Korea Digital Asset (KODA), South Korea’s leading institutional crypto custodian, reported a nearly 250% increase in its crypto assets under custody in the latter half of 2023.

This surge is closely linked to the growing excitement over the potential launch of local spot Bitcoin exchange-traded funds (ETFs).

Why South Korea Expects Local Spot Bitcoin ETFs

According to IBT, KODA’s crypto assets swelled to approximately 8 trillion Korean won (~ $6 billion), up from roughly 2.3 trillion Korean won (~ $1.7 billion) at the year’s midpoint. Moreover, this growth spurt in crypto holdings coincided with a global uptick in crypto market enthusiasm.

This was primarily due to the US Securities and Exchange Commission’s (SEC) actions towards approving spot Bitcoin ETFs. Before the SEC’s nod, Bitcoin’s price had already jumped by 40%. Following the SEC’s approval of 11 spot Bitcoin ETFs, Bitcoin’s value further escalated, surpassing the $50,000 milestone.

Furthermore, KODA has solidified its market presence by managing over 200 crypto wallets and serving around 50 institutional customers. By mid-2023, the firm claimed an 80% local market share.

In addition, the Financial Supervisory Service (FSS) of South Korea has revealed upcoming discussions between its governor, Lee Bok-hyun, and SEC chief Gary Gensler. Scheduled for the second quarter of 2024, these talks will focus on virtual asset regulations and the potential for Bitcoin spot ETFs. This indicates a forward-thinking approach to crypto regulation and international cooperation.

Read more: What Is a Bitcoin ETF?

However, the Financial Services Commission (FSC) of South Korea has urged local securities firms to tread cautiously. Engaging with overseas-listed spot Bitcoin ETFs could conflict with the nation’s existing virtual asset guidelines and the Capital Markets Act. This caution reflects a balanced stance towards embracing crypto innovations while ensuring regulatory compliance.

“Domestic securities firms brokering overseas-listed Bitcoin spot ETFs may violate the existing government stance on virtual assets and the Capital Markets Act,” FSC said.

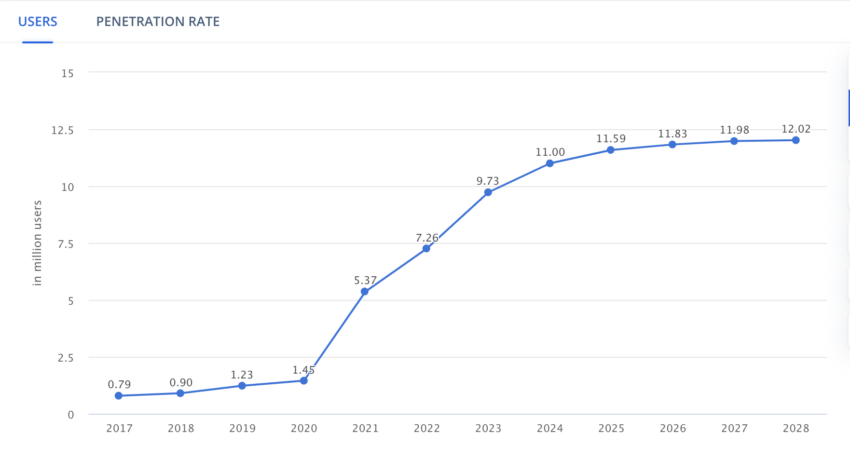

Meanwhile, the ruling People Power Party of South Korea is reportedly considering allowing investments in crypto products approved by developed countries, including spot Bitcoin ETFs. This move could signal a significant shift in the country’s investment arena, impacting over 11 million crypto users.

Simultaneously, South Korea is gearing up to enforce strict crypto regulations. The Virtual Asset User Protection Act, effective from July 2024, aims to clamp down on illicit crypto activities.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

It introduces severe penalties for major violations, including lifetime imprisonment, emphasizing South Korea’s commitment to a safe and orderly crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.