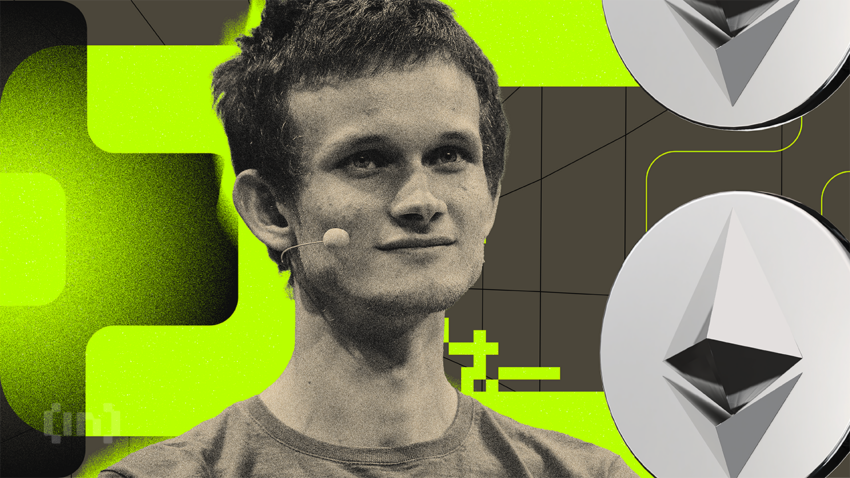

Vitalik Buterin, the co-founder of Ethereum, offered a breath of practical financial wisdom as the crypto markets turn volatile.

His recent statements encapsulated a philosophy combining traditional investment strategies with modern insights, a blend particularly relevant in today’s digital age.

Vitalik Buterin’s Financial Advice

Firstly, Buterin emphasized the value of diversification. In an era where new investment opportunities emerge daily, spreading assets across various sectors can mitigate risk. This approach aligns with traditional investment strategies and resonates with the fluid nature of the crypto market.

Secondly, the tech visionary underscored the importance of savings. Buterin advised accumulating enough to cover several years of expenses. This principle of financial safety as freedom is especially poignant in a time where job markets and economies are increasingly unpredictable. It is a reminder that financial security extends beyond mere wealth accumulation.

In his third point, Buterin advocated for a “boring’ portfolio.” This advice, seemingly at odds with the thrill of high-stakes investing, actually roots in a time-tested belief. Steady, reliable investments often lead to long-term gains. In an industry where sensational stories of overnight millionaires are common, Buterin’s counsel is a grounding call to prudent investing.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

Lastly, he warned against excessive leverage, specifically anything over 2x. This point is crucial in the context of cryptocurrency trading, where high leverage can lead to significant losses. By setting this boundary, Buterin aligned with responsible investment practices, prioritizing long-term stability over short-term gains.

Buterin’s advice, blending traditional investment wisdom with a nuanced understanding of the digital economy, offers a roadmap for both novice and seasoned investors. It serves as a reminder that in the cryptocurrency industry, sometimes the simplest strategies are the most effective.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.