Top 5 Altcoins to Watch in December 2022: Litecoin (LTC) is one of the top altcoins to watch in December. While there are no imminent developments coming up, the Litecoin price has broken out from a long-term pattern and reclaim a horizontal resistance area.

Theta Network (THETA), Chainlink (LINK) and ApeCoin (APE) have all generated bullish divergence while EOS (EOS) has bounced at its yearly lows.

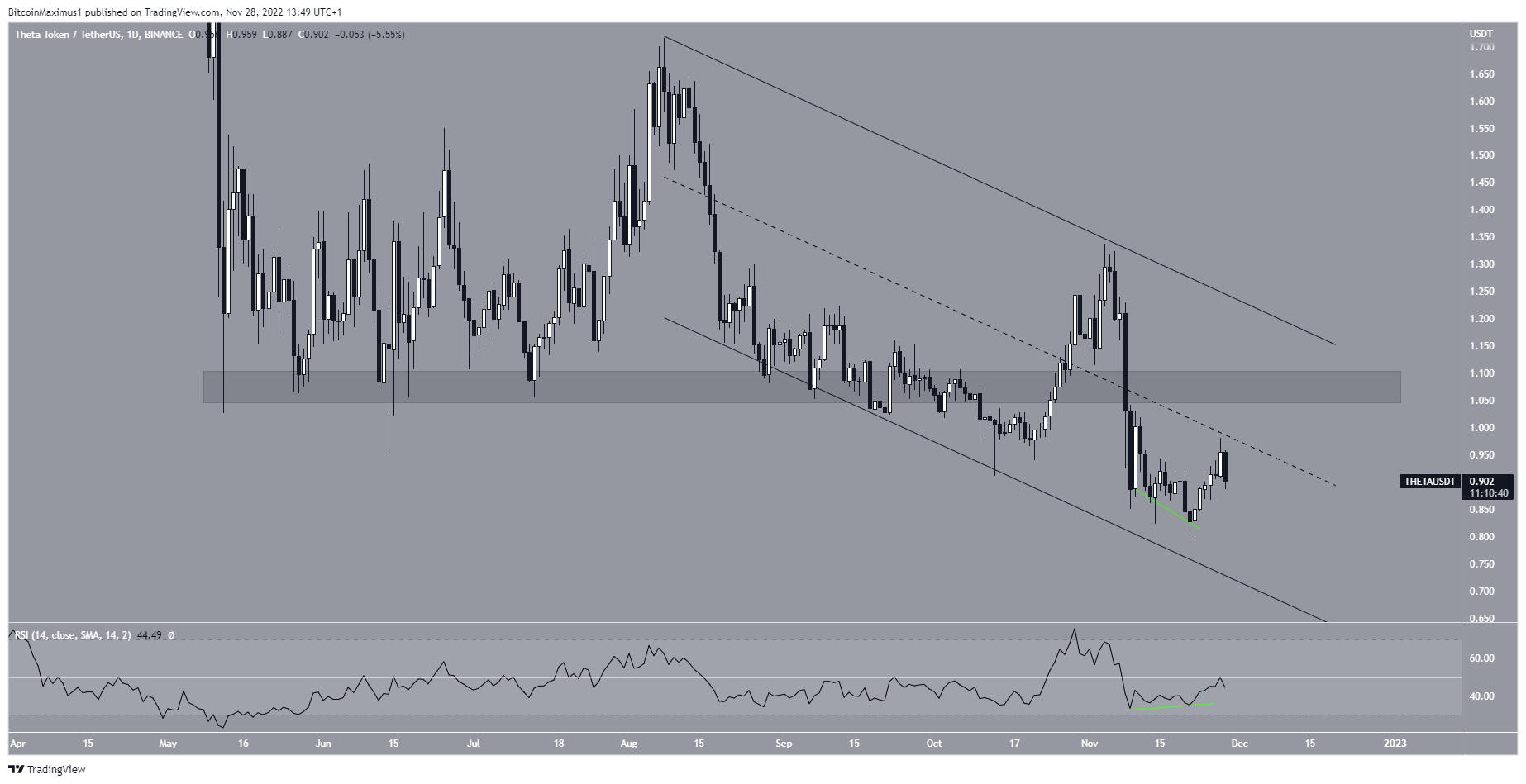

Theta Network (THETA) Leads Altcoins To Watch

- Price: $0.90

- Market cap: $912,671 million

- Rank: #45

The THETA price has decreased inside a descending parallel channel since Aug. 8. While such channels are expected to lead to breakouts, the price movement inside it is bearish.

The THETA price broke down from the $1.05 area on Nov. 8 and has yet to reclaim it.

Despite this bearish price action, the daily RSI has generated bullish divergence (green line) and is moving upwards. However, it is still below 50.

As a result, the THETA price prediction is unclear. A breakout from the $1.05 resistance area and the channel’s resistance line would be bullish. In that case, the price could begin a long-term upward movement.

Conversely, a rejection from the middle of the channel or the $1.05 resistance area would be bearish. It would likely initiate a downward THETA movement toward the channel’s support line.

Theta v4.0.0 went into effect through a hardfork on Nov. 2. The upgrade improves smart contracts by increasing the maximum code size. This was the final upgrade considered a prerequisite for the Dec. 1 launch of Metachain. The launch of Metachain will allow developers to quickly produce and launch a sub-chain and then plug it into the main chain. Since sub-chains carry out transactions independently, this will greatly assist in scaling issues.

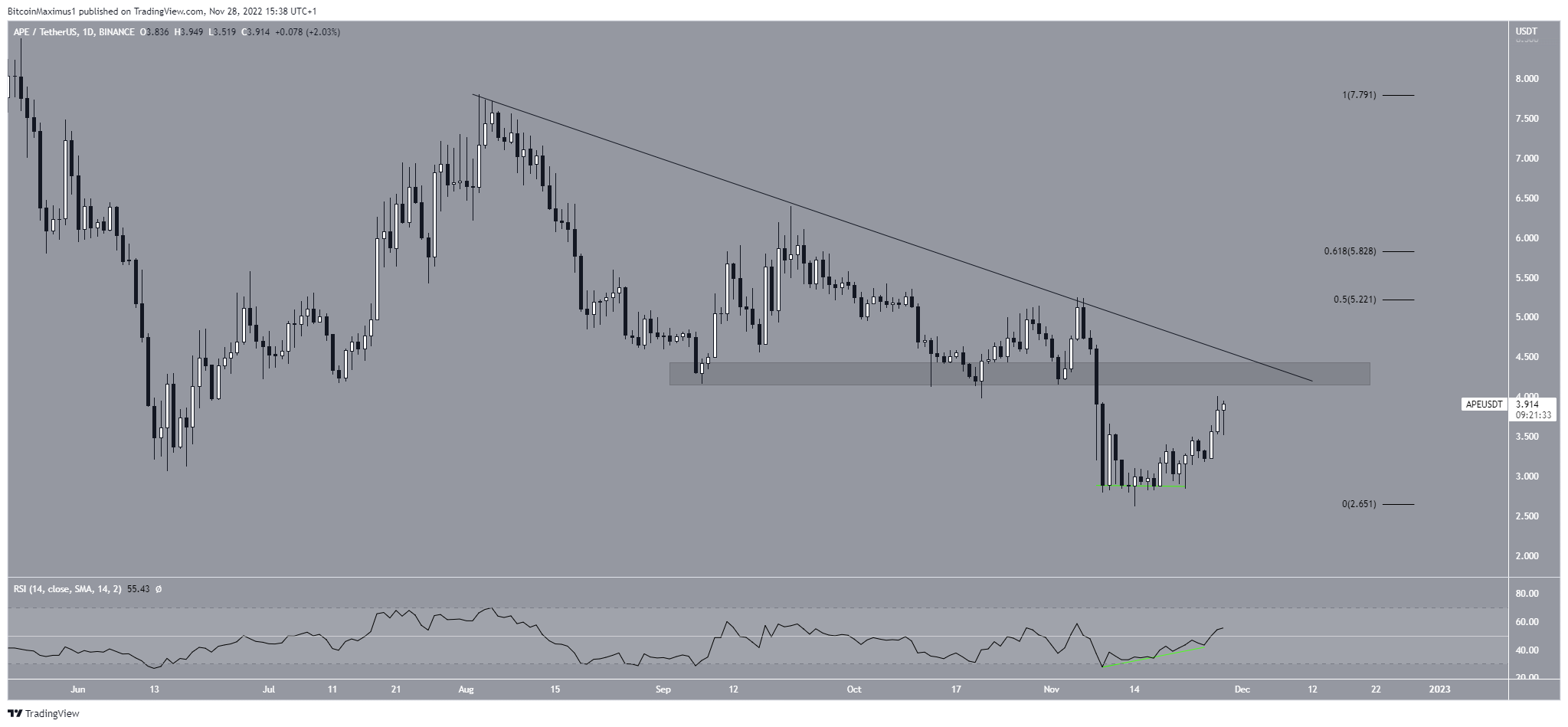

ApeCoin (APE) Could Break Out Above Resistance

- Price: $3.86

- Market cap: $1.406 Bn

- Rank: #30

The APE price has decreased below a descending resistance line since Aug. 3. The downward movement led to a low of $2.61 on Nov. 14.

The daily RSI generated bullish divergence afterward, preceding the ongoing increase, which accelerated over the past 24 hours. The price will likely face strong resistance at $4, created by both a horizontal resistance area and the descending resistance line. Therefore, whether the APE price breaks out will likely determine the direction of the future trend.

A successful breakout would likely send APE towards $5.22 – $5.83, while a rejection could cause a downward movement toward new lows.

There is positive news coming in Dec., since ApeCoin will launch its staking program on Dec. 7 after an initial delay. It is not clear if this will catalyze a breakout.

Litecoin Could Experience December Rally

- Price: $72.21

- Market cap: $5.182 Bn

- Rank: #13

The Litecoin price had been trading inside an ascending parallel channel since June. After a long period of consolidation, LTC broke out on Nov. 23 and reached a high of $83.66.

While there is a bearish divergence (green line) in place, a decrease has already occurred as a result. Moreover, the LTC price bounced at the confluence of the horizontal support area and resistance line of the channel (green icon).

Therefore, whether it bounces or breaks down from this area will determine the direction of the future trend. In the case of the former, the next resistance would be at $100. In the case of the latter, a new yearly low would be expected.

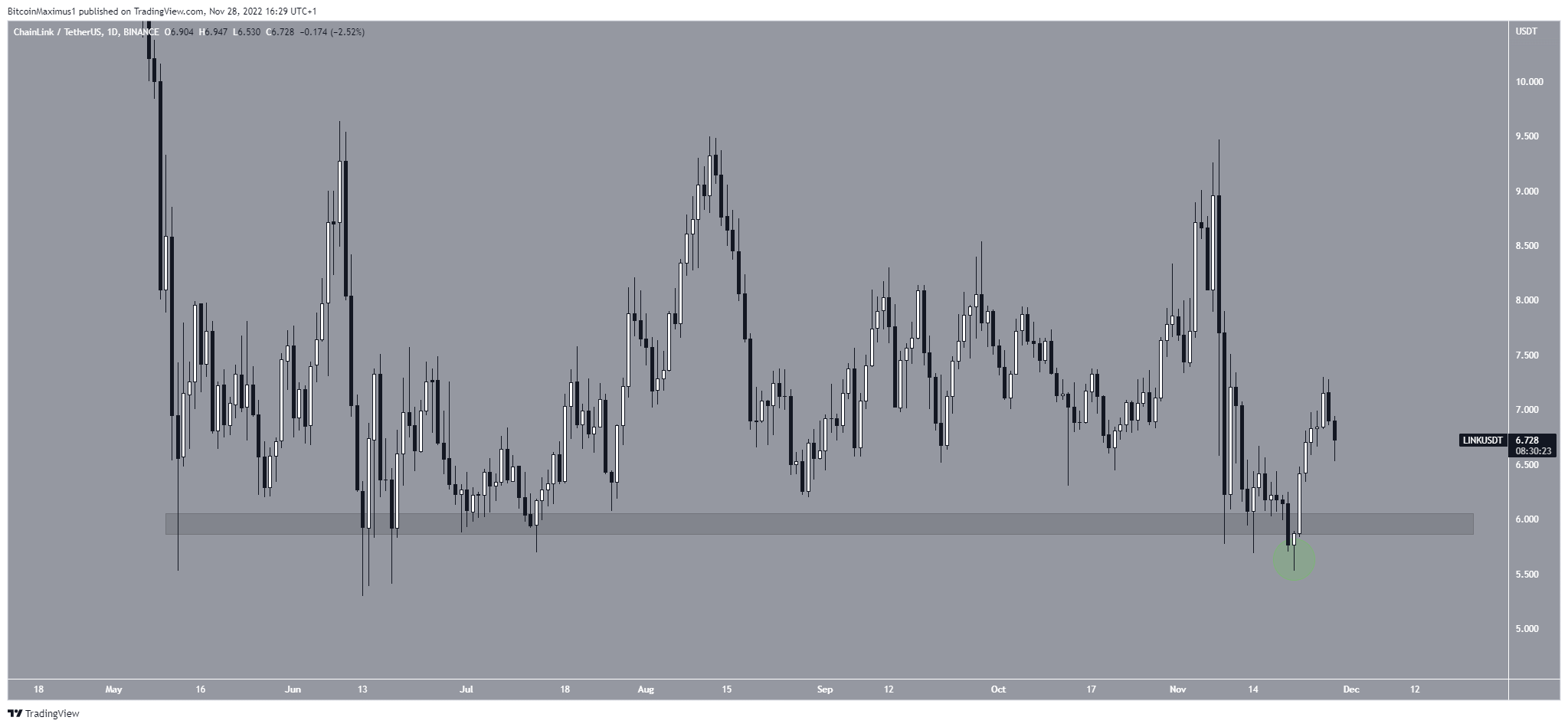

Chainlink Deviates and Reclaims

- Price: $6.83

- Market cap: $3.46 Bn

- Rank: #21

Even though the Chainlink price is trading close to its yearly lows, it has one of the more promising setups compared to other altcoins. On Nov. 20, Chainlink deviated below the $6 support area (green circle) before reclaiming it shortly afterward.

Such reclaims are often followed by significant movements in the other direction, as has been the case for Chainlink.

As a result, the Chainlink price is primed for a Dec. rally if it does not close below the $6 horizontal support area.

EOS Bounces at Nearly Lows

- Price: $0.90

- Market cap: $968 Mn

- Rank: #42

The EOS price broke down from an ascending support line on Oct. 7 and validated it as resistance on Nov. 5 (red icon). It fell sharply afterward, reaching a new yearly low of $0.79 on Nov. 9.

The price bounced afterward, validating the $0.87 area as support.

If the bounce continues, the next resistance would be at $1, created by a descending resistance line. On the other hand, a breakdown below the $0.87 area would lead to a new yearly low.

There will be several new releases in Dec. such as EOS network Ventures, EOS Developer Hub and Antelope IBC. These could have a positive effect on the EOS price.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.