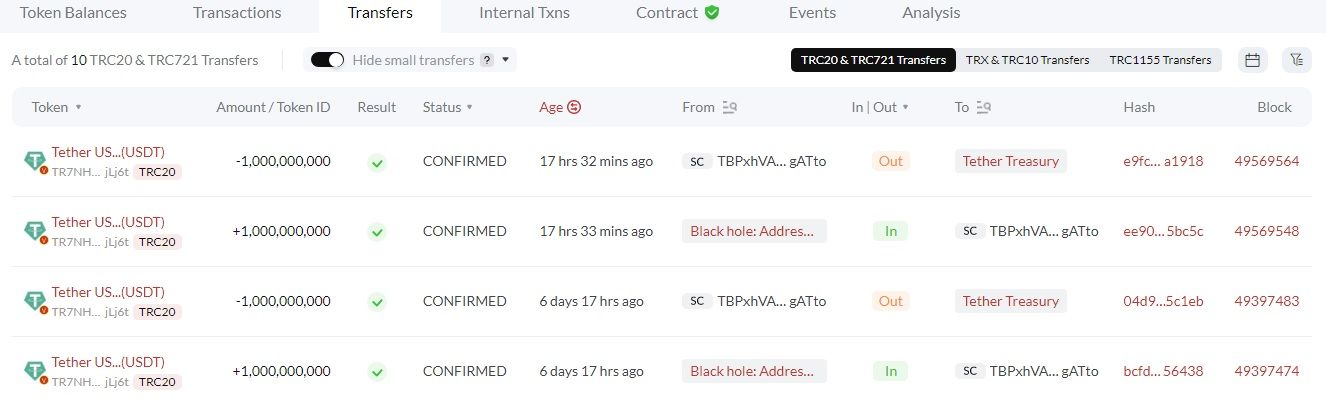

Tether has minted another $1 billion in USDT, this time on the TRON network. The stablecoin issuer has minted about $4 billion in the past week.

Tether has minted $1 billion in USDT on the TRON network, which follows up on the billions in USDT that it has minted over the past week. Over the past seven days, Tether has minted a total of $4 billion in USDT.

Tether Printer Goes Brrr

The heavy minting will bring scrutiny to the market’s biggest stablecoin, which has frequently been examined for its reserves. Tether has maintained that its supply is backed by its reserves, with accounting firm BDO most recently confirming that the former had $960 million in excess in its reserves.

The firm also increased the percentage of its reserves held in Treasury bills to 58%.

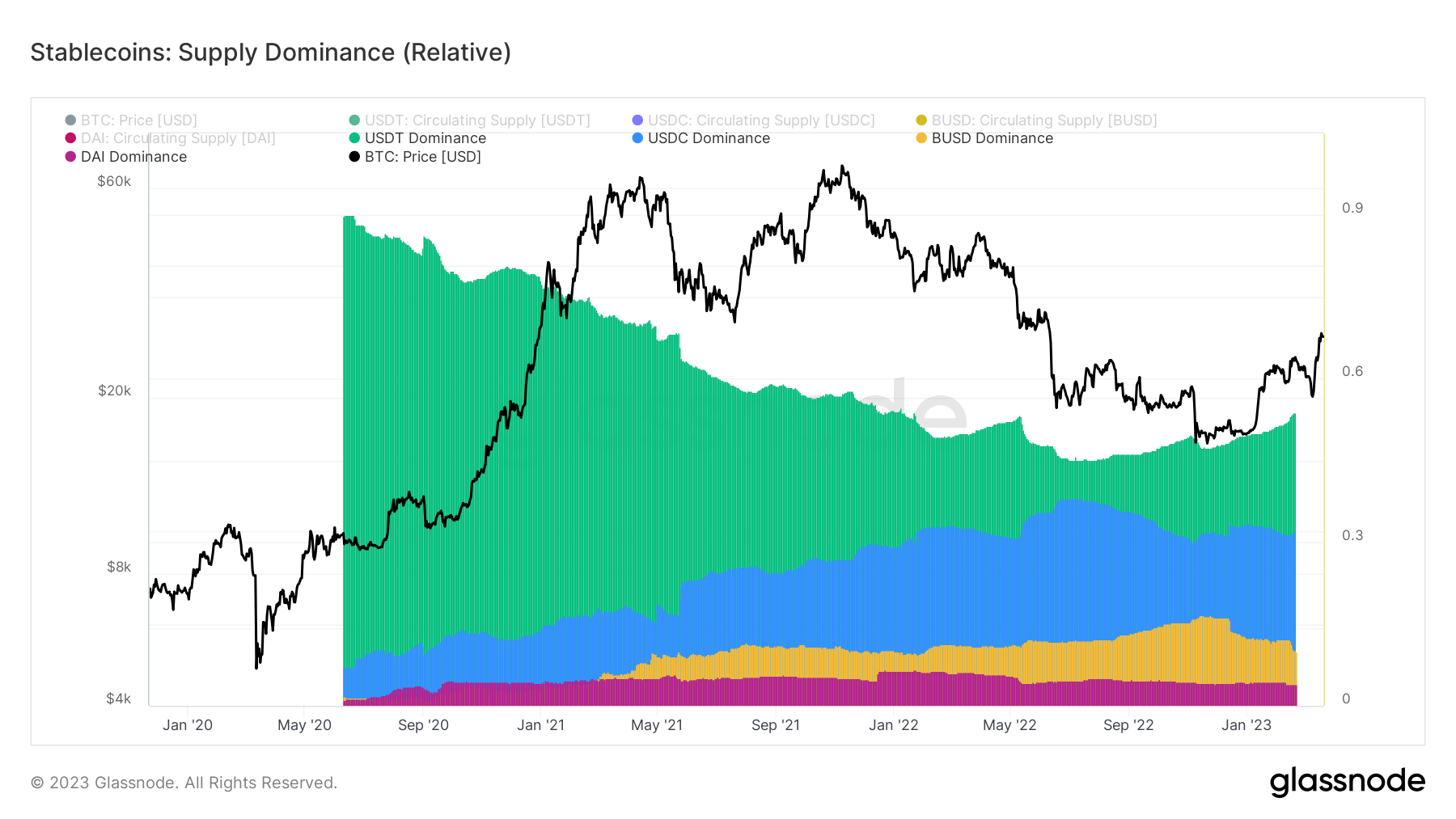

These mintings come as the stablecoin sector is seeing increased competition, with Tether attempting to entice investors away from other stablecoins. Tether is the dominant stablecoin issuer in the market, and it looks like it won’t change soon. However, some still continue to worry about the potential downfall of a stablecoin like USDT, which would have an enormous impact on the market.

Tether has faced more scrutiny recently after a Wall Street Journal investigation claimed that its partners used fraudulent documents to give the company access to bank accounts. The report stated that Tether used shell companies to access the banking system in 2018.

Ethereum Poised to Benefit From Tether Mints

Tether has benefited from the issues that USDC has faced, with the minting increasing demand for USDT. This is one of the reasons why analysts believe that it could continue to be the dominant stablecoin. The dominance is expected to persist in the medium-term future.

Increased demand for USDT could positively affect the DeFi market, as USDT is one of the popular cryptocurrencies in that sector. As such, there is a possibility that USDT minting could result in a positive cascading effect for Ethereum and its ecosystem.

USDT Dominance Reaches 18-Month High

Tether’s stablecoin dominance is also at its highest point in 18 months, which is another strong sign for its future. In terms of stablecoin market share, Tether dominates far and away, with nearly 60% of the share. USDC follows at about 27.5%.

Furthermore, the fact that USDC-issuer Circle had about $3.3 billion in Silicon Valley Bank has contributed to the stablecoin’s retraction. In any case, the stablecoin market is worth keeping an eye on. It will undoubtedly go through some changes as the year progresses.