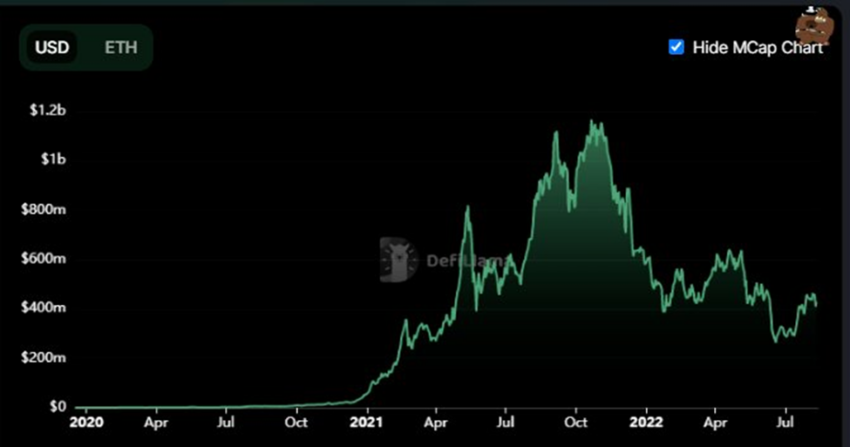

Tornado Cash TVL saw a boost in July due to renewed interest in decentralized finance (DeFi) and certain areas of the crypto finance industry.

Tornado Cash is a platform that is used to obfuscate crypto asset transfers. The platform’s native TORN asset increased by 49% in total value locked in July. On July 1, it had a TVL of around $297.13 million, and this ascended to $445.37 million on July 31.

Announced in December 2020 and launched in February 2021, Tornado Cash is a service that helps cryptocurrency owners protect their anonymity by scrambling information trails on the blockchain. Through this decentralized solution, around 40,000 users have been able to conceal transactions.

What contributed to the rising TVL?

TVL soared in July due to an increase in the value locked on all the blockchains where the protocol is deployed. There was a spike in TVL on Ethereum, Binance Smart Chain, Arbitrum, Avalanche, Gnosis, and Optimism within the same period.

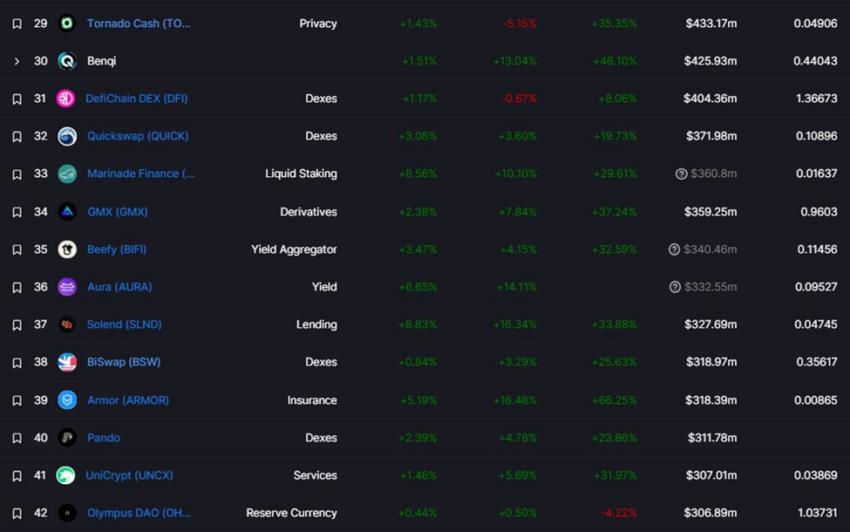

After going up by $148.24 million, Tornado Cash had the lion’s share in TVL when compared to Quickswap, DefiChain DEX, Benqi, Solend, BiSwap, and Marinade Finance.

TORN price reaction

TORN opened on July 1, with a trading price of $20.73, reached a monthly high of $28.38, tested a monthly low of $19.56, and closed the month at $25.09. Overall, there was a 21% increase between the opening and closing price of TORN in July.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.