Wallets connected to the United States government law enforcement seizures, including those from the Silk Road marketplace, have started moving Bitcoin. Concerns are mounting over whether the stash is about to be sold off.

The big Bitcoin move was noted by blockchain analytics provider Glassnode which reported it on March 8.

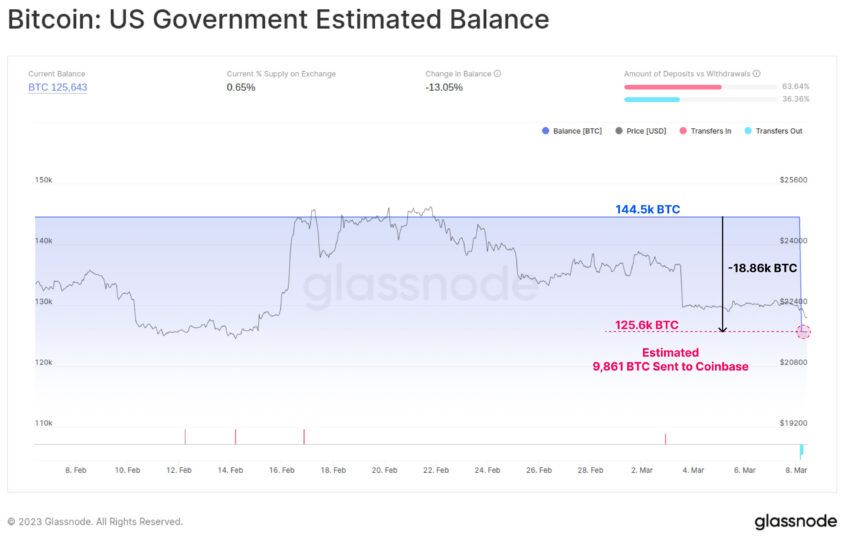

According to Glassnode, the U.S. government’s estimated wallet balance was 144,500 BTC up until the recent move.

Furthermore, it dropped to 125,600 BTC as 18,860 coins worth an estimated $418 million were on the move. The mempool tracker indicates that as many as 40,000 BTC were moved in the transaction, with around a quarter going to Coinbase.

Glassnode confirmed that an estimated 9,861 BTC worth around $219 million were sent to Coinbase. These were seized from the Silk Road hacker, according to Glassnode.

Silk Road Bitcoin Stash on The Move

In November 2022, the U.S. Department of Justice announced that James Zhong pleaded guilty to wire fraud nine years after stealing more than 51,000 BTC from the dark web platform Silk Road.

An affidavit at the time supported the government’s seizure of the massive stash worth more than $3.3 billion at the time.

The Silk Road was shuttered by a massive law enforcement operation in late 2013, leading to the arrest of creator Ross Ulbricht.

Bitcoin prices have already lost 1.5% since the move as concerns over a big selloff begin to mount. “The elites doing everything they can to dump the price of BTC,” was one response to the data.

Impact of BTC Hitting Markets

However, the slide is more likely to be linked to the Federal Reserve’s latest action. Fed Chair Jerome Powell said on March 7 that the Open Markets committee might need to increase interest rates beyond original estimates.

Higher interest rates make cash savings more attractive than risk-on assets such as crypto.

Markets have responded by sliding 1.3% to $1.06 trillion in total capitalization. Furthermore, BTC is down 1.6% on the day, trading at $22,125 at the time of press.

As reported by BeInCrypto, volume and sentiment are waning. This could lead to more short-term losses for the king of crypto.

Bitcoin is currently down more than 9% over the past two weeks. It appears to be heading for support at the mid-$21,000 level.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.