Uniswap has been performing phenomenally well in the past few months, despite the fact Ethereum (ETH) gas fees have been staggeringly high.

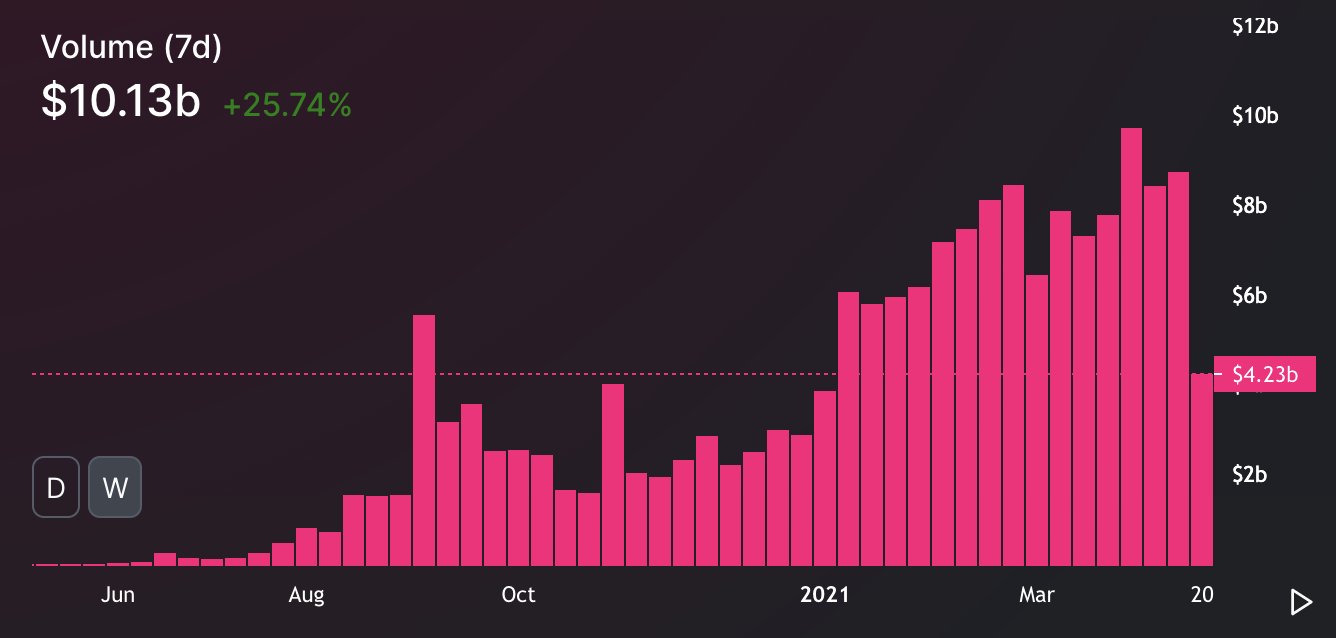

The Uniswap platform has crossed $10 billion in trading volume for the first time, founder Hayden Adams tweeted on April 20.

This is a figure roughly double that of what was being recorded six months ago. The tweet is accompanied by a chart that shows a 25.7% increase in weekly volumes.

The exchange has been performing phenomenally well in the past few months, despite the fact Ethereum (ETH) gas fees have been staggeringly high. The number of traders has also grown, and it continues to dominate the market.

Adams notes that, at the current rate, Uniswap will exceed $500 billion in trading volume for 2021.

Uniswap is at the center of DeFi, with many projects first putting themselves up on the platform. The TVL of the market, an important metric that shows how much is locked up, currently stands at over $117 billion.

This is close to its all-time high of $123 billion or so.

While the market is experiencing a correction, DeFi is apparently set to grow. Several new protocols and solutions are launching with the intention of simplifying the DeFi experience. Uniswap will likely benefit from this growth.

The DeFi growth has already boosted UNI’s price considerably, which sits nicely above $30. The platform airdropped 400 UNI tokens to users last year, which is now worth over $12,000.

However, several improvements and continual development has also added to Uniswap’s popularity. This will likely continue, as Uniswap is preparing to launch V3 of its platform.

Uniswap V3 core and peripheral contracts

Uniswap is preparing to launch V3 of its platform, with core and peripheral contracts already having been deployed on the Ethereum testnet. The new version will bring several new improvements and changes to the platform.

Among these changes are concentrated liquidity and multiple fee tiers. The former grants individual LPs “granular control” over the price ranges capital is allocated to. The latter gives LPs compensation in proportion to the amount of risk they take on.

Uniswap V3 was first spoken of in March 2021, building on the features and architecture of V2. It is slated for launch on May 5, with an L2 deployment on Optimism to follow.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.