Turkey is currently undergoing mass cryptocurrency adoption. This is despite little regulatory framework for these assets. The demand for digital assets has grown in Turkey amidst a financial crisis.

Global cryptocurrency exchange KuCoin have conducted a survey of Turks, with some interesting findings.

Survey findings

-The Turkish lira has lost nearly 50% of its value. Consumers are turning to alternative investments. While the U.S. dollar and gold remain solid options, demand for cryptocurrencies is rising.

-Cryptocurrencies have become trendy to most Turkish nationals for the first time. New traders are exploring what the technology offers.

-25% of Turkish traders have been trading crypto assets for over a year.

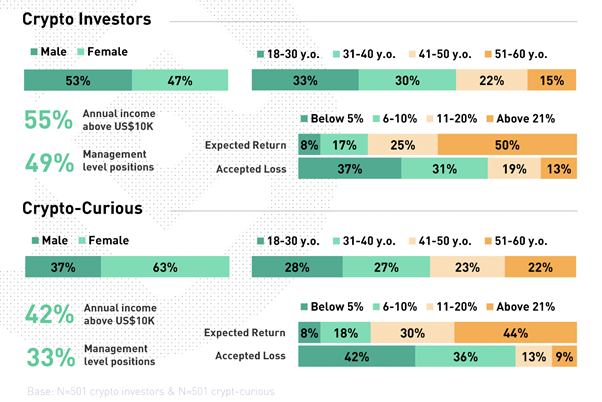

-There is no gender divide. Turkish women are nearly as well-represented as men when it comes to trading and investing in crypto. 47% of investors are women and 63% of the crypto-curious are women.

-Turks over the age of 40 are more interested in cryptocurrencies, according to a survey by a major Turkish bank.

-Stablecoins and metaverse tokens have caught the attention of Turkish traders. Bloktopia was the third-most traded asset on KuCoin in Turkey last year. Verasity is also popular.

Inflation is currently running wild in Turkey, and Turkish lira has lost nearly 50% of its value. This probably explains the fact that 40% of the internet population aged 18-60 own crypto or have traded them in the past 6 months. 59% of crypto investors plan to buy more in the next 6 months.

Turkish residents who invest in cryptocurrencies are focused on:

-Stablecoins

-Derivatives

-Metaverse projects

Turkey and stablecoins

According to Kucoin, “The demand for stablecoins makes sense, as it provides U.S. Dollar exposure in digital format through Tether’s USDT. Additionally, USDT is a very liquid asset supported by almost every trading platform worldwide and is used in spot and futures trading too. Furthermore, derivatives – futures and options – are essential risk management tools when dealing with volatile assets.”

Kucoin also said that metaverse projects are a hot trend globally, and Turkey is no exception. “Although these assets can see extreme volatility in this early stage of metaverse development, investors show a growing interest in trading project tokens.”

Here are some other findings.

70% of Turkey’s respondents said that security and stability matter when trading.

66% of respondents said that fiat deposits and withdrawal convenience is important.

User Interface is important to 65% of respondents.

63% of traders want a variety of tradable coins.

55% of users think transaction liquidity is important.

Got something to say about the situation in Turkey or anything else? Write to us or join the discussion in our Telegram channel.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.