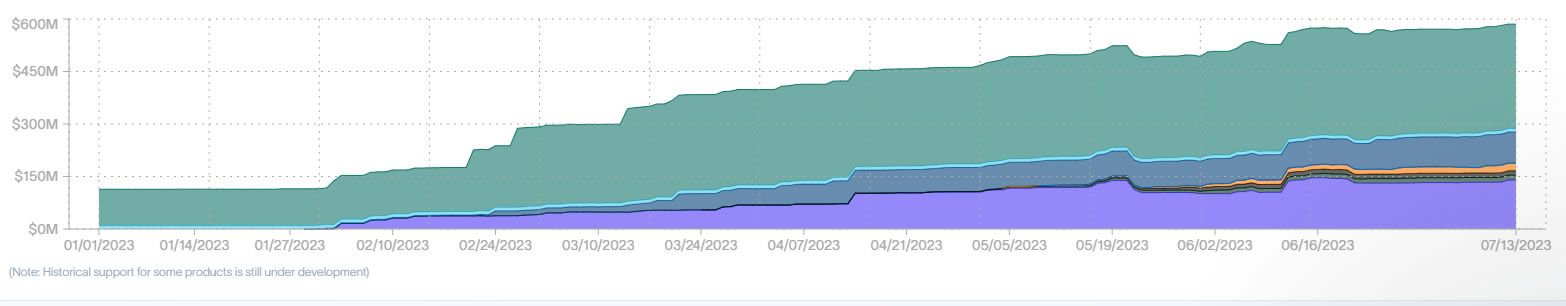

The tokenization of real-world assets (RWA) is one of the few sectors in the crypto industry that is currently seeing healthy growth. As a testament to that progress, the value of tokenized US Treasuries has topped a milestone figure of $600 million.

According to real-world asset data firm RWA.xyz, the market value of tokenized US Treasuries, bonds, and cash-equivalents is at a record high of $621.8 million,

Real-World Asset Tokenization Growth

Moreover, the value of tokenized Treasuries has grown by a whopping 448% since the beginning of the year, according to RWA.xyz data.

The demand for tokenized Treasurys among crypto investors has surged as yields on these low-risk investments have surpassed those in decentralized finance (DeFi).

The platform reports a current average yield of 4.24% for all tokenized Treasuries. This is better than many DeFi platforms such as Compound Finance which is offering less than 1% on stablecoin deposits.

The largest Treasury tokenizer is the Franklin OnChain US Government Money Fund which has a 48% share of the total.

Furthermore, there have been several new entrants this year, with OpenEden, Ondo Finance, and Maple Finance offering blockchain-based Treasury products,

Researcher at RWA.xyz, Jack Chong, commented:

“The entire macroeconomic backdrop has shifted. This naturally attracts investors to shift their exposure from crypto assets into US Treasuries.”

Find out which are the best DeFi lending platforms: Top 6 DeFi Lending Platforms

Treasuries are just one investment product that can be tokenized. Real-world assets cover everything from art to real estate, which can all be tokenized on the blockchain.

According to Boston Consulting Group (BCG) research earlier this year, the tokenization of global illiquid assets could become a $16 trillion industry by 2030.

Last month private wealth management firm Bernstein estimated that about 2% of the global money supply, or around $3 trillion, could be tokenized over the next five years.

Back in January, BeInCrypto predicted that real-world asset tokenization would surge in 2023, and they were not wrong.

Crypto Market Outlook

RWA tokenization may be on the up, but crypto asset prices are moving in the opposite direction today.

Total market capitalization is down 1% at $1.22 trillion, but the general trend is still sideways.

BTC has dropped 1.2% in a fall to $30.277, while ETH is down 1% to $1,865.

There has been little momentum in either direction for crypto markets over the past three weeks. Volumes and liquidity remain fairly stagnant.