Since the birth of bitcoin, the market for digital assets is constantly evolving. Several solutions have been created through blockchain.

As a result, the price of crypto assets has skyrocketed. Many individuals have become millionaires but many have also lost in this market. Nowadays, it is possible to see the sector of decentralized finance (DeFi) gaining popularity as the solution to real-world problems. .

However, just like the other side of crypto assets, DeFi faces gigantic drops due to bad news, hacks, exploits, rug pulls, sell-offs, and other black swan events. Thinking about investors in this area, Shield Finance came to help with these issues.

Getting to know Shield Finance

Shield Finance is a multi-chain DeFi insurance aggregator that allows users to buy protection against major market crashes due to black swan events.

In other words, it intends to provide stability for its community. To achieve this goal, Shield Finance works by interacting with several insurance providers. In this way, it can provide its users with reduced slippage and wide coverage.

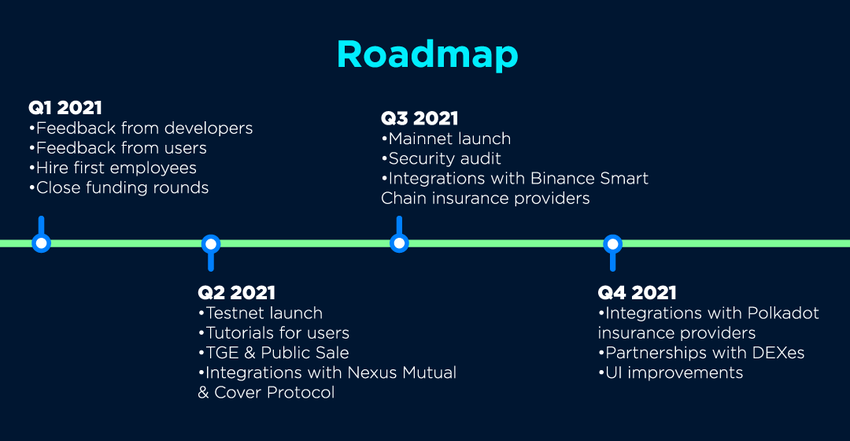

The project is about to launch its IDO on the PAID network’s launchpad. When the public IDO is complete they will build their platform. To offer secure packages customized to the investor’s needs, Shield Finance uses a proprietary aggregation mechanism.

Think of Shield Finance like the Skyscanner for DeFi insurance. Users can see and select offers from multiple insurance providers on the same platform for a small fee.

Token Economics

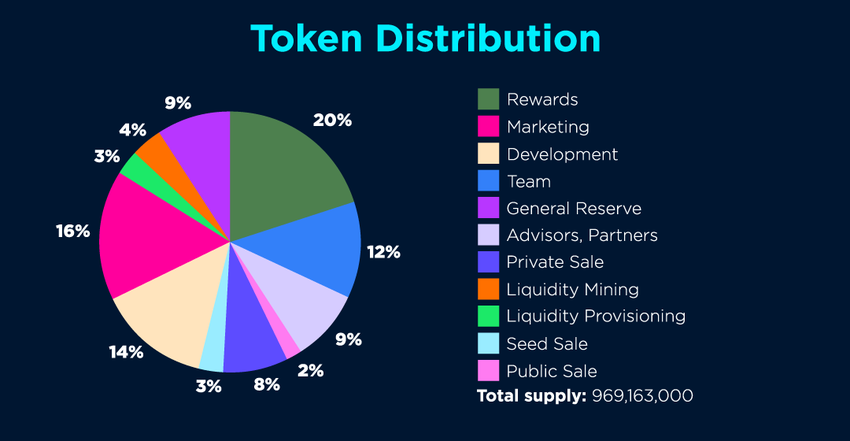

The most important feature of the $SHLD token is the buy and burn program. This directs 50% of the fees towards purchasing the token on the open market and burning it, removing it from circulation forever

Governance

Token holders can change fee structure and other contract parameters.

$SHLD token will allow holders to vote on protocol parameter changes:

- Fee percentage.

- New insurance providers.

- Additional rewards for holders.

Burning

50% of the fees are used to buy and burn $SHLD token permanent supply reduction.

Staking

30% stable APY for yield farmers.

The recent market drop has shown once again how volatile the crypto markets can be. Initiatives like Shield Finance aim to help people stay involved despite these extreme events.