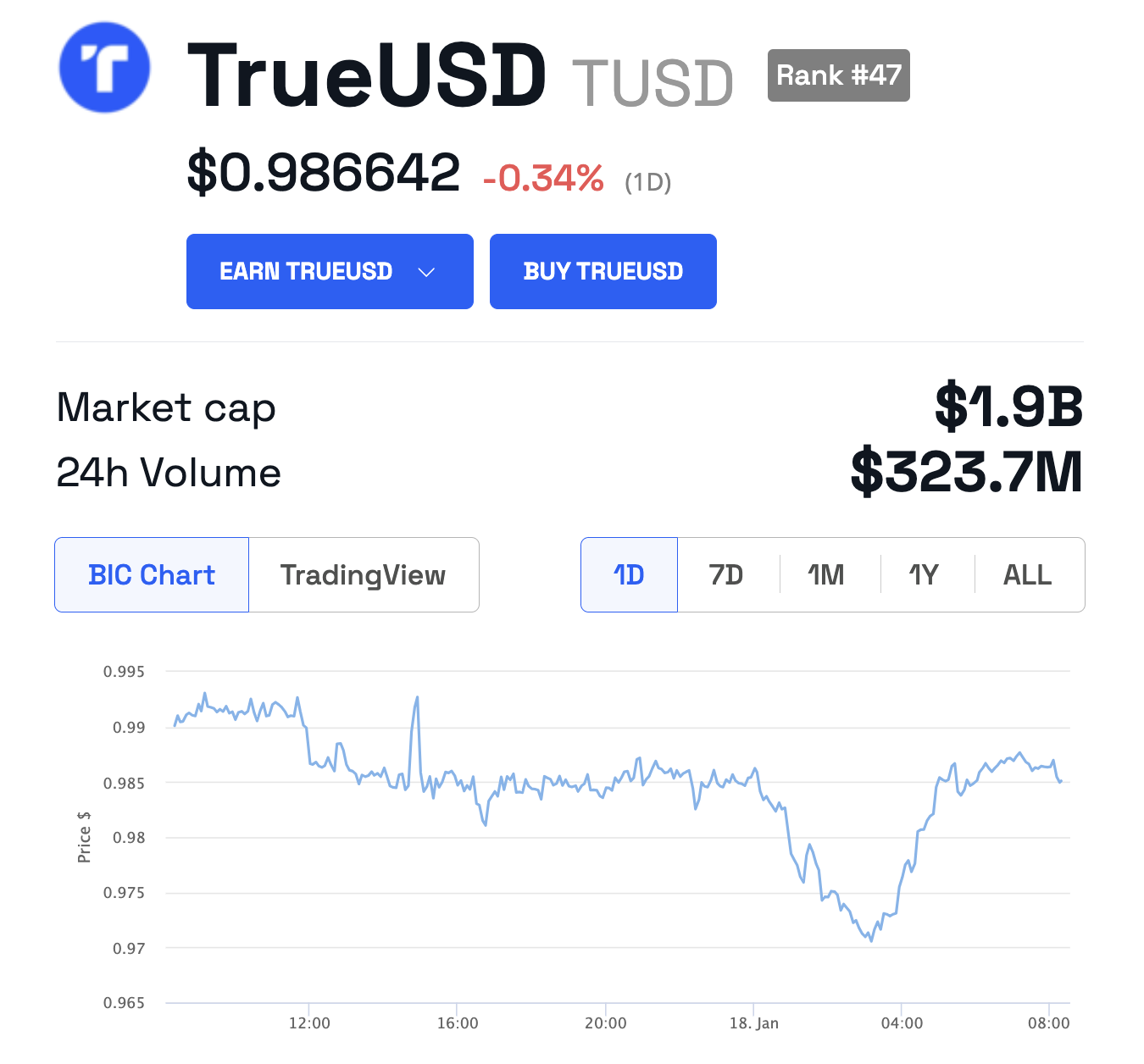

TrueUSD, a stablecoin linked to the founder of the Tron blockchain, Justin Sun, depegged in the past 24 hours to below $0.97. This depegging comes as the team behind the algorithmic stablecoin FRAX readies to launch a new Ethereum rollup.

Wu Blockchain said outflows from TrueUSD in the last 24 hours came to around $141 million. The outflow of funds caused a depeg despite a recent report attesting to TrueUSD reserves.

How Coins Like TrueUSD Lose Their Peg

The market capitalization of TrueUSD is $1.9 billion, making it the fifth-largest stablecoin after USDT, USDC, DAI, and FDUSD. The price of the token had not yet recovered to $1 at the time of writing.

Read more: What Is a Stablecoin? A Beginner’s Guide

Binance supported the rise in the use of TrueUSD last year. In June, Binance launched free trading for all TrueUSD pairs. The move caused BTC trading volumes to flourish on the exchange.

Stablecoins like TrueUSD rely on other assets to maintain a value of one unit of fiat currency. In the case of TrueUSD, the stablecoin is pegged to the US dollar.

Whenever someone wants 1 TUSD, they must provide $1 cash. A crypto company then does the technical job of converting that deposit into one fiat unit on a blockchain network.

When that conversion is done, all transactions on the blockchain recognize the buyer’s address as holding a tokenized version of a fiat currency. The amount held is the same value as the cash the buyer spent.

Why Accurate TUSD Reserves Are Important

Stablecoin issuers need funds when the buyer wants to exchange his tokenized asset for cash. Therefore, crypto companies need liquid assets called reserves to fulfill all withdrawal requests.

“For any financial market to be efficient, it needs to be liquid. There needs to be a lot of trading going on, it needs to be functioning smoothly,” According to Glen Goodman, author of The Crypto Trader.

If there is increased demand for the coin, market volatility, or a lack of confidence in the stablecoin issuer, and the issuer does not have liquid assets to provide in exchange for one stablecoin, the value of one unit of the stablecoin could deviate from the value of one unit of fiat currency.

Read more: What Is Curve (CRV)?

Following allegations that reserves did not fully collateralize its coin, TrueUSD upgraded its reserve system on Wednesday. FRAX, one of the largest stablecoins, relies on collateral and an algorithm to keep its value at $1.

FRAX issuer Frax Finance will launch a new rollup called Fraxtal. The network will launch in the first week of February. Curve, a decentralized stablecoin exchange, plans to deploy on Fraxtal.