The VeChain (VET) price prediction for Feb. is bullish as long as the price does not reach a daily close below $0.0217.

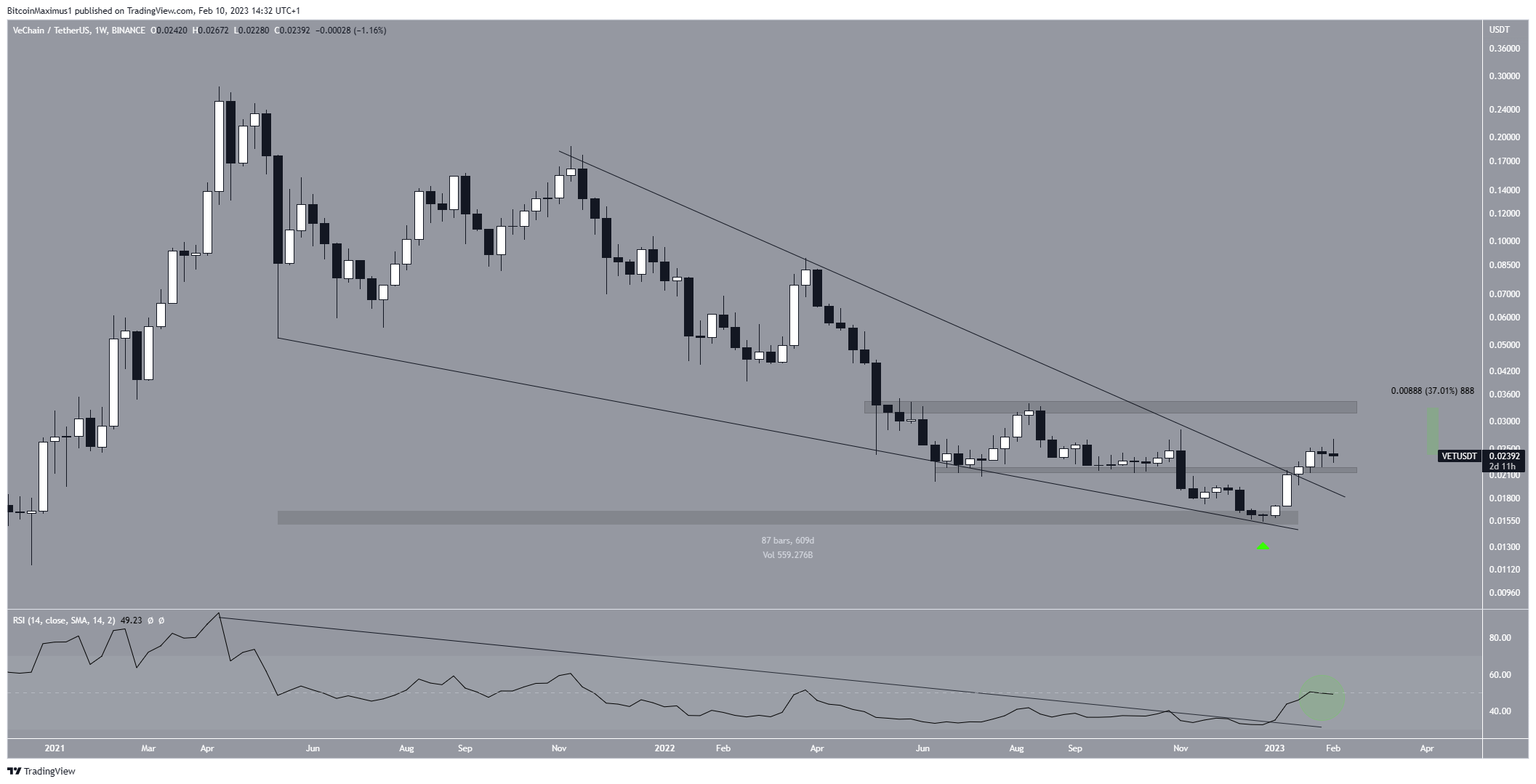

Since reaching an all-time high of $0.2793 in April 2021, the price of VeChain has fallen. The downward movement had been contained by a falling wedge, considered a bullish pattern.

In Dec. 2022, the price fell to a low of $0.0153, validating the support line of the wedge before resuming its upward trend.

During the second week of Jan., VET broke out of the descending wedge. Given that the wedge had been in place for 609 days, a significant upward movement is expected to follow. Moreover, the VeChain price reclaimed the $0.0217 area, which previously acted as resistance.

The weekly RSI, which broke out from its own descending resistance line, supports the possibility of an increase. This would be confirmed by a movement above 50 (green circle). If the upward trend continues, the nearest resistance level would be $0.033, a 40% increase from the current price. However, since the wedge had been in place for a long period of time, the VeChain price may also break out above this resistance area.

On the other hand, a close below $0.0217 would invalidate this bullish VeChain price forecast. In that case, the VET price could fall to an average price of $0.012.

VeChain Price Prediction for Feb: New Yearly High Incoming?

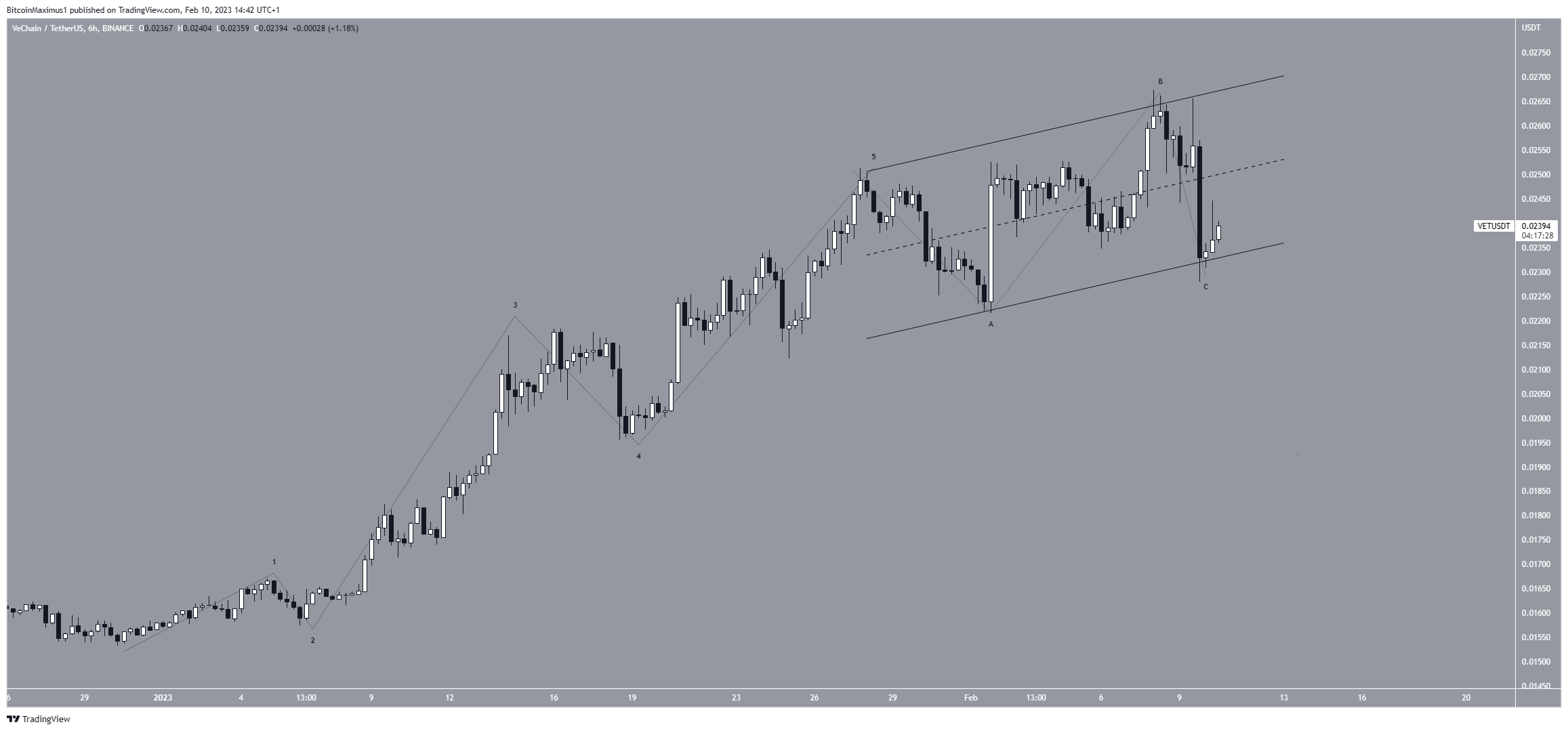

The technical analysis from the daily chart provides some mixed readings. On the bullish side, the price broke out from a descending resistance line and reclaimed the $0.0217 support area.

On the bearish one, it was rejected by the $0.0270 resistance area and created a bearish candlestick.

The daily RSI generated bearish divergence, preceding the ongoing downward movement. However, it has now developed a hidden bullish divergence (white), which is a sign of trend continuation.

Therefore, as long as the VET price does not close below $0.0217, the VeChain price prediction for Feb. remains bullish. A breakout above $0.0270 could accelerate the increase toward $0.0330.

The wave count supports the possibility of an increase. The VET price has likely completed a five-wave upward movement and an A-B-C correction (black). Since the correction is contained inside a short-term ascending parallel channel, it is a running flat correction.

While the C wave may extend further, falling below the A wave lows, the possibility of continuing the future price upward movement remains valid as long as the price does not close below $0.0217. The potential drop could occur in the next 24 hours.

To conclude, the most likely VeChain price prediction for Feb. is an increase toward $0.0270 and an eventual breakout. On the other hand, a daily close below $0.0217 would invalidate this forecast and could send the price back to $0.0120.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.