Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for insight into what Standard Chartered expects the next half of the year to look like for Bitcoin (BTC). Amid a unique mix of institutional flows, geopolitical tension, and macroeconomic uncertainty, the pioneer crypto continues to show strength, with experts anticipating even more growth.

Crypto News of the Day: ETF Flows, Trump Risk, and Policy Shifts Could Send Bitcoin to $200,000

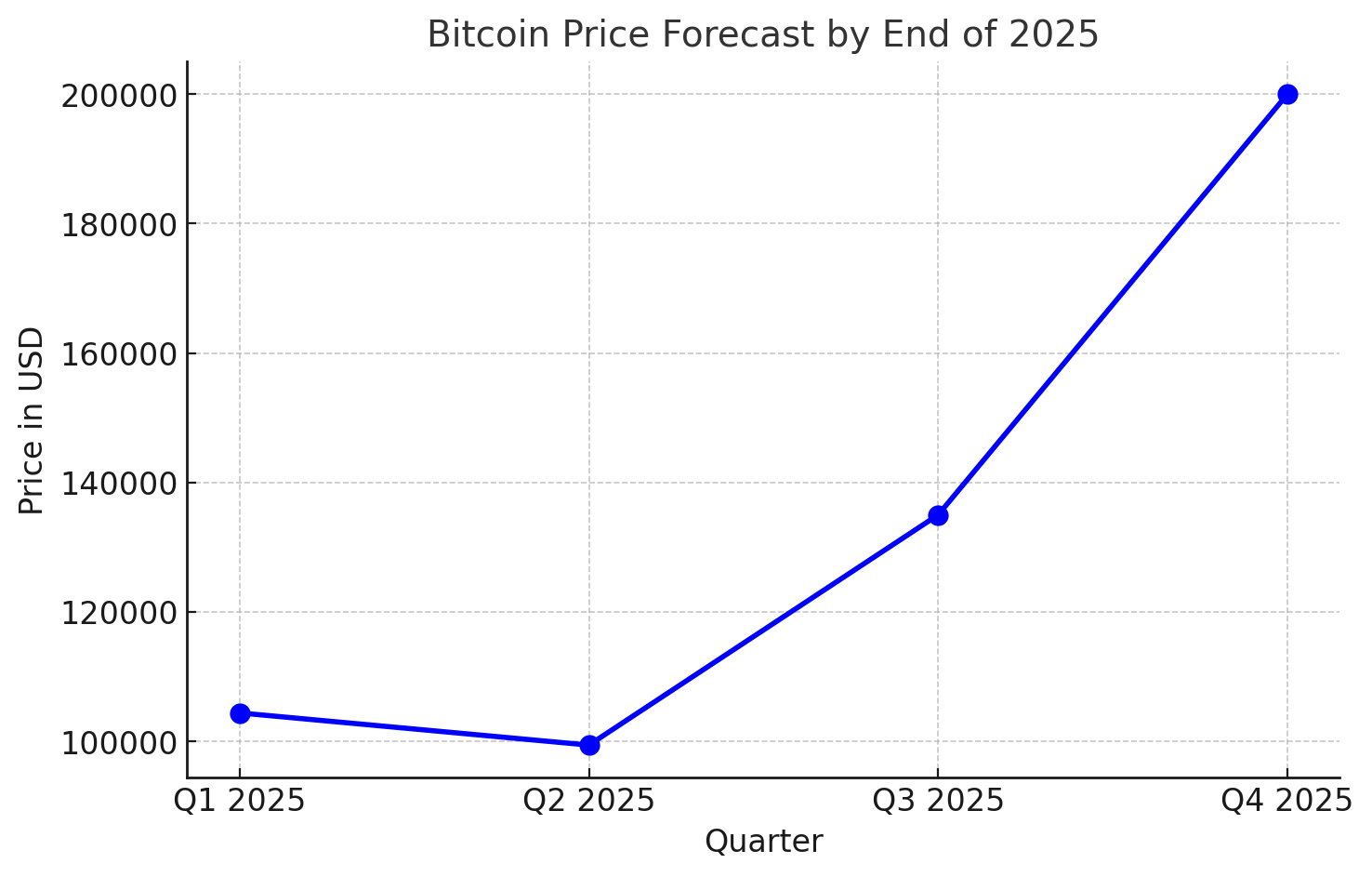

In a recent US Crypto News publication, Standard Chartered predicted Bitcoin would rise to $200,000 by the fourth quarter (Q4).

In a statement to BeInCrypto, the bank reiterated the target and then some, forecasting BTC’s best second half ever.

“We maintain our year-end forecast of $200,000…I expect H2 2025 to be Bitcoin’s best ever,” Standard Chartered Head of Digital Assets Research Geoff Kendrick said in a statement to BeInCrypto.

Kendrick’s strong forecast comes amid expectations of strong institutional inflows through ETFs (exchange-traded funds) and corporate treasury buying. The Standard Chartered executive said these would exceed Q2 buying in both Q3 and Q4.

Further, Geoff Kendrick anticipates more tailwinds from the expedited US stablecoin bill and the growing sovereign buying.

According to Kendrick, additional catalysts could include rising risks to the Federal Reserve’s (Fed) independence from President Trump, as reported in a recent US Crypto News publication.

He says these would open crypto traders’ and investors’ eyes to the realization that this Bitcoin halving cycle is different from previous ones.

“…the market will come to realize that the pattern from previous halving cycles…We expect Bitcoin to print new all-time highs in H2…We believe BTC has moved beyond the previous dynamic whereby prices fell 18 months after a ‘halving’ cycle (which would have led to price declines in September-October 2025,” Kendrick explained.

Against this backdrop, the Standard Chartered executive forecasts $135,000 for Q3 and $200,000 by Q4. Increased investor inflows are a key driver of this traction.

This aligns with a recent US Crypto News publication, highlighting Bitwise’s bullish forecast for Ethereum ETFs. For Bitcoin ETFs, however, Kendrick highlights flows and corporate treasury buying totaling in Q3 and Q4 exceeding the 245,000 BTC recorded in Q2.

Nevertheless, Kendrick does not rule out choppy price action, particularly in late Q3 and early Q4, citing concerns about historical patterns repeating post-halving. However, prices would resume their uptrend, ultimately achieving Standard Chartered’s $200,000 target.

BlackRock’s Bitcoin ETF Out-Earns Its $624 Billion S&P 500 Fund on Fees

Elsewhere, BlackRock’s bold leap into crypto continues to pay off, in a literal sense. According to reports, IBIT, the firm’s spot Bitcoin ETF, has generated more fee revenue in 2024 than its massive $624 billion iShares S&P 500 ETF (IVV).

Despite holding just $74 billion in assets, IBIT has earned $187.2 million in fees year-to-date (YTD), slightly edging out IVV’s $187.1 million.

Reportedly, BlackRock’s expense ratio on Bitcoin is higher than that of VanEck, according to Mathew Sigel, the firm’s head of digital assets research.

The discrepancy is economic, given that Bitcoin ETFs command much higher fees, sometimes up to 8x more than traditional index funds.

This explains why BlackRock, and CEO Larry Fink in particular, has leaned into digital assets. Fink projects a $700,000 Bitcoin price target amid institutional interest.

While once a crypto skeptic, Fink now champions Bitcoin as a new asset class. The change in perspective is an ideological pivot now backed by real dollars.

The results suggest Bitcoin is going beyond diversifying investor portfolios, reshaping Wall Street’s business model.

As fee compression continues to squeeze margins in traditional finance (TradFi), crypto ETFs like IBIT offer asset managers a lucrative alternative.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Strategy (MSTR) stock surges past $407 despite Bitcoin disclosure class action.

- Bitcoin hits $110,000 as Coinbase Premium and market greed surge.

- Crypto billionaire bites off attacker’s finger in Estonia kidnap attempt

- Custodia and Kraken are leading the crypto firms in the race for the Federal Reserve master accounts.

- How the US and Swiss approaches differ in crypto staking regulation in 2025.

- Hyperliquid whale loses $15 million betting against the market.

- BONK rises 22% as ETF excitement sparks fresh rally.

- Bitcoin’s rally towards an all-time high may have more room to run.

- Here’s what caused Bitcoin mining output to drop in June.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 2 | Pre-Market Overview |

| Strategy (MSTR) | $402.28 | $403.17 (+0.22%) |

| Coinbase Global (COIN) | $354.45 | $355.70 (+0.35%) |

| Galaxy Digital Holdings (GLXY) | $22.22 | $22.41 (+0.86%) |

| MARA Holdings (MARA) | $17.80 | $17.67 (-0.73%) |

| Riot Platforms (RIOT) | $12.20 | $12.28 (+0.66%) |

| Core Scientific (CORZ) | $17.56 | $17.48 (-0.46%) |