Stellar’s (XLM) price is looking to recoup its recent losses after avoiding falling below the one-year low.

The path ahead for XLM seems rather positive, as the altcoin supports the broader market and investors.

Stellar Investors Stand Optimistic

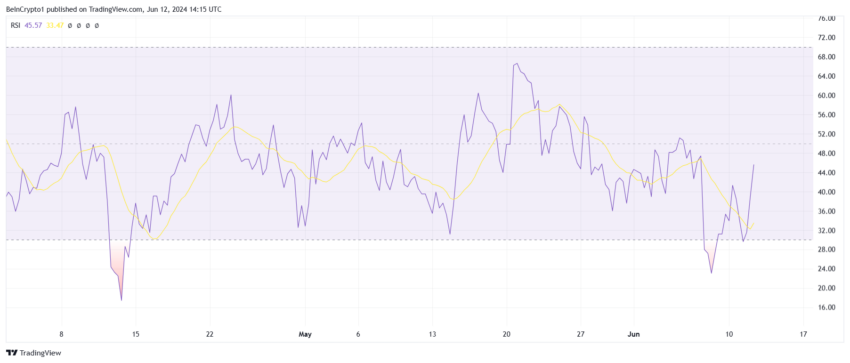

Stellar’s price is expected to grow in the coming days as the crypto asset observes rising interest. The positive cues from the broader market are the first sign visible in the Relative Strength Index (RSI).

The RSI is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100. It is used to identify overbought or oversold conditions in a market and typically indicates potential reversal points.

The indicator has bounced back from the oversold threshold of 30.0 over the last few days. RSI is now inching close to breaching past the neutral line at 50.0, enabling XLM to reinitiate a recovery rally.

Read More: How To Buy Stellar (XLM) and Everything You Need To Know

Furthermore, XLM investors are also optimistic about a rally, as evidenced by their behavior. They are pining for a price rise, which is evident in the positive funding rate.

The funding rate is a periodic payment made between traders in futures contracts to maintain price parity with the spot market. Positive rates indicate that long positions pay short positions, while negative rates mean short positions pay long positions.

When the funding rate is positive, long contracts dominate short contracts. Conversely, negative rates suggest short contracts are taking precedence. In the case of XLM, the funding rates are consistently positive, indicating investors are anticipating a price rise.

XLM Price Prediction: Aiming for Recovery

Stellar’s price bounced off the support floor of $0.096 to trade at $0.099 at the time of writing. The next major resistance now sits at $0.104, and given the aforementioned factors, the chances of breaching are high.

A break above the $0.104 resistance would recover the recent losses and enable XLM to rally further.

Read More: Stellar (XLM) Price Prediction 2024/2025/2030

However, failure to breach it would result in Stellar’s price losing the support of $0.10 for good. This would invalidate the bullish thesis, pushing the altcoin further upwards.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.