Telegram coin PAAL AI (PAAL) marked a surprising move over the last 24 hours, whiplashing during a bearish market.

This volatility did bring some benefits for the altcoin as PAAL holders noted a return to the network, which could trigger recovery.

PAAL AI Investors Might Accumulate

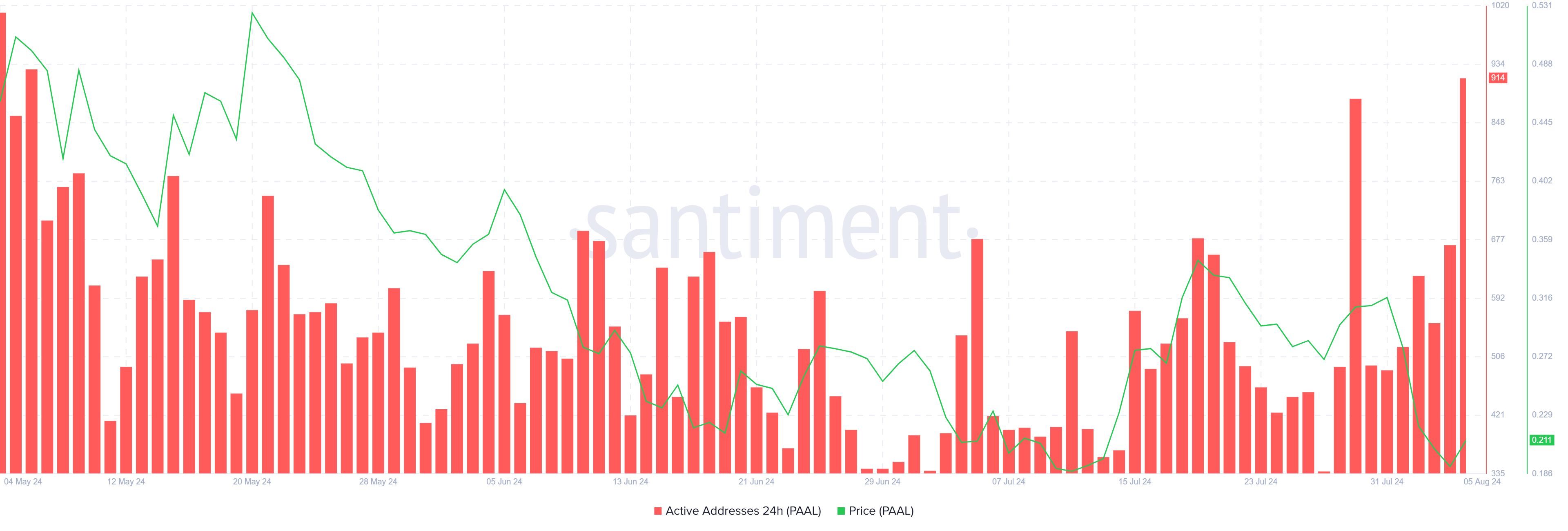

PAAL’s price has noted a considerable recovery of 28% over the last 24 hours, which has driven many investors to jump back into participating in the network. As a result, active addresses registered a 36% increase, reaching a three-month high.

These investors have exhibited a tendency to conduct transactions on the network around the beginning of rallies or when profits are high. Since the latter is not the case, it could be possible that the Telegram coin is looking at a recovery rally.

Read More: What Are Telegram Bot Coins?

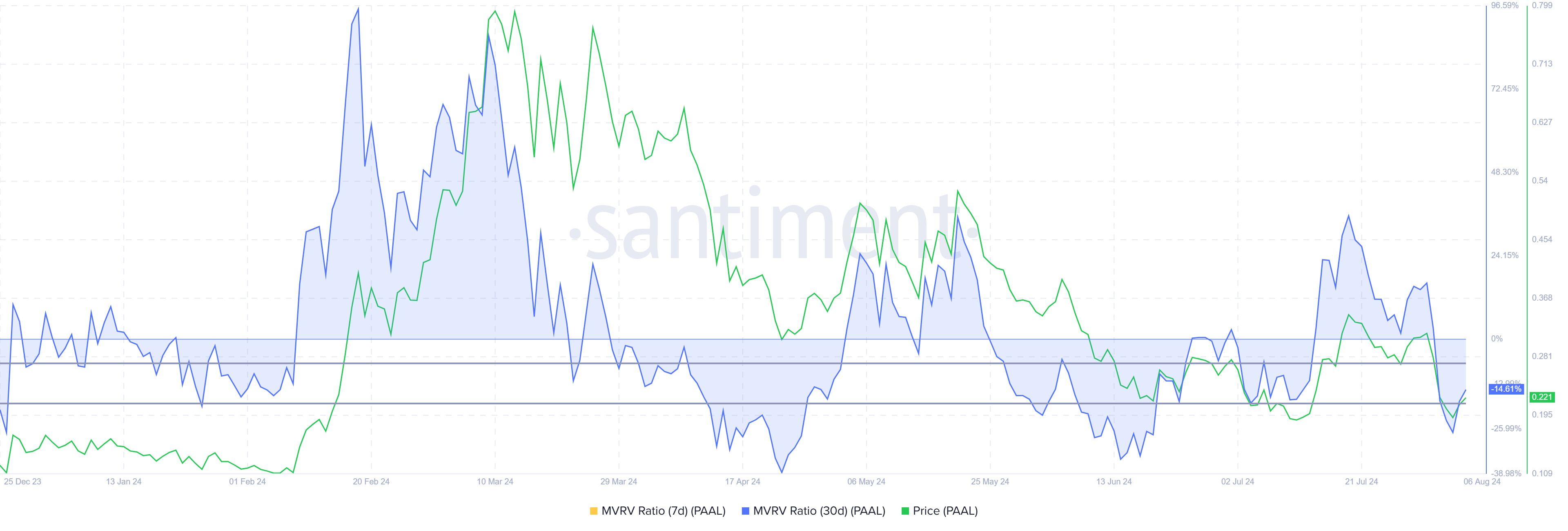

This would make accumulation a smart choice at the current prices, as indicated by the Market Value to Realized Value (MVRV) ratio, which assesses investor profit and loss.

Currently, PAAL AI’s 30-day MVRV stands at 10%, indicating losses and possible buying pressure. Historically, PAAL MVRV between -8% and -18% usually signals the start of recoveries or rallies. This makes it a good area for accumulation and is labeled as an opportunity zone.

Thus, if these conditions impact the price, PAAL AI could see a recovery.

PAAL Price Prediction: Supply Might Meet Demand

PAAL’s price has been witnessing bullishness despite the broader market’s bearish conditions. Evidence of this can be seen in yesterday’s intra-day high when the Telegram coin noted a 94% rise.

Furthermore, in the last 24 hours, the altcoin has already marked a 28% rise, changing hands at $0.218. PAAL is presently attempting to flip the resistance at $0.218 into support after bouncing from $0.172. This could enable further recovery, pushing the altcoin back above $0.300.

Read More: Crypto Telegram Groups To Join in 2024

However, the Telegram coin had noted recovery within $0.218 and $0.172 in early July. A failed breach could result in a similar outcome, albeit for the short term, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.