Ethereum co-founder Vitalik Buterin has been very active on crypto social media recently. His latest post has offered some financial advice. However, it has not been received well by those who have invested in Ethereum.

On January 7, Vitalik Buterin responded to a post regarding billionaires Bill Gates and Warren Buffett. In that response, he offered his own response, claiming that this was “awful advice,” offering some of his own “actual financial advice.”

Ethereum’s Vitalik Buterin on Investing

The original post by X user ‘alex_avoigt’ claimed that Bill Gates began to diversify his portfolio, selling Microsoft shares, after he met Warren Buffet. “Be careful with diversification and with friends who recommend it,” was the comment that got Vitalik’s attention.

Much of Buterin’s financial advice was pretty sound.

Diversification is good, he said, urging people to have savings. “Get to the point where you have enough to cover multiple years of expenses,” he said before adding, “Financial safety is freedom.”

However, he also said, “Be boring with most of your portfolio,” implying favoring low-risk investments, which crypto is not.

Finally, Vitalik advised against using more than 2 times leverage, which also makes sense.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

However, the responses raised eyebrows, with crypto investor ‘CoinMamba’ kicking off with:

“Good advice if you are already a millionaire. But these don’t apply to someone who is trying to get rich.”

Tether and VanEck strategist Gabor Gurbacs asked if he was “still selling ETH,” while Autism Capital said, “This doesn’t sound bullish.”

‘Dark Crypto Lady’ chimed in with, “But why do you and your friends keep selling Ethereum?”

Commodities and futures trader ‘Googly’ was also disgruntled with ETH’s recent price performance:

“However, I can’t take this advice anymore, I have over-invested in ETH, by a lot. It is what it is. Every day I am checking price and its underperforming.”

Last week, Buterin quipped, “In Ethereum, the worst thing that happens is people lose money.”

Ethereum Price Outlook

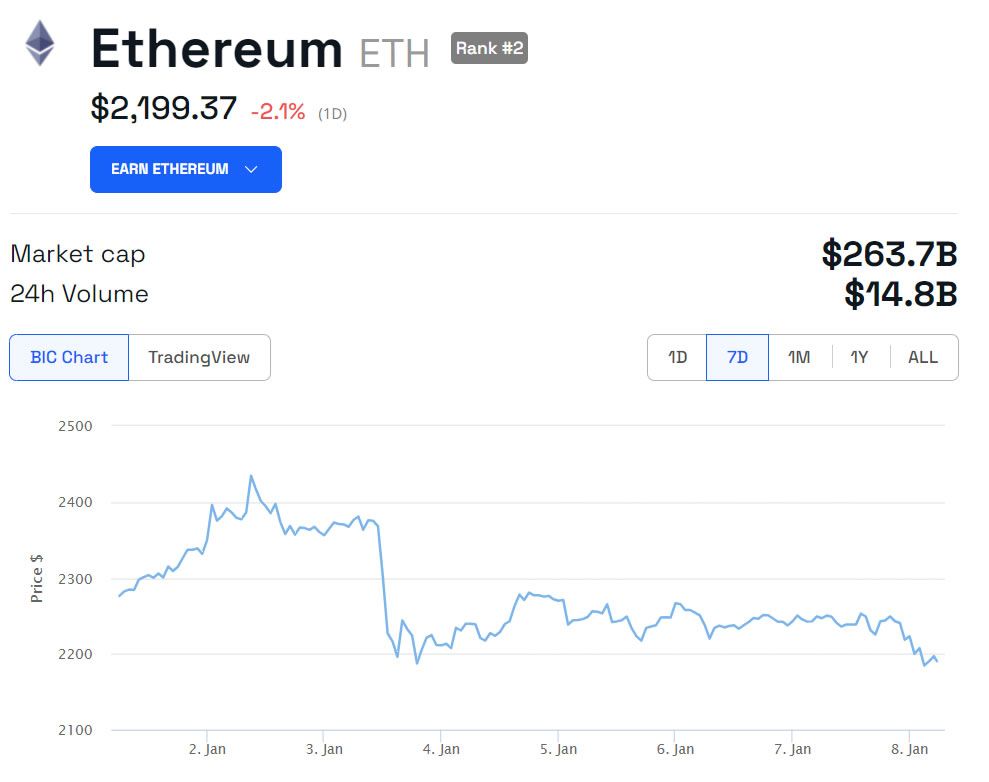

As if to emphasize the point, the Ethereum price has declined 2.4% on the day. As a result, the asset has fallen to $2,196 at the time of writing during Monday morning trading in Asia.

Moreover, Ethereum has dropped almost 10% since its 2024 high of $2,434 on January 2. While Bitcoin remains in a consolidation phase, poised for a big move on ETF news, Ethereum and the altcoins are dumping again.

Ethereum has been slow to react during recent rallies, with alternative layer-1 tokens such as Solana and Avalanche surging ahead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.