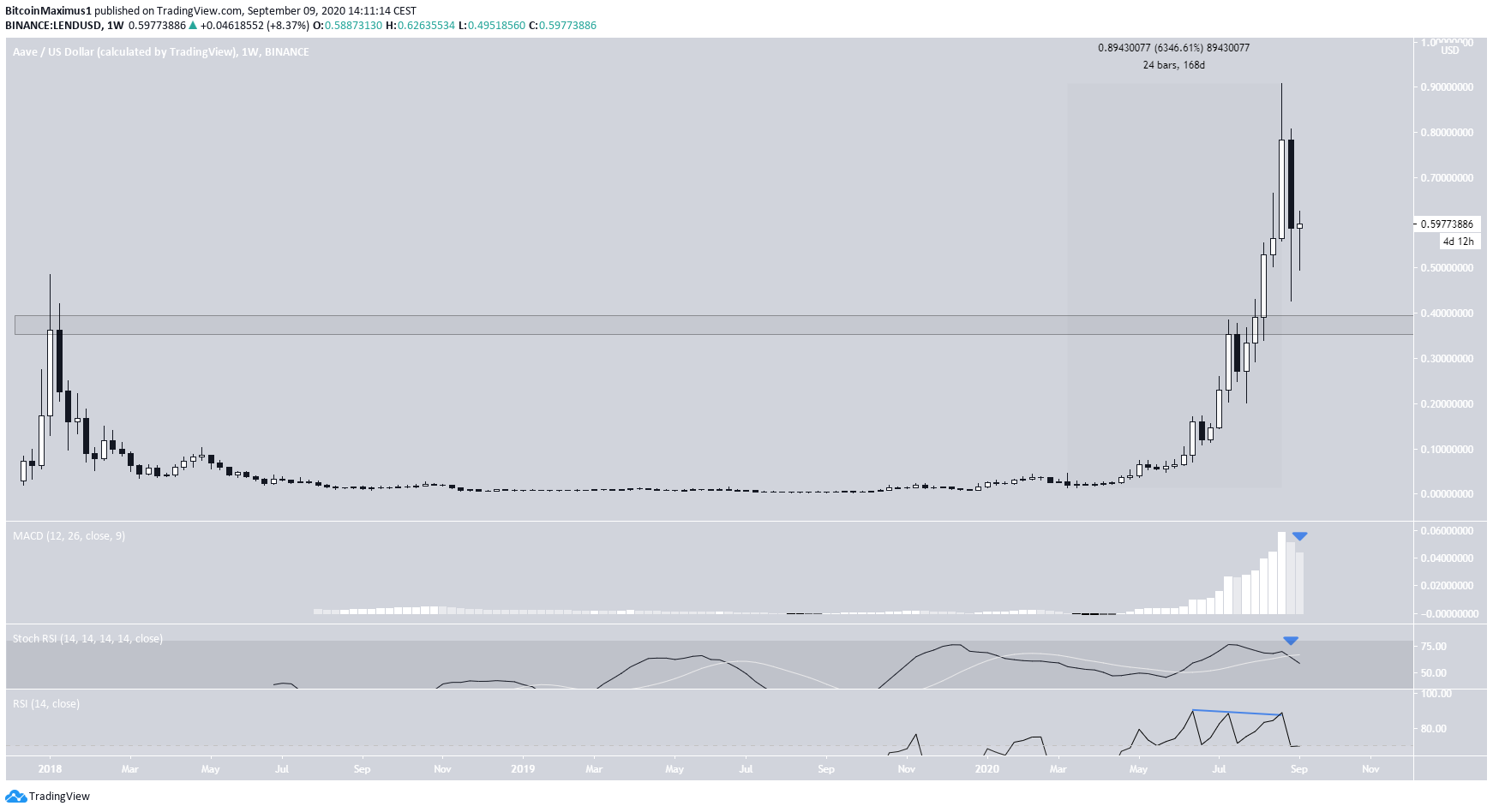

After increasing by more than 6000% in less than six months, Aave (LEND) may have begun a lengthy correction.

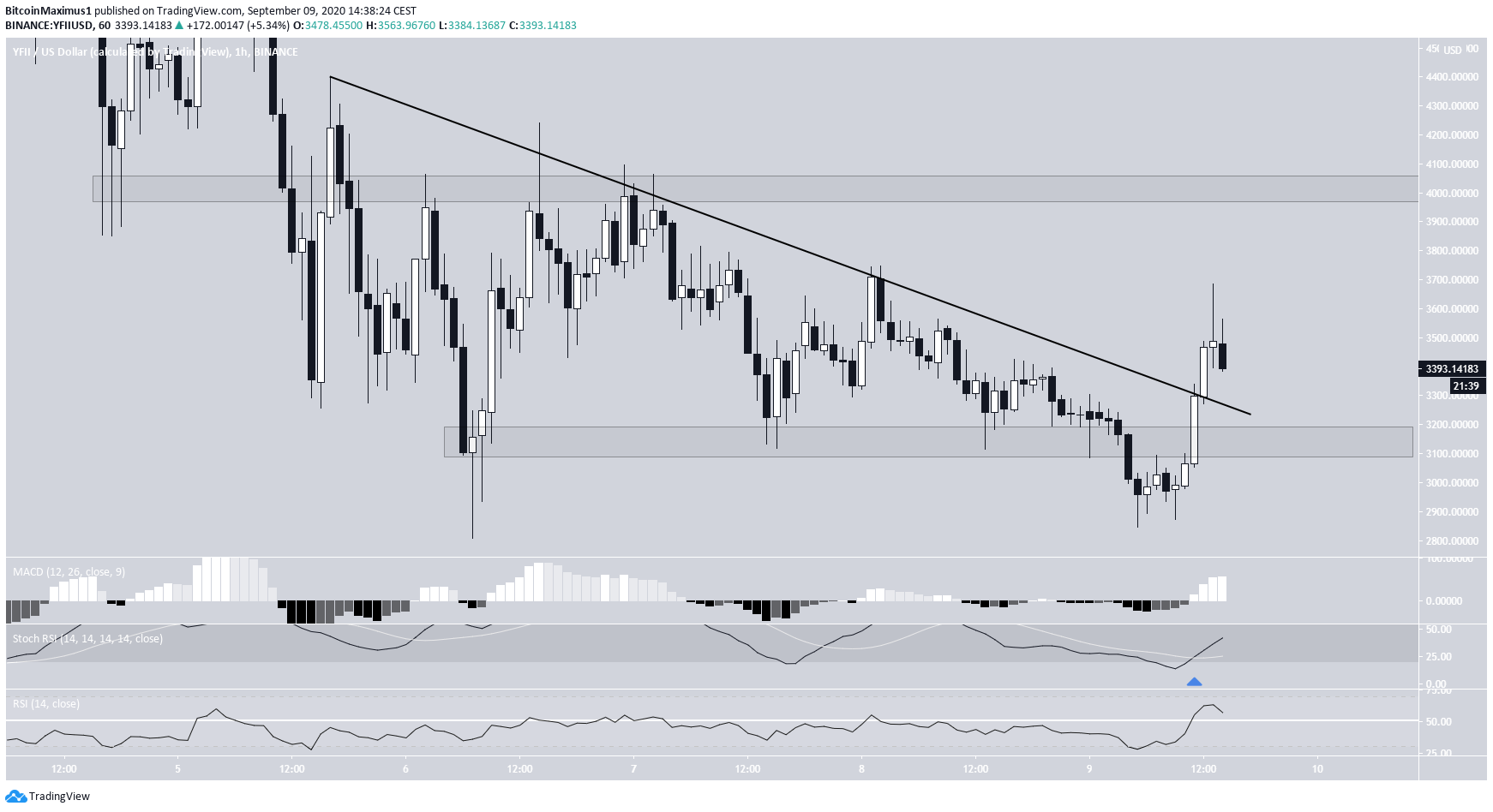

After a sharp drop, DFI.Money (YFI) has broken out from a descending resistance line and is moving towards the closest short-term resistance.

Aave (LEND)

Since the beginning of March, the LEND price was subject to a near parabolic increase that took the price to an all-time high of $0.90 on August 26. The entire rise spanned 168 days and measured a 6361% gain.

DFI.Money (YFI)

YFI was subject to a similarly rapid increase, reaching a high of $9,954 on September 1. The price has been falling since then, losing 65% of its value. However, the price has successively broken out from two descending resistance lines and validated them as support afterward. This is a bullish sign that suggests the price will move upwards.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored