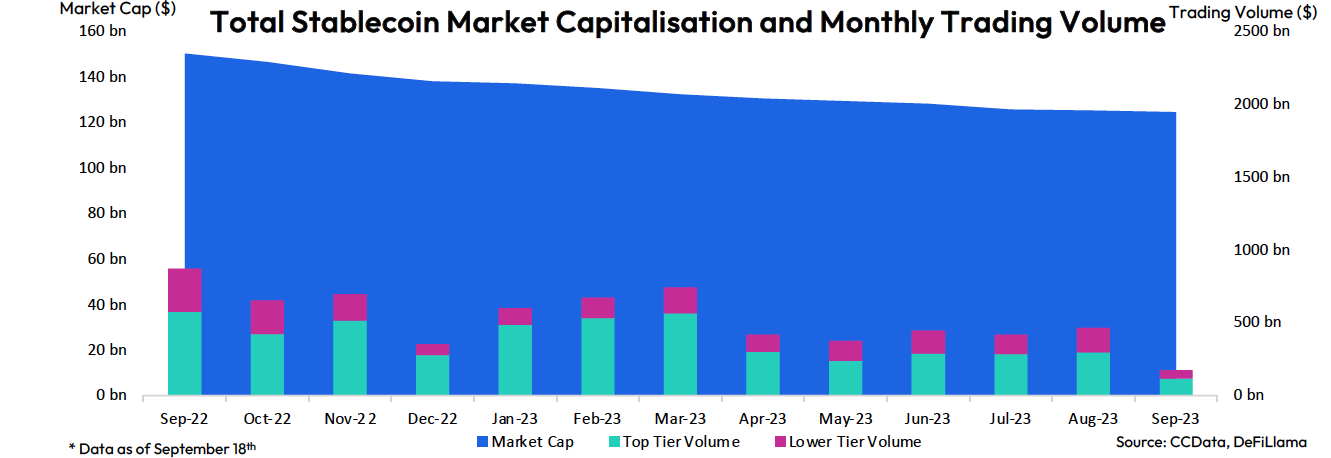

A new report from CCData reveals that the market capitalization of stablecoins fell to $124 billion in September, its lowest level since August 2021. Further, stablecoin dominance of the whole crypto market cap fell 0.2% to 11.6% as of Sep. 18.

Of the 118 stablecoins evaluated, BUSD and FRAX recorded the largest declines among the top 10 by market cap. BUSD’s market cap declined 19.2% to $2.5 billion, while FRAX’s share fell 16.7% to $670 million.

Thin Markets Lower Trading Volumes

The decline in BUSD is hardly surprising after New York’s financial regulator ordered issuer Paxos to stop minting the coin.

Newcomer PYUSD saw its trading activity increase fourfold between August and September. Huobi bagged the highest share of volumes at 57%, while USDT, now the largest stablecoin by market cap, saw its valuation increase by 0.23% to $83 billion.

However, despite an increase in overall stablecoin trading volume to $462 billion in August, activity on centralized exchanges remains muted. Uncertain regulations and tough macro conditions are pushing investors to lower-risk government investments like treasuries.

As a result, stablecoins, which are often a gateway between traditional finance and crypto, may be growing less popular as investors favor less risky investments. In a recent opinion piece for the Wall Street Journal, Brian P. Brooks, the former US Acting Comptroller of the Currency, said US dollar-backed stablecoins, if regulated correctly, could quash foreign attempts to de-dollarize.

What is a stablecoin, and how can it help you trade crypto? Find out here.

Asian Stablecoins Ripe for New Opportunities

But, the global push for tokenization has spurred the development of non-dollar-backed stablecoins whose value propositions are growing.

Japanese bank Mitsubishi UFJ Financial Group announced its new Progmat stablecoin platform in June. The platform allows banks to issue assets on various public blockchains, including Ethereum and Polygon.

Learn more about the blockchain infrastructure stablecoins use to settle transactions here.

Minna Bank, a digital lender, as well as Tokyo Kiraboshi Financial Group and Shikoku Bank, will all issue yen-backed stablecoins on a platform provided by Tokyo startup G.U. Technologies. Upcoming regulations to govern SGD-backed stablecoins in Singapore have prompted interest from issuers, including StraitsX, the issuer of SGD-backed XSGD stablecoin, and Circle Singapore.

Do you have something to say about the continuing decline in the stablecoin market cap, the rise of foreign stablecoins, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).