Tron (TRX) price has been range bound for the most part of Sept. and Oct., barring a few pumps owing to high social sentiment. Yet again, Justin Sun’s name in the news generated bullish momentum for the altcoin, but what next?

The global crypto market cap has been stuck below the $1 trillion mark but seemingly Tron price has turned for the better at least on the short-term charts. Amid rumors of TRON founder Justin Sun buying Huobi Global, TRX price shot up by 4.06% over the last 24 hours.

At press time, TRX traded at $0.06472 as its 24-hour volumes sat at $469.96 million noting a 107.38% rise over the last day. The sheer rise in trade volumes over the last day alongside bullish price momentum was indicative of a renewed retail interest in the token.

So, will this Tron price uptick sustain, or will it be another short-term uptick?

Tron (TRX) price in green again

Despite the recent gains, Tron price was down 77.74% from its all-time high of $0.29 made in March 2018. After falling below the $0.065 mark at the end of Aug. TRX price tested the $0.058 low just 10 days ago.

While Tron price has managed to gain 9.59% price from the $0.058 lows, it still seemed to lack a push from bulls that would place its price above the key resistance level at the $0.065 mark.

A healthy uptick in daily RSI suggested that buyers were pushing in as price gained momentum alongside retail volumes picking up which was a good short-term sign in terms of technical data, however, on-chain indicators still presented a shaky road for TRX price.

Going forward, the $0.065 resistance would play a crucial role in the coin’s trajectory. In the short-term, retail push can aid TRX uptrend above the aforementioned level, however, with weak supply-demand metrics chances of a recovery above the next major resistance at $0.703 looks less likely.

On-chain indicators are looking weak

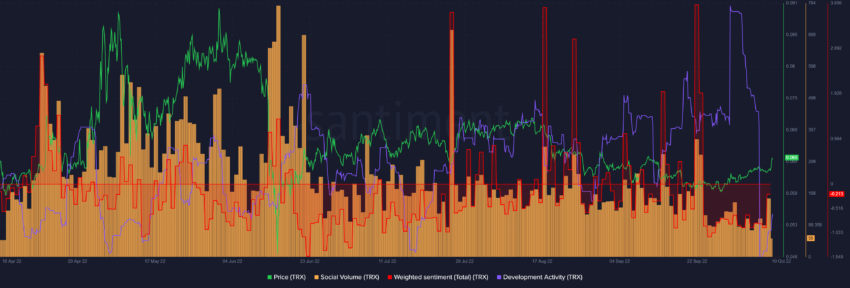

Looking at TRX on-chain metrics, it was evident that development activity had fallen to all-time low levels alongside weak weighted social sentiment despite the Justin Sun Huobi buyout news.

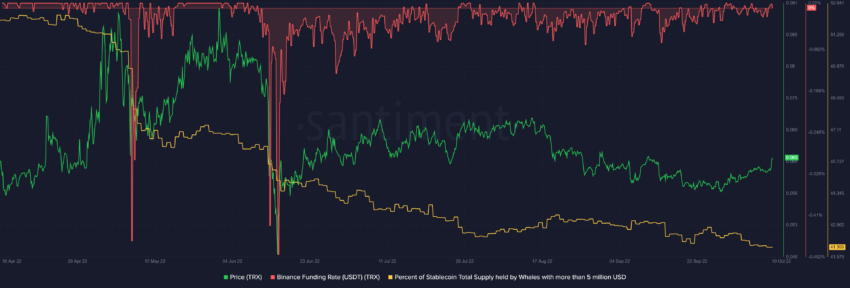

Additionally, the percentage of stablecoin total supply held by whales with more than $5 million was also treading in a bearish region presenting very low confidence from whales in the coin.

Nonetheless, a rise in funding rate showed an increasing bullish sentiment in the futures market for the coin.

In the short-term, while Tron price can see the above $0.065 levels owing to the bullish momentum in the spot market as well as futures sentiment turning bullish sustaining the same could be a major task for TRX bulls.

Invalidation of the above long-term bearish thesis could push TRX price above the upper resistance at $0.703.

Disclaimer: Be[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.