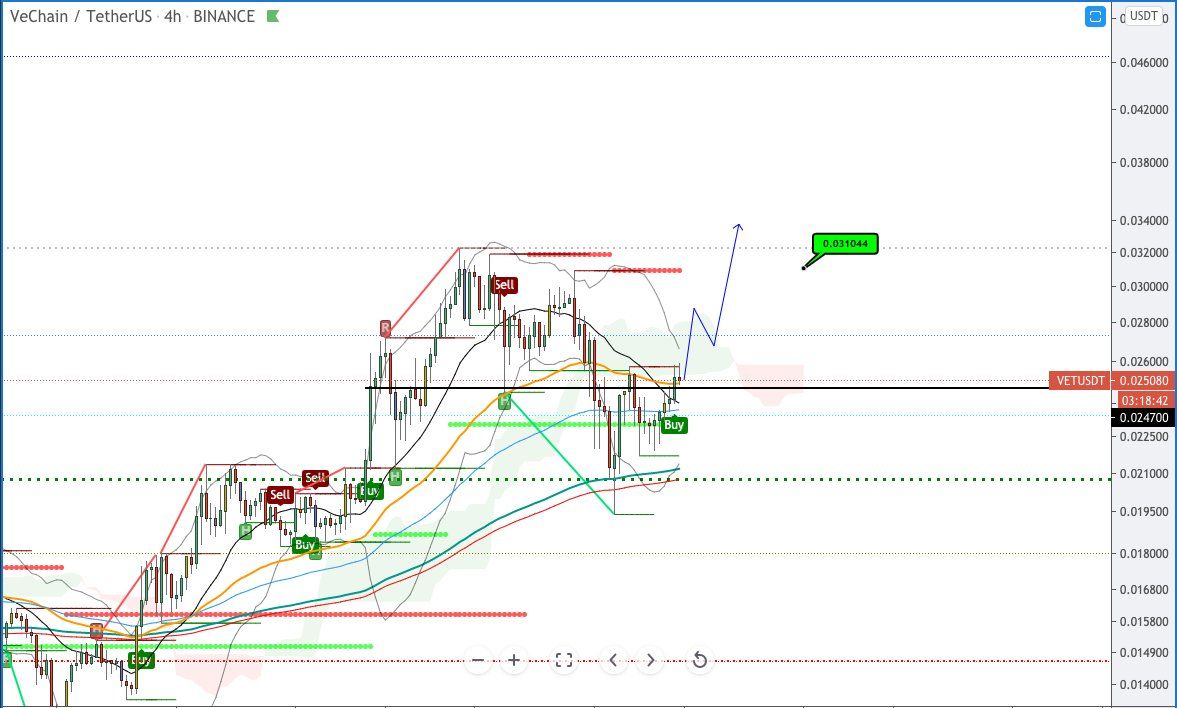

Cryptocurrency trader @CryptoNewton outlined a VET chart, stating that the price is likely to go to $0.031. Since the tweet, VET has broken out and reached a new all-time high of $0.032.

Short-Term Movement

The daily chart reiterates the significance of the $0.022 support area, which previously acted as resistance in July and August of 2020.

While VET has validated this area as support, technical indicators are not entirely bullish. Both the RSI and MACD have begun to decrease.

However, the RSI is trading above 50 and the MACD is above 0, suggesting that the trend is still bullish.

The two-hour chart shows that VET is trading inside a parallel ascending channel, in a movement that appears to be corrective.

Despite short-term indicators being bullish, the presence of the channel and the proximity to the $0.030 resistance area points to a rejection.

VET Wave Count

The wave count suggests that VET is either in wave 4 or 5 (orange) of a bullish impulse that began on Nov. 20. It is possible that VET has completed a fourth wave pullback.

A likely target for the top of the entire impulse is found between $0.04 and $0.045, using a combination of Fib extensions and projections;

- $0.04 (White) – 1.61 external retracement of wave 4

- $0.042 (Orange) – Projection of the lengths of waves 1-3

- $0.045 (Black) – 3.61 Fib extension of wave 1

A decrease below the wave 1 high of $0.0187 would invalidate this particular wave count.

Conclusion

While the long-term trend for VeChain is likely still bullish, a short-term correction could occur before it resumes its upward movement. A top is estimated to occur between $0.04-$0.045.

For BeInCrypto’s latest Bitcoin (BTC) and altcoin analyses, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.