PEPE price has seen a more than 50% rise in the span of a week and is seemingly going to continue this rally.

The meme coin has also received support from its whales, and this chunk of PEPE supply could be just the boost it needs.

PEPE Investors See Potential

PEPE price, trading at $0.00000738 at the time of writing, has witnessed massive support from its investors. These meme coin enthusiasts have added PEPE to their wallets, bolstering the ongoing rally.

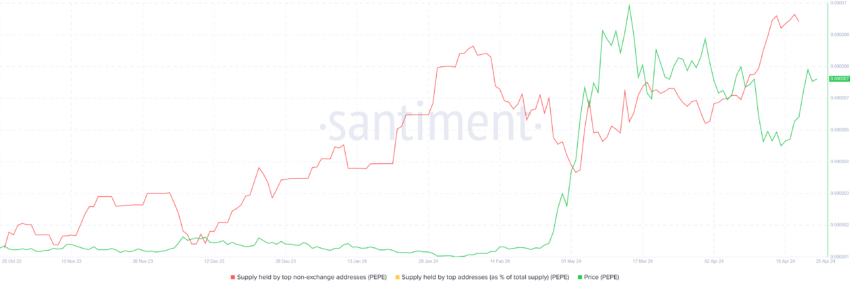

A very important cohort in this process has been the whales. These large wallet holders have accumulated over 3.3 trillion PEPE worth more than $24.3 million in the last two weeks, bringing their total holdings to 46.96 trillion PEPE.

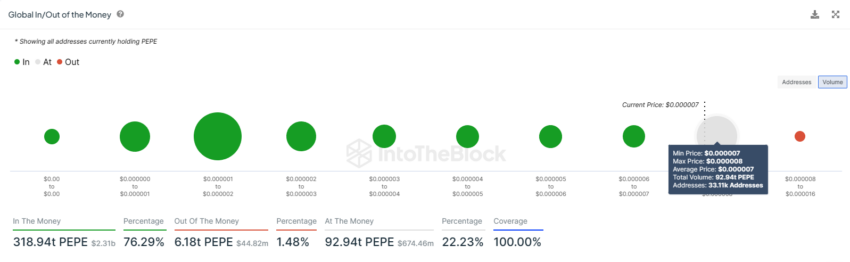

Their conviction has provided the meme coin with the necessary support to continue rising. This price increase is expected to continue as over 92 trillion PEPE are on the verge of becoming profitable to its investors.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

Worth more than $686 million, this supply was bought at between $0.00000700 and $0.00000890. Given the meme coin is currently trading at $0.00000738, it could flip this supply of PEPE into profit-bearing assets.

Consequently, it would result in the altcoin witnessing further growth in price as the potential of profits would drive more investors to the coin. This would also encourage existing PEPE holders to HODL instead of sell.

PEPE Price Prediction: A Key Barrier

PEPE price did manage to escape the descending wedge, but it is still facing a crucial barrier on its path to $0.00001000. The resistance level marked at $0.00000826 has been tested as both resistance supports in the past.

Flipping this line into support is key, as only then can the aforementioned supply have a shot at becoming profitable. This would also enable the PEPE price to rally on and test the $0.00001007 resistance, validating the 60% target obtained by the falling wedge.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

However, if the breach fails, the PEPE price could note a drawdown to test the support at $0.00000633. Losing this as support would invalidate the bullish thesis, pushing the meme coin towards $0.00000474.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.