Decentralized derivatives protocol SynFutures has announced plans to expand its market share and is considering a Coinbase Layer-2 network as its platform.

The venture will enable its commitment to support emerging meme coin projects with incentives available for the best performers.

SynFutures Joins the Meme Coin Craze

In a recent X post, SynFutures announced plans to expand its market reach on the Coinbase L2 network, Base. The decentralized derivatives protocol will also launch a six-week campaign blitz christened “Memecoin Perp Summer.”

This marketing strategy is toward expanding community asset listings. Based on the post, there are rewards or incentives for the meme communities that will drive organic traction on Base.

“SynFutures will offer 100,000 USDC and future airdrop allocation to support the growth of emerging token projects that meet participation requirements,” reads the excerpt.

Read more: 7 Best Base Chain Meme Coins to Watch in June 2024

The 6-week campaign, which began on Tuesday, June 18, will conclude on July 29, 2024, marking the tentative end of Meme Perp Summer. The eligibility criteria stipulate that projects must have an ERC20 token on Base that does not represent any underlying assets. An active and engaged community and a record of accomplishment driving community traction without the intent of rug-pull are also requirements.

SynFutures entered the market as a decentralized perpetual futures protocol, enabling open and transparent trading. Its V3 Oyster Automated Market Maker (AMM) introduced the industry’s first unified AMM and permissionless on-chain order book. SynFutures is backed by top investors, including Pantera Capital, Polychain, Standard Crypto, and HashKey.

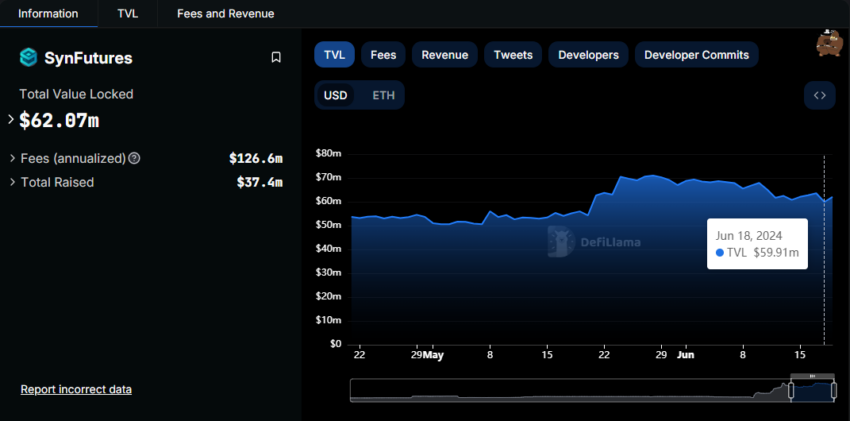

Protocol’s TVL Rises By Over $2 Million In 24 Hours

This news caused the decentralized derivatives protocol’s Total Value Locked (TVL) to soar by over $2 million, from $59.91 million to $62.07 million between June 18 and 19.

The TVL metric measures the amount of capital users have collectively deposited into smart contracts within a specific ecosystem. It is a key indicator of activity and adoption within the DeFi space.

Read More: What are Perpetual Futures Contracts in Cryptocurrency?

SynFutures’ rise to fame came as startups capitalized on the implosion of Sam Bankman-Fried’s (SBF) crypto empire, FTX. Specifically, this demise created the need for more transparent, decentralized forms of crypto trading.

“There’s no way for us to do any backdoor out there. For every fund, you could see yourself: how are the funds doing? What is the exact price that you’re trading at? What is the exact liquidity line,” said SynFutures’ co-founder and CEO Rachel Lin in a 2023 Reddit post.

The protocol became attractive for traders because all SynFutures-facilitated transactions happen on-chain, and users’ funds are stored in self-custodial wallets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.