The Korea Fair Trade Commission (KFTC) is considering bringing the operator of South Korea’s largest exchange, Upbit, under “large business” regulations.

The Korea Herald reported that Dunamu’s reclassification as a large business will likely bring Upbit under more stringent government regulations.

Dunamu owns and operates Upbit among other investment platforms. The operator came under review during KFTC’s annual assessment for businesses with total assets over 5 trillion won ($4.03 billion).

Additional regulations would include disclosing information on major intracompany dealings, board decisions and shareholders, along with disclosing conflict that could provide “unfair” benefits to related parties, the local report underlined.

Sources to the paper revealed that the KFTC can likely group Dunamu as a “non-financial business,” further stating customer deposits with Upbit as the firm’s own assets. Currently, the KFTC does not classify crypto companies and services firms as financial businesses.

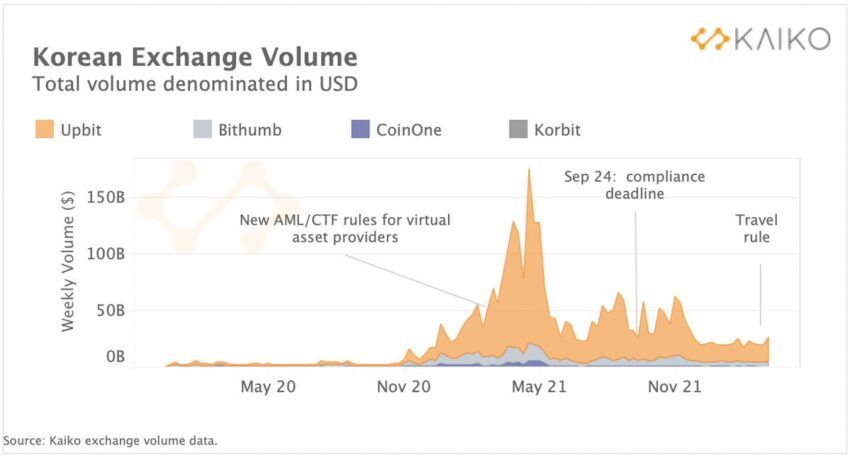

The Monopoly Regulation and Fair Trade Act also defines conditions for large businesses to promote competition in markets. Currently, the top five exchanges including Upbit, Bithumb, Coinone, Korbit, and Gopax are dominating the crypto market.

South Korea introduces AML safeguards

Under the Moon Jae-in administration, South Korea has been making regulatory changes to implement anti-money laundering and counter-terrorist financing (AML/CFT) safeguards in the crypto sector.

The shakeup left Upbit with a form of monopolistic advantage. Looking at the trading volumes from Sept 2021, Upbit led the market, despite other exchanges receiving regulatory approvals thereafter.

However, Dunamu now holds close to 10.4 trillion won in assets as of end-2021, according to government data. Therefore, it will be categorized as “companies subject to limitations on mutual investment,” prohibiting it from certain activities.

Meanwhile, the Korea Federation of Banks (KFB) is reportedly asking South Korea’s incoming presidential administration to approve local banks servicing cryptocurrencies.

Non-crypto companies are also entering the crypto space. e-Commerce platform Tmon and luxury hotel and resort brand Ananti are making an entry into the virtual currency space expanding the workforce in the area.

Tmon is reportedly set to allow consumers purchasing on its platform, to use virtual currency like digital cash.

These changes could possibly dethrone Upbit as the leader in the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.