Cryptocurrency traders and investors are closely monitoring key events on this week’s US economic calendar. As Bitcoin (BTC) maintains a price above $64,000, these events could trigger significant market fluctuations.

The crypto market, largely driven by retail investors, remains susceptible to economic pressures and regulatory uncertainties. With these factors at play, traders are eager to see how the week unfolds.

Key US Economic Events This Week

Bitcoin is eyeing further gains, supported by the Federal Reserve’s recent dovish tone. This week’s US economic events could heavily influence retail sentiment, potentially setting the stage for the next price movement in crypto markets. Several key items on the economic calendar hold the potential to impact Bitcoin and broader crypto prices, making them critical for traders to watch.

Consumer Confidence Index

The Conference Board is set to release the US Consumer Confidence Index on August 27, the last Tuesday of the month. This index offers insights into spending trends by reflecting consumer attitudes, buying plans, and vacation intentions.

High consumer confidence typically correlates with increased spending, potentially boosting economic activity. Such optimism might lead to greater investments in assets like Bitcoin. On the flip side, low consumer confidence, signaling reduced spending, could prompt the Federal Reserve to maintain a dovish stance, leading to more liquidity in the financial system.

In this scenario, Bitcoin could benefit as investors turn to it as an alternative store of value and inflation hedge. Given this backdrop, Tuesday’s data will be pivotal for crypto markets, offering a snapshot of consumer sentiment regarding the economy. The current forecast stands at 100.5, a slight increase from 100.3.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Initial Jobless Claims

Crypto markets are also closely watching Thursday’s initial jobless claims report, which will offer fresh insights into the US labor market’s health. Recently, the number of Americans filing new unemployment claims has edged higher, signaling a gradual cooling of the labor market — a factor that has encouraged the Fed’s cautious stance on rate cuts.

The last reported figure was 232,000, with a middle projection of 234,000 for the upcoming data. According to the Labor Department, initial jobless claims increased by 4,000 to a seasonally adjusted 232,000 for the week ending August 17, while economists expected 230,000.

A higher-than-anticipated rise in jobless claims could point to economic instability, driving investors toward Bitcoin as a hedge against traditional markets. Conversely, a drop in claims may boost confidence in traditional assets, potentially diverting capital away from cryptocurrencies. With the Fed closely monitoring labor conditions, these numbers will be key for both traditional and crypto investors alike.

GDP

This week’s second revision of Gross Domestic Product (GDP) data, scheduled for Thursday, is a critical release for the markets. GDP measures the overall economic output and health of a country by calculating the total value of goods and services produced.

A positive revision would signal robust economic growth, potentially driving investors to riskier assets like Bitcoin and other cryptocurrencies. On the other hand, a downward adjustment could dampen sentiment, leading to a pullback in crypto prices as investors grow cautious.

In the previous report, GDP grew at an annualized rate of 2.8% in Q2, surpassing the 1.4% pace recorded in Q1. This steady growth has helped ease recession fears, suggesting resilience in the broader economy. If confirmed by Thursday’s data, investor optimism could spill over into the crypto market, reinforcing Bitcoin’s appeal as a high-reward asset.

Personal Income and PCE Index

The US Bureau of Economic Analysis (BEA) is set to release personal income, spending, the PCE index, and core PCE data on Friday. These figures will provide crucial insights into inflation and consumer behavior, directly influencing the Federal Reserve’s next moves.

Weaker personal income and spending data, paired with softer inflation, could pave the way for a 50-basis-point rate cut in September. Such a dovish approach from the Fed could boost demand for riskier assets like Bitcoin. However, if spending power drops sharply, recession fears might resurface, potentially dampening Bitcoin demand.

The Personal Consumption Expenditures (PCE) index, especially the core PCE excluding food and energy prices, will be a key inflation gauge. A higher-than-expected core PCE reading would indicate persistent inflationary pressures, leading investors to seek alternative assets like Bitcoin, which is often viewed as an inflation hedge. On the flip side, a lower core PCE index could reduce demand for cryptocurrencies as investors turn to more stable investments.

Consumer Sentiment

Markets also brace for the University of Michigan’s Consumer Sentiment survey release for August on Friday. This data shows the gap between the US economy’s continued strength and how households feel about their personal financial situation.

If the data shows consumers are still struggling with inflation and high interest rates while also worrying more about their jobs, crypto could react in different ways. Notably, consumer sentiment is much more sensitive to inflation, while consumer confidence is more sensitive to the labor market.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Ultimately, the relationship between crypto and US macroeconomics is not always straightforward. The market reacts to data releases in unexpected ways determined by what transpires in the days leading to the data release date. It is worth mentioning that all of the above data will affect the S&P500 Index (SPX) and, therefore, also impact Bitcoin.

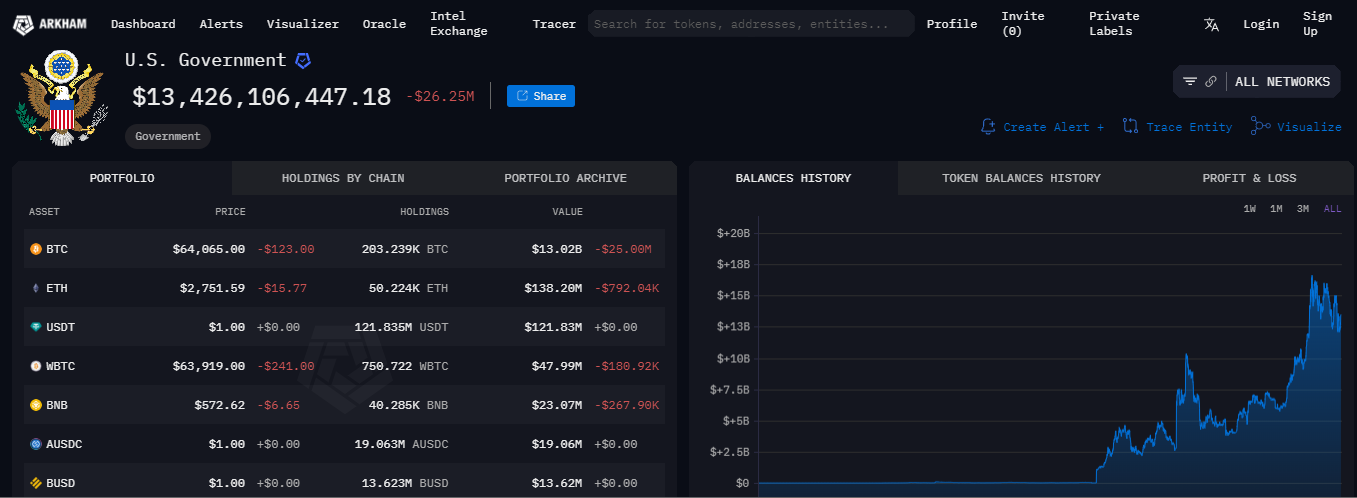

US Government Bitcoin Supply Overhang

The US government’s Bitcoin holdings remain a significant concern for the market. According to Arkham Intelligence, the government currently holds around 203,239 BTC. Any large transfer from this inventory could trigger fears of an oversupply, potentially driving Bitcoin’s price below the $60,000 mark.

According to BeInCrypto data, Bitcoin is currently trading at $64,067, reflecting a 0.23% dip since the market opened on Monday. Further developments this week could determine its next directional move.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.