United States citizens holding cryptocurrency face a new obligation that demands awareness to avoid potential serious consequences.

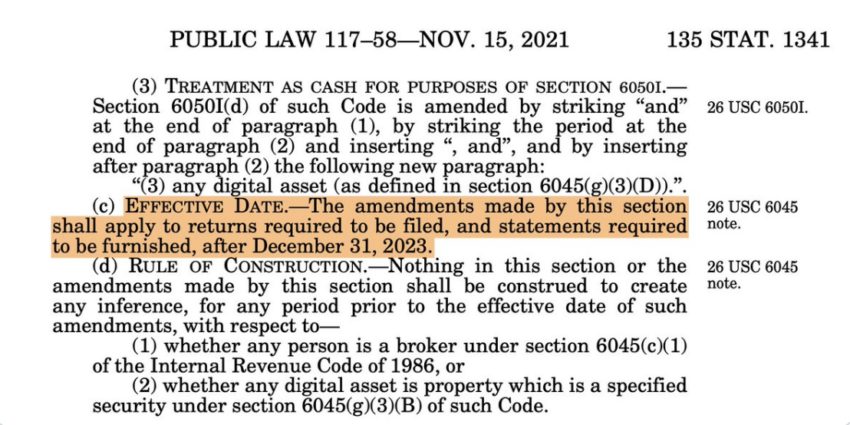

“The amendments made by this section shall apply to returns required to be filed, and statements required to be furnished, after December 31, 2023,” the filing noted.

US Citizens Must Fulfill Crypto Tax Obligations

Jerry Brito, the executive director of Coin Center, recently reported that US citizens holding more than $10,000 USD equivalent in crypto must understand and fulfill their tax reporting obligations.

“If you receive $10k or more in crypto you now have an obligation to report the transaction (including names, addresses, SS numbers, etc.) to the IRS within 15 days under threat of a felony charge.”

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

Ongoing Crypto Tax Measures Target US Citizens in Latest Taxation Developments

This comes after BeInCrypto recently reported on new crypto tax rules coming into effect that will effect companies holding crypto.

The Financial Accounting Standards Board (FASB) introduced new rules requiring companies to measure their crypto assets at fair value.

This measurement technique, capturing the most up-to-date value of digital currencies like Bitcoin and Ethereum, aims to provide a more accurate reflection of their worth. The rules, effective from 2025, allow companies the option of earlier adoption.

Meanwhile, in April 2023, BeInCrypto reported that nearly all crypto investors avoided paying tax in 2022.

According to research firm Divly, hardly anyone declared their crypto trading or investing activities to tax authorities last year.

“We estimate that globally just 0.53% of cryptocurrency investors declared their cryptocurrency activity to their local tax authorities in 2022.”

Read more: The Ultimate US Crypto Tax Guide for 2023

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.