As the crypto market holds its collective breath, Bitcoin has managed to surge ahead. BTC broke the $26,000 mark, even as the industry waits for a key US inflation report.

The report, expected to be a major catalyst for cryptocurrencies, comes amidst a backdrop of increased regulatory scrutiny that has left the market in a state of flux.

Bitcoin Turns Volatile Before US Consumer Price Index (CPI) Report

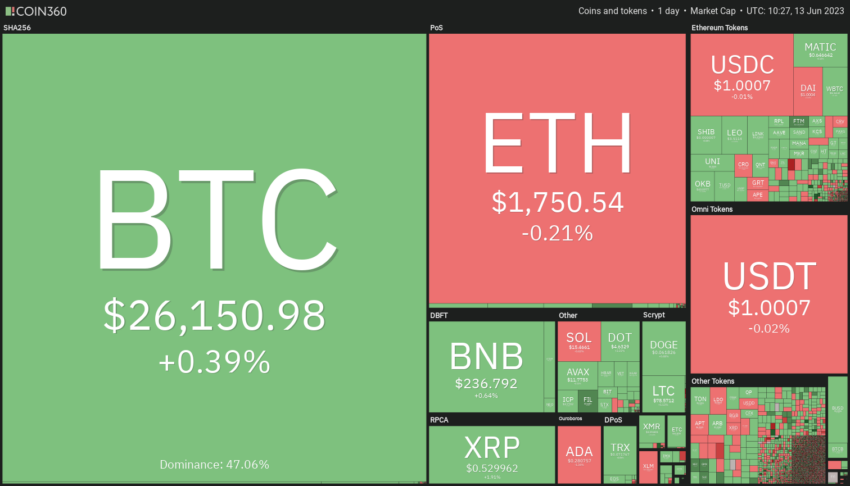

Bitcoin has seen a slight increase of less than 1% in the last 24 hours, bringing it close to $26,200. It continues a consolidation trend within the range of $26,000 to $27,000. This has been the norm since Bitcoin’s 10-month peak above $30,000 in April.

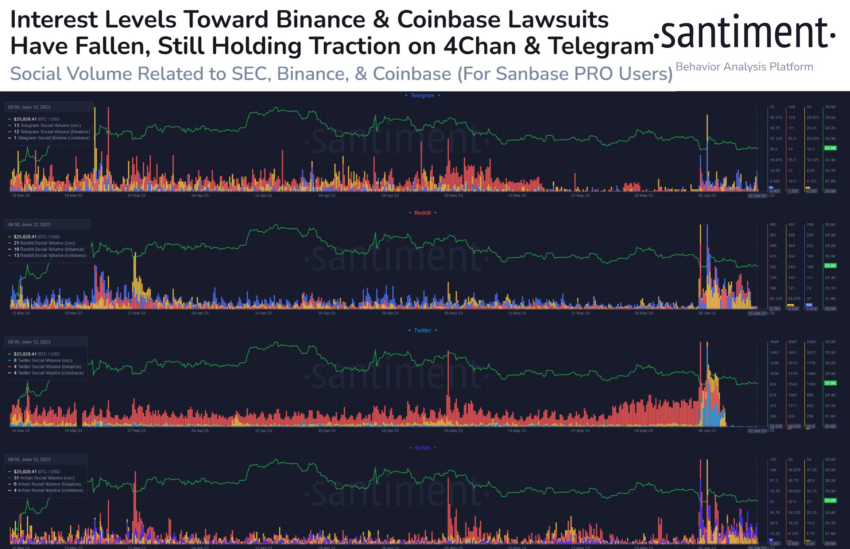

Despite regulatory fears spurred by recent US Securities and Exchange Commission (SEC) charges against exchanges Binance and Coinbase, Bitcoin has managed to maintain a steady course, even after a price drop to $25,500 last week.

“With traders still very much aware of the SEC going after Binance and Coinbase, the mass hysteria has at least settled down. Until the next developments with the lawsuits, we could see some gradual rising of prices back to pre-crash levels,” concluded blockchain forensics firm Santiment.

The past year has seen dramatic rate increases by the US Federal Reserve to combat inflation, a move that has exerted downward pressure on cryptocurrencies.

Bitcoin’s impressive rally this year, a surge of around two-thirds, has been largely based on expectations that these rate hikes will soon end and possibly reverse. Investors are hoping that the Fed will halt rate increases this Wednesday.

Still, the release of the US Consumer Price Index (CPI) for May, a crucial inflation indicator, could upend these expectations.

“The inflation news continues to evolve in a positive direction. The early reports on May CPI have largely come in below expectations. Most forward-looking indicators line up nicely to point to a sustained downshift in inflation,” said analytst at JP Morgan.

With these macro catalysts on the horizon, Bitcoin’s position remains precarious.

“Bitcoin continues to grind sideways-to-lower but remains above key support near $25,200. A breakdown below $25,200 would turn our attention to nearby secondary support from the 200-day moving average, near $23,600. Long-term momentum has yet to recover meaningfully,” affirmed Managing Partner at Fairlead Strategies, Katie Stockton.

However, Bitcoin is not the only crypto in play. Ethereum held steady at $1,750. Altcoins saw mixed reactions, with Cardano slipping by 2.20% and Polygon rising by 0.50% in the last 24 hours. Meanwhile, memecoins such as Dogecoin and Shiba Inu saw 0.55% and 1.55% gains, respectively.

In this climate of uncertainty and anticipation, Bitcoin’s resilience underscores the dynamism and intrigue that continues to surround the crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.