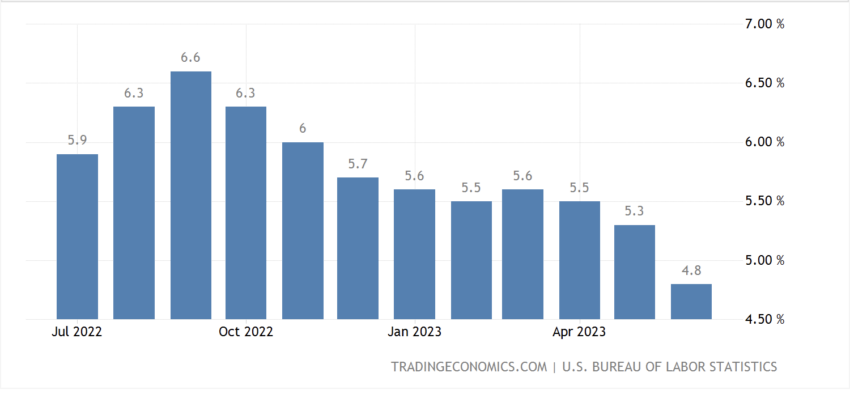

The monthly headline and core US Consumer Price Indexes (CPI) rose 0.2%, cooler than the estimated 0.3%, but are unlikely to change the Federal Reserve Board’s decision on interest rate hikes at their July meeting.

The core and headline numbers came in at their lowest since 2021. Food, the largest driver a year ago, was up only one-tenth of a percent, while housing prices fell 0.4%.

Fed Likely to Remain Hawkish Despite CPI

Annual core inflation rose 4.8%, lower than analysts’ 5% estimate, which is still below the Fed’s 2% target.

While the cooling prices suggest the Fed’s tightening policy may have worked to lower prices, economists agree that a robust US labor market almost guarantees that the bank will increase interest rates for the eleventh time when they meet in two weeks. The central bank started raising interest rates in March 2022.

Hourly earnings rose 0.6% in June, while job US nonfarm payrolls fell, suggesting the jobs market is strong, but slowing. Jobless claims fell in the third week of June. At the time, Fed Chair Jerome Powell said that cooler inflation would lead to fewer job losses down the line.

Find out here how to protect your retirement from inflation.

After the CPI print, Bitcoin (BTC) briefly spiked to $30,905 from $30,750 before falling to $30,802.40. Most of the altcoins in the top 10 cryptocurrencies by market cap recorded increases of under 1% since the news, while the Dow Jones Industrial Average futures index rose 0.93%, and the S&P 500 increased 0.6%.

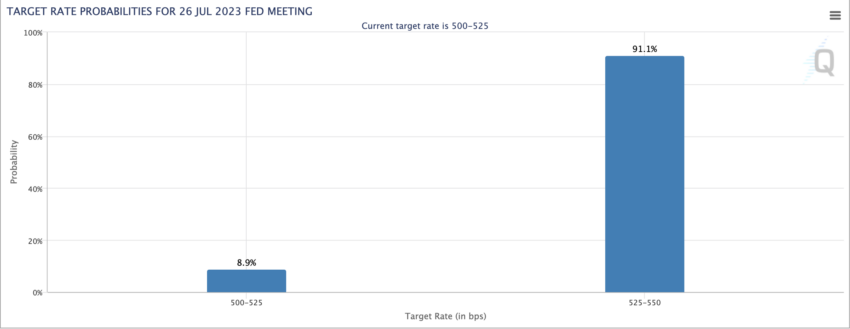

Markets Price 25 Basis Point Interest Rate Hike

Markets more or less have already priced in a July interest rate hike, with the CME’s FedWatch tool predicting a 25 basis point increase, taking the Federal funds rate to 5.25-5.5%. However, Bloomberg’s Mike McKee suggested the outcome of the Fed’s September meeting will be less certain.

On Monday, three Fed employees predicted the bank would need to persist with its tightening policy this year. Mary Daly, the San Francisco Fed President, said,

“We’re likely to need a couple more rate hikes over the course of this year to really bring inflation back into a path that’s along a sustainable 2% path.”

A failure to further tighten policy could see prices spiral back up.

Got something to say about Fed’s hawkishness despite cooler US CPI or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.