As cryptocurrencies gain traction in the global financial environment, an undercurrent of legislative apprehension brews in the United States. Senator Elizabeth Warren’s campaign to address malpractices in the crypto industry has garnered a broader base of bipartisan support.

Nine more senators have aligned with Warren’s proposed Digital Asset Anti-Money Laundering Act, which Senator Roger Marshall (R-Kan.) co-sponsors.

Elizabeth Warren’s Anti-Crypto Army

The new additions to Warren’s coalition include a mix of moderate and progressive members. Therefore hinting at a unified concern that transcends party lines.

Senators Gary Peters (D-Mich.) and Dick Durbin (D-Ill.), both chairing key Senate committees — Homeland Security and Judiciary, respectively — feature prominently in this list. The inclusion of Senators Tina Smith (D-Minn.), Angus King (I-Maine), Jeanne Shaheen (D-N.H.), Bob Casey (D-Pa.), Richard Blumenthal (D-Conn.), Michael Bennet (D-Colo.), and Catherine Cortez Masto (D-Nev.) only serves to underscore the gravity with which the Senate views the crypto industry.

“Our expanding coalition shows that Congress is ready to take action – our bipartisan bill is the toughest proposal on the table cracking down on crypto’s illicit use and giving regulators more tools in their toolbox,” Warren said.

Read more: What Could Elizabeth Warren’s Senate Reelection Bid Mean for the Crypto Industry?

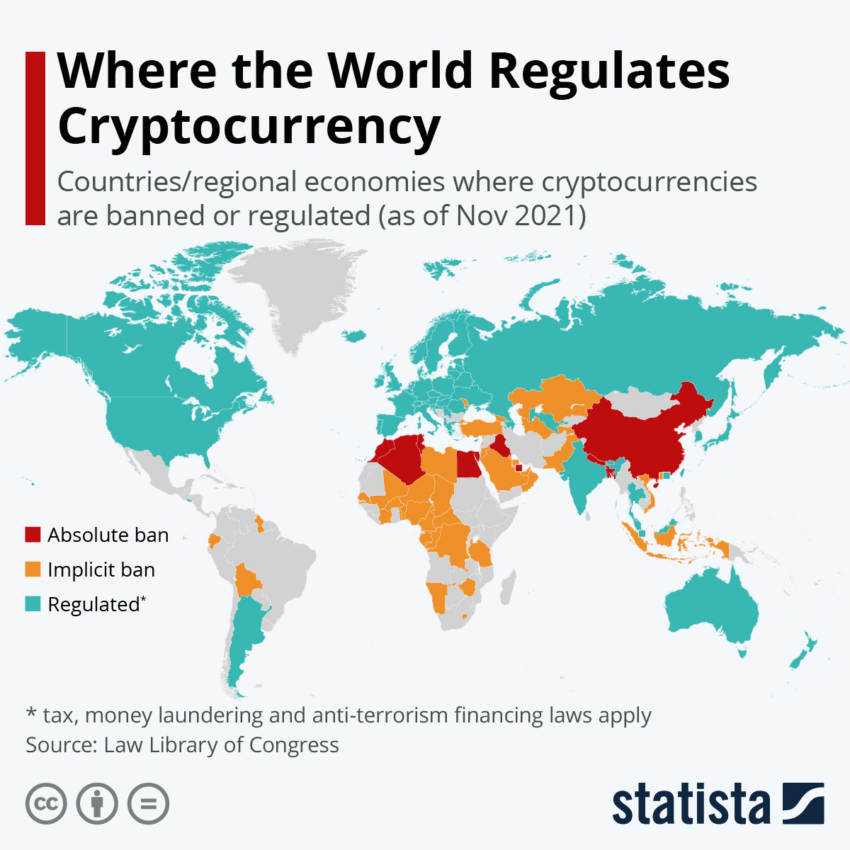

This surge of support echoes a growing unease about the illicit applications of crypto. With Capitol Hill’s attention increasingly zooming in on the market’s vulnerabilities, such as money laundering and tax evasion, the narrative presents a stark challenge for the market.

“Our bipartisan bill would help fight back against terrorist organizations and rogue state actors, such as Russia and North Korea, who use crypto to bankroll illicit activities and require cryptocurrency platforms to abide by the same anti-money-laundering rules that banks follow,” Manchin added.

Warren’s legislative move also seeks to bridge an alarming “crypto tax gap.” By her estimation, a lack of stringent policies in the crypto market threatens to deprive the US Treasury and the Internal Revenue Service of roughly $1.5 billion in tax revenue for the upcoming financial year.

The proposed Digital Asset Anti-Money Laundering Act is comprehensive. Warren aims to regulate noncustodial digital wallets and augment the Bank Secrecy Act’s scope. She also wants to introduce stringent Anti-Money Laundering/Combating the Financing of Terrorism compliance checks and craft additional legal deterrents against the misuse of digital currencies.

Read more: Stablecoin Regulations Around the World

The act has garnered endorsements from reputable organizations, including Transparency International US, Global Financial Integrity, and the National Consumers League. This suggests that Warren’s endeavors resonate within the confines of the Senate and with those acutely aware of financial intricacies.

Other Senators Called for Transparency

Yet, it is not just Warren sounding the alarm. Senator Sherrod Brown (D-Ohio), Chair of the Senate Banking Committee, recently urged regulators to harness their existing powers over crypto.

“As Congress reviews crypto legislation, I ask that your agencies assess their authorities and evaluate how we can build on our existing disclosure guardrails to effectively target the deficiencies we have observed in digital asset tokens and digital asset platforms,” Brown wrote.

Brown emphasized the need for enhanced transparency and sought to shield investors from potential risks. His assertion — that the crypto industry will not self-regulate — echoes a broader sentiment demanding rigorous legislative oversight.

“Crypto firms have taken no meaningful steps to improve their transparency, leaving customers vulnerable. We cannot settle for a status quo in which Americans lack the basic, comprehensive transparency they would receive in any other market in which they choose to invest,” Brown added.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

While the transformative potential of crypto cannot be downplayed, US lawmakers are becoming increasingly wary of the shadows accompanying it. Elizabeth Warren’s anti-crypto coalition highlights that legislative scrutiny and demands for transparency will significantly shape the future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.