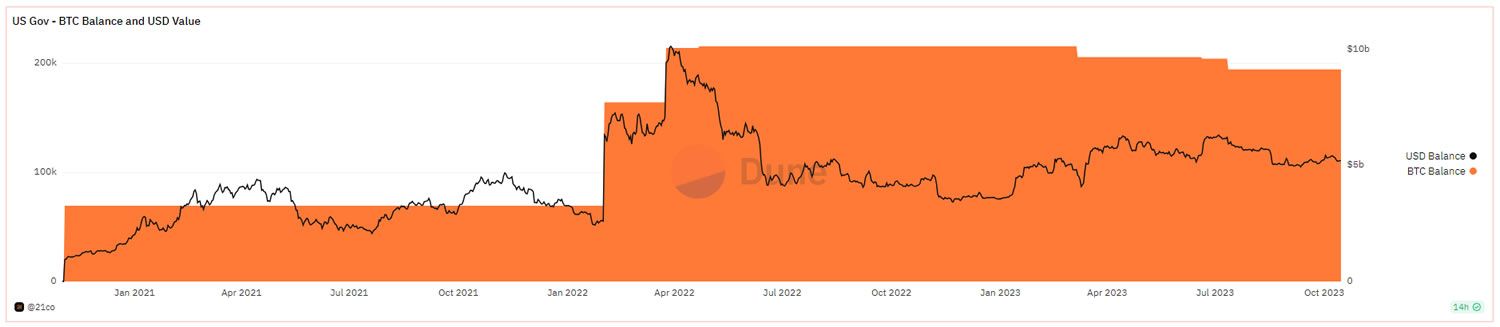

The United States government has seized around 200,000 BTC from cybercriminals and holds one of the world’s largest Bitcoin stashes. However, Uncle Sam appears to be in no rush to liquidate its fat stack and has assumed the unintentional position of lazy hodler.

The federal government holds around $5.4 billion worth of Bitcoin. If liquidated, a stash this large would definitely move markets and increase selling pressure.

No Urgency to Sell

On October 15, the Wall Street Journal delved into the government’s Bitcoin holdings. It noted that the US has been “notoriously slow to convert its stash of Bitcoin” into dollars.

Moreover, it doesn’t appear to be intentionally hodling for higher prices, it noted.

“That big pile of bitcoin is more a byproduct of a lengthy legal process than strategic planning.”

Executive director of the IRS’s cyber and forensics services section, Jarod Koopman, said, “We don’t play the market. We basically are set by the timing in our process.”

The BTC is kept offline in hardware wallets controlled by agencies like the Department of Justice and Internal Revenue Service (IRS).

Moreover, it can take years from initial seizure to liquidation due to lengthy investigations and legal proceedings. This has sometimes allowed the government to benefit from Bitcoin price appreciation.

Any airdrops this week? Find out more: Best Upcoming Airdrops in 2023

Once cases conclude, the Marshals Service liquidates the Bitcoin and distributes proceeds to victims or covers investigative expenses.

Early liquidations were done via auction, but now exchanges like Coinbase are used. The Marshals Service spreads out sales to avoid market impact.

Professor of computer science at Carnegie Mellon University, Nicolas Christin, commented:

“The government moves generally very slowly to dispose of those assets because they’ve got to do a ton of due diligence, the cases are often complicated and there’s a lot of red tape.”

In a recent sale in March, the government sold 9,861 BTC via Coinbase. According to a govt spokesperson, “Our goal is to dispose of assets in a timely manner at fair market value.”

The government started moving BTC around again in July, as reported by BeInCrypto.

Uncle Sam’s Big Bitcoin Stash

According to 21.co, the parent company of 21shares, the US government has seized at least 215,000 BTC since 2020. It has tracked three seizures since 2020 on a Dune Analytics page.

The November 2020 Silk Road seizure was 69,369 BTC. In January 2022, a Bitfinex hack seizure totaled 94,643 BTC, while in March 2022, the James Zhong seizure was 51,326 BTC.

This means that its overall stash could be much more than the 194,188 BTC that 21.co has counted and tracked.

All in all, it is unlikely that this entire tranche of BTC will ever be liquidated at the same time, causing a market crash.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.