Amid growing popularity and adoption of digital assets in the traditional financial space, the value of tokenized treasury bonds has soared to $1.44 billion. Moving from the year-to-date lows of $719 million, this marks a 100.27% increase in 2024.

The largest asset management in the world BlackRock is making headlines again, but not for a Bitcoin ETF. Its tokenized fund has become the largest tokenized treasury product just three months after its launch.

BlackRock’s BUIDL Skyrockets Three Months After Debut

Real-world assets (RWAs) have gained traction within the digital asset space since late 2023. Analytics platform Santiment reported a surge in social volume early in the year, citing growing crowd interest. Crypto-focused companies, global bankers, and asset managers have since front-run this interest, bringing traditional financial instruments such as bonds, funds, or credit to blockchains.

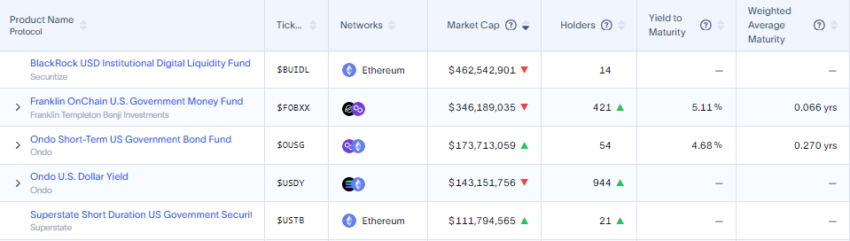

Among them, BlackRock, which launched its tokenized treasury bond in late March 2024, the BUIDL, has ascended to the helm of the list on market capitalization metrics. It ranks as the largest tokenized treasury product with up to $462 million in market value. BUILD launched on the Ethereum network, allowing qualified investors to earn US dollar yields by subscribing to the Fund through Securitize Markets, LLC.

Tokenization is at the core of BlackRock’s digital asset strategy, delivering important benefits to investors. It enables issuing and trading ownership on a blockchain, widens investor access to on-chain offerings, and provides fast and secure cross-platform transfer settlements.

Franklin Templeton’s FOBXX follows BUIDL with $346 million, whereas Ondo protocol’s OUSG and USDY take third and fourth places with $173 million and $143 million, respectively. The Superstate protocol closes the top 5 list with a market valuation of $111 million.

Read more: What Are Tokenized Real-World Assets (RWA)?

Asset tokenization, including government bonds, is a growing innovation as blockchain technology revolutionizes finance. RWAs, such as Treasury bonds, can now be represented as digital tokens on a blockchain. This enables greater accessibility, liquidity, and efficiency in trading and investment.

Therefore, the 100.27% surge comes amid increasing interest from institutional and retail investors in leveraging blockchain technology for traditional financial instruments. Asset digitalization ensures investors enjoy fractional ownership, seamless share trading, and enhanced transparency and security in blockchain networks.

Tokenized Treasury Bonds Soar as RWAs Go to Congress

The US House Financial Services Digital Assets Subcommittee scheduled a court date with RWAs. This action comes amid recognition of the fundamental potential of the tokenization of securities to transform capital markets.

The subcommittee will discuss the tokenization of real-world assets (RWAs) in a hearing on Wednesday. Committee chair Patrick McHenry announced this last week, stressing its potential to reduce portfolio risk and increase stability.

Securitize CEO Carlos Domingo confirmed that he would testify at the hearing. His testimony will be part of Congress’s effort to understand the potential benefits of RWA tokenization in creating efficient markets. Securitize, a key player in RWA tokenization and BlackRock’s transfer agent, will be highlighted.

“I am one of the expert witnesses for this hearing, and I am proud to represent the industry in this important meeting,” Domingo stated.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

The specific aspects of RWA tokenization the subcommittee will focus on remain unknown. However, legal foundations, use cases, risk management, and control issues have been identified as concerning topics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.