South Korea has laid down stringent regulations that could lead to lifetime imprisonment for individuals involved in illicit crypto gains exceeding $3.7 million. This bold step forms part of the Virtual Asset User Protection Act, established on July 18, 2023, which is set to be implemented starting from July 19, 2024.

The act aims to safeguard cryptocurrency users and instill order in the South Korean crypto market.

South Korea Set to Implement Robust Crypto Regulations

The new rules ban practices like hiding key information, market manipulation, and fraud. Breaking these rules can lead to tough penalties, including at least one year in jail or fines of three to five times the illicit gains. However, the consequences are more severe for illicit gains of over 50 billion Korean Won, about $3.7 million. Indeed, sentences can go up to lifetime imprisonment, and fines may exceed the illegal gains.

The enforcement of these penalties follows a structured process where the Financial Services Commission (FSC) plays a pivotal role. The FSC must notify the Prosecutor General of any suspicions related to virtual asset violations. The South Korean authorities can impose fines following an investigation and the receipt of disposition results from the Prosecutor General.

“If a violation of the ‘Virtual Asset User Protection Act’ is found, the Financial Services Commission can take measures such as business suspension, corrective orders, filing complaints, or notifying investigative authorities against virtual asset operators,” FSC stated.

The Virtual Asset User Protection Act sets guidelines for protecting user assets. It requires crypto exchanges to secure users’ deposits and assets. A large part must be stored offline. Also, exchanges must have insurance or reserve funds for hacking or failures.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

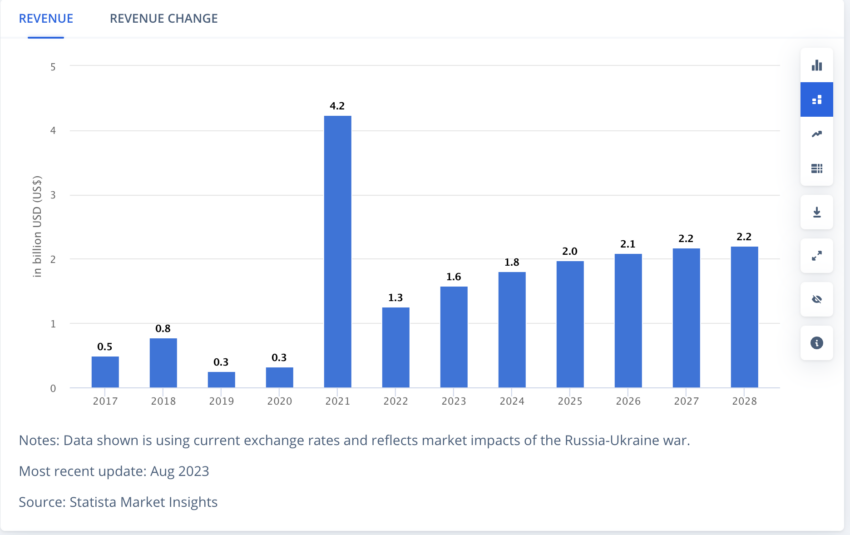

Regulation becomes imperative in light of the projected expansion in South Korea’s cryptocurrency market. With an anticipated Compound Annual Growth Rate (CAGR) of 5.12% from 2024 to 2028, the market’s revenue is expected to reach $2.2 billion by 2028.

Moreover, South Korea’s proactive stance on crypto regulation is part of a broader effort to protect the financial ecosystem and increase transparency within the crypto sector. Lawmakers designed measures to enhance the crypto industry’s integrity, such as requiring crypto exchanges to report executive leadership changes.

Read more: How to Choose The Right Crypto Exchange

Additionally, the crackdown on crypto mixers by the Financial Intelligence Unit underscores South Korea’s commitment to combating illegal activities associated with crypto assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.