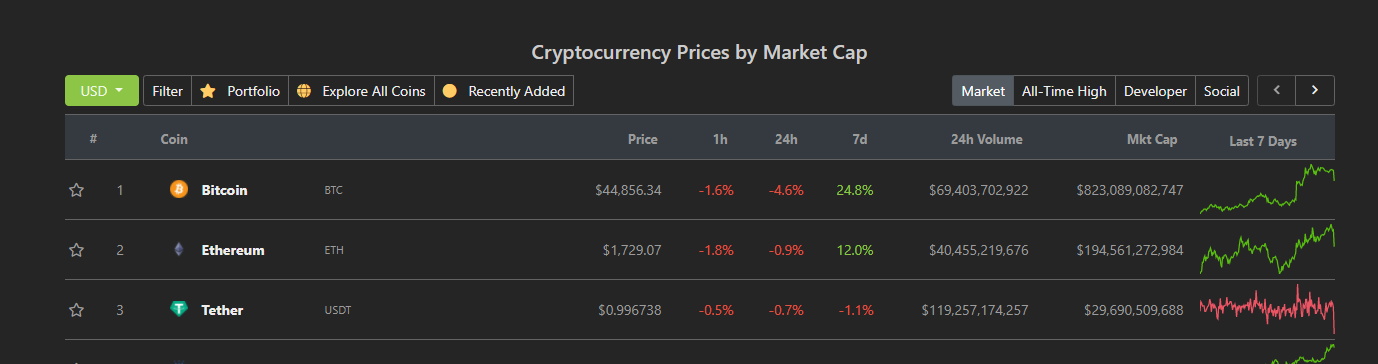

Tether’s (USDT) market capitalization recently surpassed $30 billion, according to data from CoinGecko.

Stablecoins like Tether (USDT), directly pegged to the US dollar, require minimal price fluctuations. Since Tether claims that each US dollar physically backs each USDT, this increase in Tether production may show an increase in demand for stablecoins as a whole.

As cryptocurrency prices rise, stablecoins provide a vehicle for users to exit their trades in crypto. They also allow for an easy store of value, especially for people with unstable fiat currencies that would highly benefit from the relative stability of the US dollar.

The stablecoin industry continues to grow, and USDT appears to be leading the way.

USDT Is the Market Leader in Daily Trading Volume

USDT has passed a daily trading milestone. The crypto regularly trades well over $100 billion per day, according to CoinGecko. This places it in the top spot in terms of volume.

This, however, doesn’t include the countless users holding it as a store of value. With increasing usage comes an increase in production, enabling easier access.

Following Other Cryptocurrencies

Some pundits argue that Tether prints massive amounts of USDT to artificially pump up bitcoin’s (BTC) price.

On Feb 8, Elon Musk announced that Tesla would purchase $1.5 billion in bitcoin. It seems that new institutional and retail investors are waiting in the wings. As more users get involved in cryptocurrencies and inject money into the market, they are looking for the most efficient way to interact within the blockchain economy.

For many who want to navigate between wallets, applications, and exchanges, or those looking to preserve their wealth, stablecoins like USDT are filling this role. Many users want access to the benefits of blockchain technology without moving their money back into fiat. As cryptocurrency adoption grows, expect stablecoins to play an increasingly larger role.