The collapse of FTX and the conviction of former CEO Sam Bankman-Fried has left the crypto industry with questions about how it will survive. In some regions like the UK and Canada, crypto exchanges have been forced to exit or merge to survive, even as others in the crypto community see traditional finance as the path to survival.

Earlier this month, a nine-person jury convicted former FTX CEO Sam Bankman-Fried on several counts of fraud. The fall from grace of the former golden boy of crypto has since left many in the industry indecisive about how to proceed.

Crypto Industry Faces Tough Questions

Bankman-Fried’s high-profile FTX backers gave crypto an aura of legitimacy after the collapse of Mt. Gox, a Japanese exchange that lost hundreds of thousands of dollars in customers’ funds. At its peak, FTX attracted investments from Sequoia Capital, Tiger Global, and an Ontario pension fund.

Now, Crypto detractors view Bankman-Fried’s fall as the end of a largely lawless era of crypto. Well-known crypto skeptic John Reed Stark called Bankman-Fried’s conviction a “death knell” for blockchain and Web3.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Now, even as firms like BlackRock and Fidelity show an interest in the sector, crypto proponents face a tough choice. Either seek mainstream acceptance, or adhere to crypto’s ethos and risk staying on the fringes.

According to Charles Storry of crypto futures index platform Phuture, there is still life in the industry.

“Crypto’s public image is at an all-time low, but the industry isn’t done yet.”

But one thing is certain: the road ahead won’t be easy.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

Crypto Exchanges Reorganize in Canada, UK

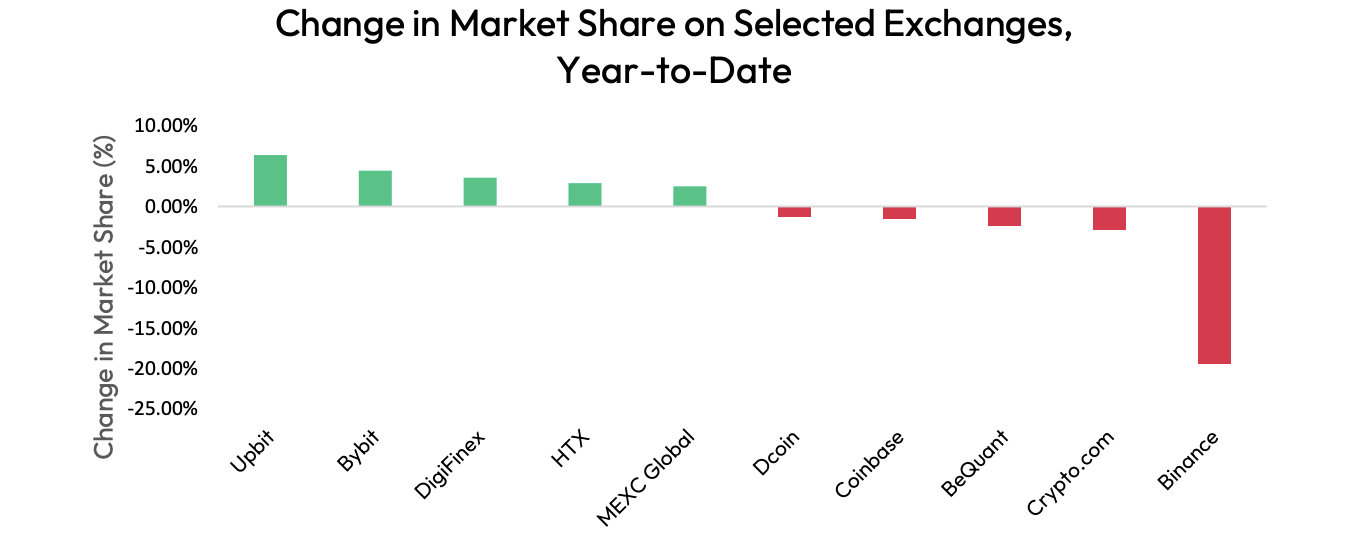

Following the collapse of FTX, lawmakers worldwide have tightened crypto rules to the point where some exchanges have suffocated. Recently, the UK Financial Conduct Authority made it illegal for crypto companies to advertise without approval from an authorized company. As a result, Binance said it would stop accepting new UK customers, following Bybit’s announcement it would leave the region.

The Canadian Securities Administrators previously classified stablecoins as securities, making business untenable for most crypto exchanges in Canada. Binance and Bybit left the region earlier this year.

The merger of Coinsquare and CoinSmart with their parent company WonderFi is intended to consolidate Buybit and CoinSmart, two major crypto exchanges in Canada. WonderFi acquired BuyBit in 2022.

Hong Kong has limited the assets exchanges can list, while Europe’s Markets in Crypto-Assets bill makes the listing process for crypto assets laborious. Hong Kong seen only a handful of exchanges acquire licenses, while the effects of Europe’s bill will only be seen in the new year.

Last month, US lawmakers French Hill and Cynthia Lummis cooled earlier pro-crypto enthusiasm by calling for Binance and stablecoin issuer Tether to be criminally charged. The companies were allegedly implicated in the funding of terrorists.

Do you have something to say about crypto exchanges in Canada, the UK, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).