US headline inflation slowed to 4% in May, its lowest annual level since March 2021, increasing the chances that the Federal Reserve (Fed) will pause interest rate hikes at Wednesday’s meeting.

Month-on-month headline Consumer Price Index (CPI) rose 0.1%, falling 0.3% short of analysts’ estimates, further strengthening the rate pause narrative.

Price Pressures in PCE and Core CPI Suggest July Hike

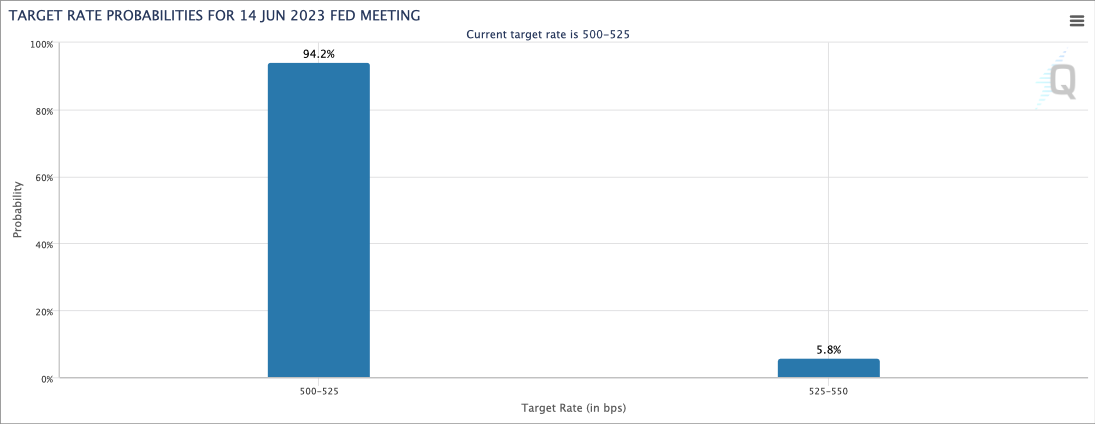

Earlier this week, futures markets predicted with a 78% probability the Fed would keep interest rates at 5-5.25% as unemployment increased from 3.4% in April to 3.7% in May.

Since the release of the CPI, the probability of a pause has increased to 94%.

The Fed has increased rates 10 times since March 2022 to induce price stability after keeping rates at zero and buying government bonds to stimulate the US economy.

Now, markets hope the rate increases will pause in June as several key indicators suggest the economy is cooling.

However, the Fed’s preferred inflation gauge, Personal Consumption Expenditure Index (PCE), has not responded as favorably to rising rates as its relative, the CPI.

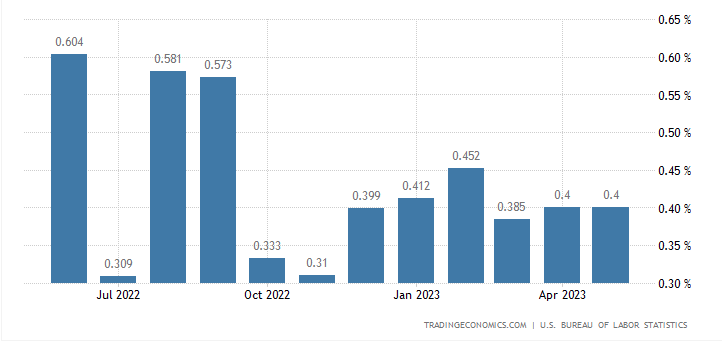

PCE grew at an average of 4.3% over the past three months, while wages grew 0.3%. Additionally, core CPI, excluding food and energy prices, increased 0.4% for the third consecutive month ending May.

These numbers may cause the Fed to pause hikes in June and resume them in July.

“Don’t get sidetracked by falling headline inflation,” said Morning Consult economist John Leer.

“The Fed may pause hiking rates tomorrow [Wednesday], but it will have to raise rates again if it hopes to tame inflation.”

Bitcoin Tracks Futures, up but Key Data Still Outstanding

The Dow Jones Industrial Average rose 75 points after the CPI numbers were released. S&P 500 and Nasdaq futures rose 0.3% and 0.6%. Bitcoin rose 1% to $26,300 to $26,200 but has since fallen below $26,100.

The asset is up almost $10,000 from its $16,600 level on Jan. 1, 2023, buoyed partly by expectations that the Fed would pause or even reduce interest rates.

Wednesday’s Federal Reserve interest rate announcement could be a catalyst for sending the asset higher.

Read here about the Fed’s role in cryptocurrency.

The central bank’s Summary of Economic Projections for year-end, also due this week, will likely test investors’ trust in Bitcoin as a safe haven.

The report will probably revise unemployment and PCE expectations down to 4.5% and 3.6% at the end of this year.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.