The crypto market has sustained remarkable growth since the beginning of the year, with the stablecoin sector showcasing significant expansion.

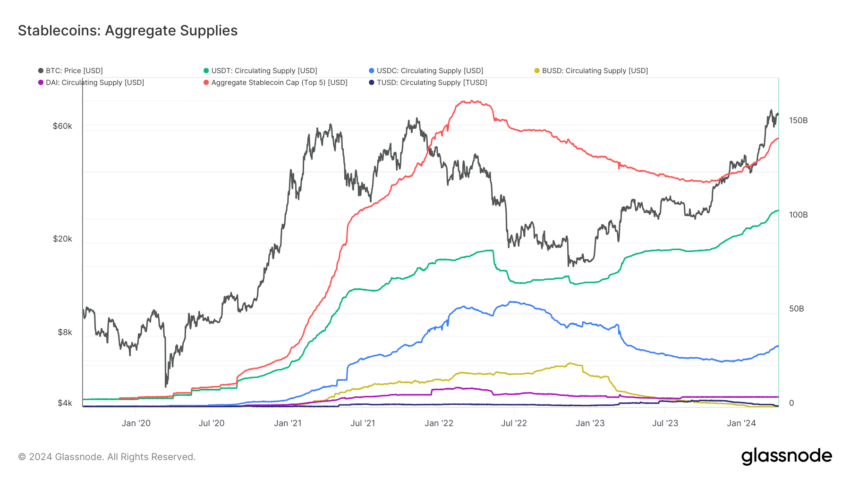

According to DeFiLlama, the stablecoin supply has surged by nearly $20 billion since the year’s outset, reaching over $150 billion. This marks the highest level observed since the collapse of FTX in November 2022.

Why Stablecoin’s $150 Billion Surge Since January Matters

Stablecoins are a crucial bridge between the crypto market and conventional fiat currencies. Given their prevalence and popularity among traders, stablecoins significantly influence liquidity. Therefore, the recent uptick signifies a prevailing optimism within crypto markets, indicative of increased capital infusion.

Tether’s USDT remains the frontrunner having recently surpassed $100 billion in market capitalization. Its growth trajectory persists, now standing at approximately $104 billion.

Concurrently, Circle’s USDC is undergoing a resurgence amid prevailing market conditions. Expanding its presence across various blockchain networks, its supply has surged to $32 billion, reflecting heightened activity and investor confidence.

Read more: A Guide to the Best Stablecoins in 2024

Meanwhile, recent newcomers to the cryptocurrency market, such as FDUSD and Ethena’s USDe synthetic dollar stablecoin, have experienced a surge in supply. FDUSD’s growth is largely fueled by adoption on platforms like Binance, while USDe benefits from solid support within the crypto community and provides attractive yields on its deposits.

“[Stablecoins] rise in March is likely attributable to heightened demand from trading activities on centralized exchanges and decentralized applications, as Bitcoin achieved new all-time highs for the first time since May 2021,” CCData explained.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

Interestingly, the supply surge has led to a notable uptick in trading volume across various assets. According to data from the crypto analysis platform CCData, trading volume for stablecoins saw a 5.14% increase, reaching $1.09 trillion in February. This marks the highest trading volume for stablecoins on centralized exchanges (CEXs) since December 2021.

Moreover, CCData predicts that March will surpass this figure, with trading volume already hitting a substantial amount by mid-month.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.