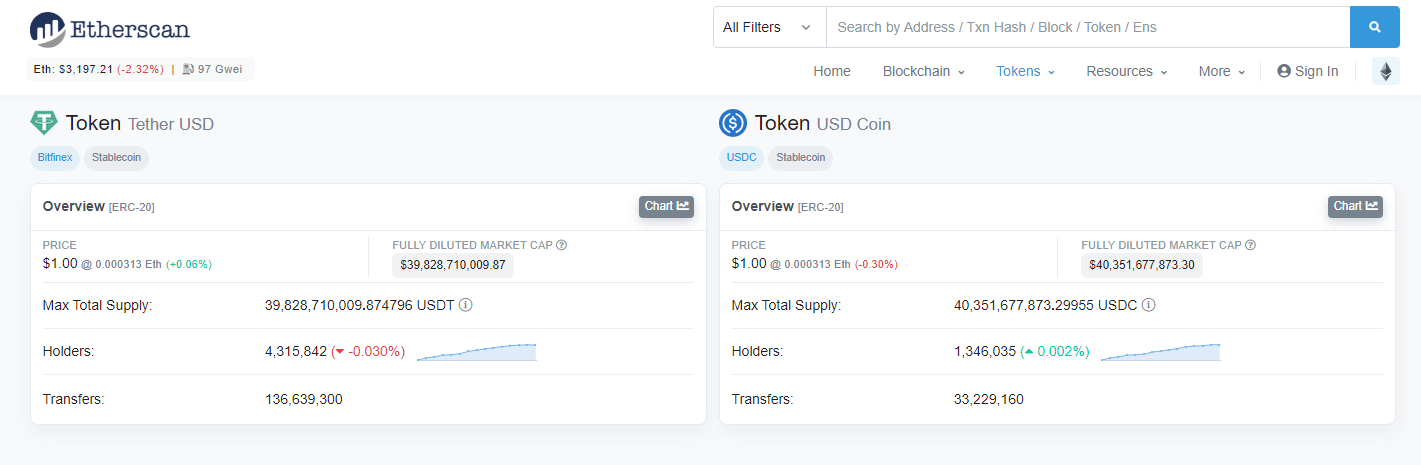

USD Coin (USDC) has surpassed Tether (USDT) in total supply on the Ethereum blockchain. USDC has a total supply of $40.3 billion on Ethereum, while USDT has a total supply of $39.8 billion.

USD Coin (USDC) has surpassed Tether (USDT) in total supply on the Ethereum blockchain. The total supply of $40.3 billion USDC, while USDT’s total supply on Ethereum is $39.8 billion. Unlike USDT, most of USDC’s supply is present on the Ethereum blockchain.

USDT still has an overall greater total supply, of roughly $78.5 billion, with the token present on several other networks, including Algorand, BSC, EOS, and TRON. Tether’s large supply has been a point of contention in the crypto community, as there is controversy surrounding its backing of its large supply.

USDT is the market’s most popular stablecoin, despite that controversy. Market enthusiasts have been hoping for a complete audit of its reserve, and this issue has been going on for years. Tether has also attracted the attention of regulators for its operations and has been subject to multiple lawsuits, which led to the stablecoin vowing to work with lawmakers around the world.

USDC issuer Circle, meanwhile, has been working on being more compliant with regulation. The company announced that it would be more transparent and adhere to accountability standards in 2021. USDC has also been on the SEC’s radar, with the regulator subpoenaing Circle in Oct. 2021.

Stablecoins surely a hot priority for regulators in 2022

Regardless of the stablecoin, regulators are looking into the niche for fear it might interfere with the sovereignty of national currencies. Stablecoins have been repeatedly touted as a circle by both U.S. regulators and global bodies. The CPFB Director has also revealed that stablecoin is a part of a big tech probe, which proves the extent to which they are perceived as a problem.

In some slightly optimistic news, the Federal Chairman has said that stablecoins could co-exist with Central Bank Digital Currencies (CBDCs). The regulation of the digital assets will nonetheless remain a hot topic until lawmakers find a way for them to co-exist.

Outside the U.S., G20 heads also called for stablecoin regulation before approval. All of these developments point to incoming stablecoin regulation, which on the whole could benefit the market.

What do you think about this subject? Write to us and tell us!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.