Sui’s (SUI) Total Value Locked (TVL) is nearing the $1 billion mark, leading to speculation that the native token of this Layer-1 blockchain could reach a new all-time high. SUI has been one of the best performers in the past 30 days, second only to Bittensor (TAO), outpacing every other altcoin in the top 100.

This remarkable surge has drawn comparisons to Solana’s (SOL) impressive rallies in 2021 and 2023. The big question now is whether SUI’s price will continue to climb or if the current momentum will start to slow down.

Sui Gets Close to Crucial Landmark

On August 5, during a broader crypto market crash, Sui’s TVL plummeted to $342 million. However, since then, it has surged nearly threefold, with DeFiLlama data now showing it at $913 million.

This rapid increase in TVL has pushed Sui ahead of Polygon (POL) and brought it close to the $1 billion milestone. TVL, a key metric, reflects the dollar value of assets staked or locked within a protocol. A decrease in TVL indicates liquidity is being withdrawn, while an increase, like Sui’s 40% rise over the past 30 days, signals growing trust in the project and improved ecosystem health.

Read more: Everything You Need to Know About the Sui Blockchain

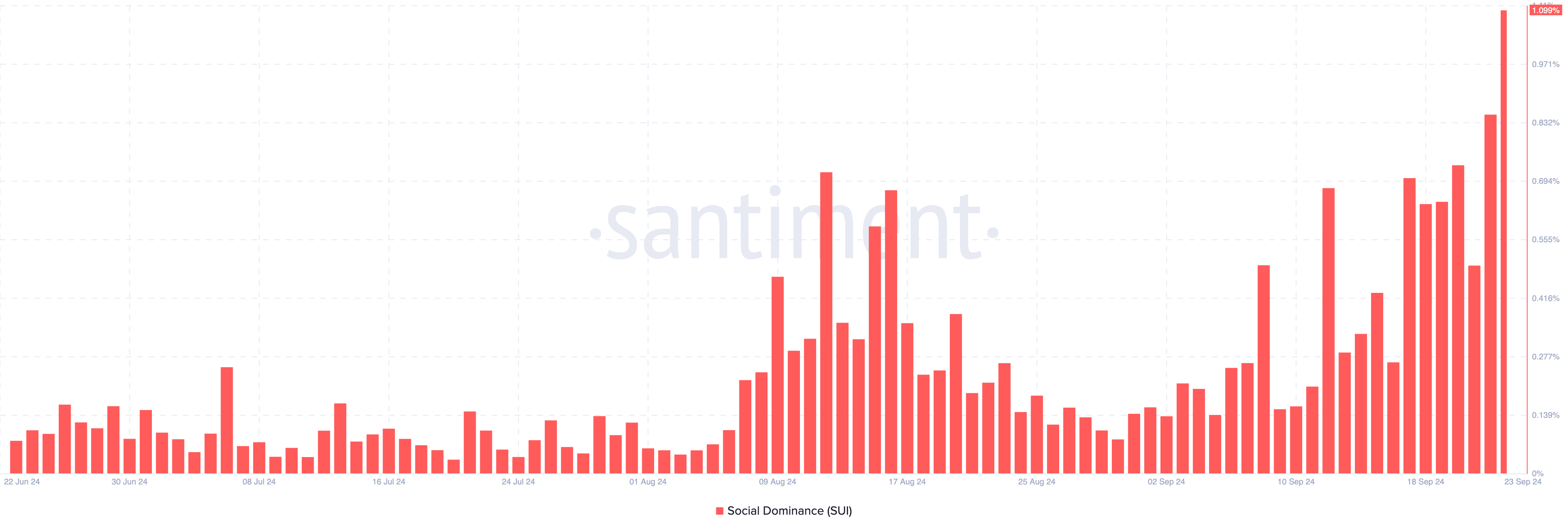

If the current trend holds, SUI’s price could benefit from the recent surge in Total Value Locked (TVL), potentially pushing it higher. This development has drawn comparisons with Solana, given Sui’s rapid growth. In addition to the TVL increase, on-chain data from Santiment reveals a spike in SUI’s social dominance.

Social dominance measures an asset’s share of discussions compared to the top 100 cryptocurrencies by market cap. A rise in social dominance means more people are talking about the asset, while a decline suggests waning interest.

If the dominance had fallen, Sui’s price might have decreased. Since the bull market is assumed to have returned in full force, the rising social dominance suggests that demand for the crypto might continue to climb.

SUI Price Prediction: All-Time High Again

On the daily chart, SUI bulls faced challenges in their recent push to $1.54. As the price approached $0.83, it met resistance that initially aimed to pull it back. However, the 20-day Exponential Moving Average (EMA) crossed above the 50-day EMA at this point, signaling a bullish trend.

This crossover helped SUI’s price break through the $1.06 resistance. If these EMA positions hold in the coming weeks, SUI’s price could potentially rise by 42%, reaching its all-time high of $2.18.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

On the other hand, SUI’s price could face a pullback if demand for the cryptocurrency falls short of the 64 million tokens set to be unlocked on October 1. In this case, the influx of new tokens could lead to a correction, potentially pushing the price down to $1.32.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.