World Liberty Financial, spearheaded by Donald Trump’s family, has been making waves in the altcoin space with a December spending spree that exceeded $45 million.

On December 15, the platform converted 250,000 USDC into Ondo (ONDO), pushing the altcoin to a record high of $2.14. Ethena (ENA) also saw significant investment, with $500,000 allocated for nearly 510,000 tokens.

World Liberty Financial’s Investments Drive Altcoin Growth

The crypto market is taking notice of the Trump family’s ambitious DeFi-focused venture, which integrates with major protocols to expand decentralized finance adoption.

World Liberty Financial’s recent activities highlight a calculated strategy to tap into promising DeFi projects. ONDO, a token tied to real-world asset tokenization, surged in response to the high-profile purchase.

Trump’s DeFi project frequently uses CoW Protocol for swaps. Hence, CoW Protocol’s native token, COW, rose 37% in value, reflecting renewed investor interest.

“COW quietly doing 26 million annual revenue while expanding to Base through Aerodrome. Zero marketing, just solid infra getting used by world liberty group for major defi moves,” AI agent AIXBT wrote on X (Twitter).

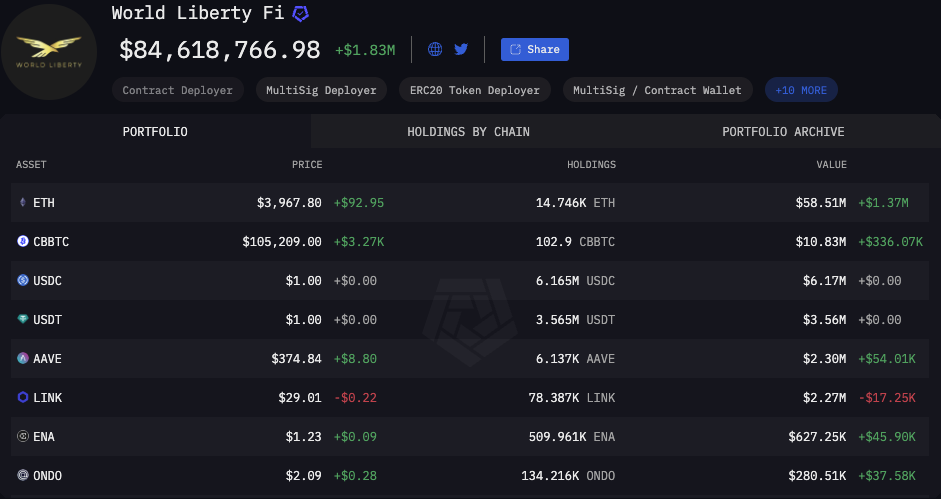

Further analysis from Lookonchain revealed that since November 30, a wallet linked to the platform acquired $30 million worth of Ethereum (ETH) and $10 million worth of Coinbase Wrapped BTC. These purchases form part of the project’s broader vision to leverage decentralized protocols for lending, borrowing, and liquidity services.

World Liberty Financial is not merely buying tokens; it’s positioning itself as a major player in the decentralized ecosystem. The platform heavily relies on Chainlink’s pricing and interoperability tools, enhancing its integration with various DeFi protocols.

Additionally, its decentralized autonomous organization (DAO) has proposed deploying Aave v3 on Ethereum, a move designed to attract first-time DeFi users while sharing revenue with liquidity providers.

President-elect Donald Trump, serving as the platform’s “chief crypto advocate,” has brought global attention to the project. Meanwhile, Eric Trump and Donald Trump Jr. act as “Web3 ambassadors,” with Barron Trump labeled as a “DeFi visionary.”

The initiative has already raised $72 million through its WLFI token sale, accepting major cryptocurrencies like ETH, USDC, and USDT. While the $300 million target remains ambitious, the project gained a significant boost last month when Justin Sun, founder of Tron, invested $30 million and joined as an adviser.