Solana’s (SOL) price has been an institutional favorite for the last couple of months, but this is changing again.

As Q3 approaches its end, the outflows of large wallet holders, along with the declining strength, are killing the uptrend.

Solana Is Losing Its Grip

Solana’s price is bound to continue its ongoing consolidation after the altcoin failed to note a considerable recovery. There are two reasons in why SOL may not continue its uptrend, the first being the dying trend.

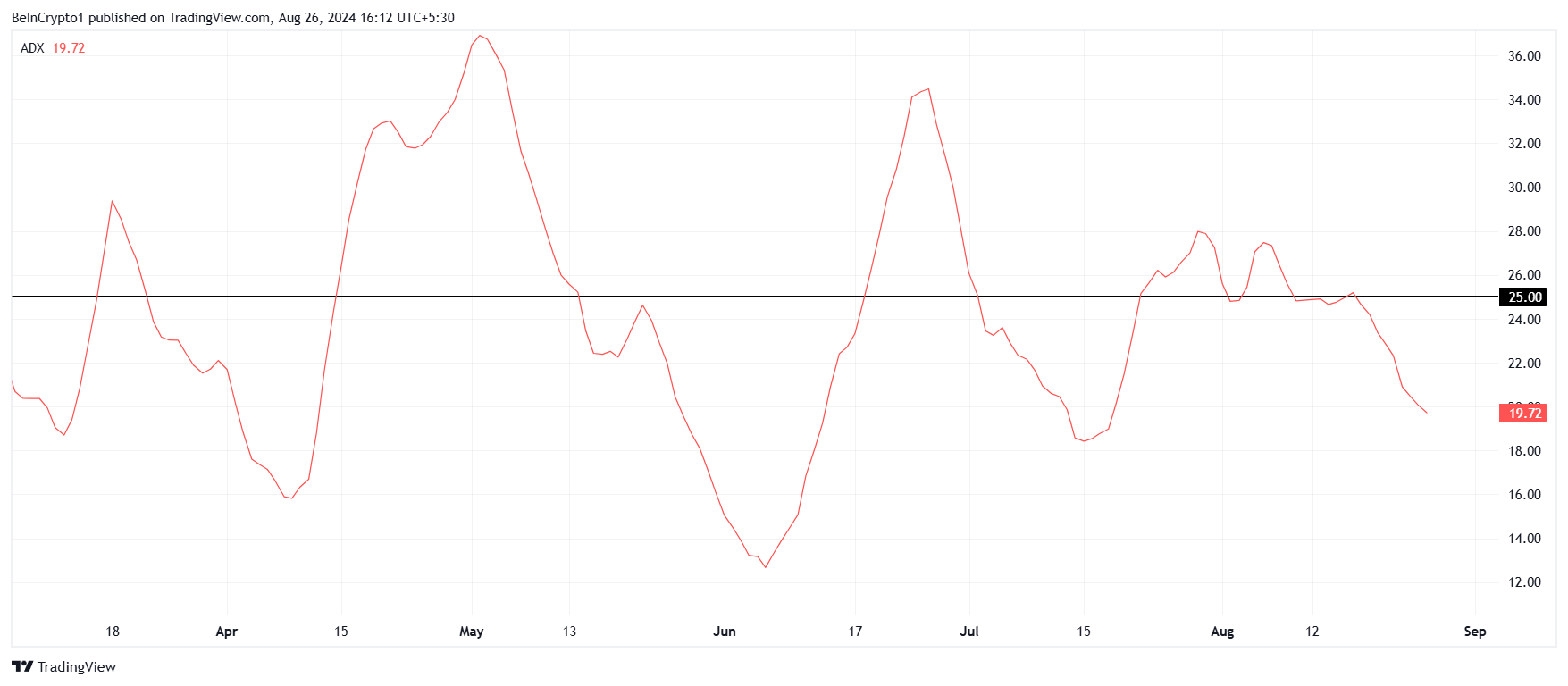

The Average Directional Index (ADX) falling below the 25.0 threshold indicates that the uptrend has completely lost its momentum. This technical indicator, which measures the strength of a trend, suggests that the market no longer has a strong directional bias.

This suggests that the possibility of a recovery has become increasingly difficult. Without a clear trend direction, the market may struggle to gain upward momentum. If selling pressure intensifies, this situation could lead to a period of consolidation or even further decline.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

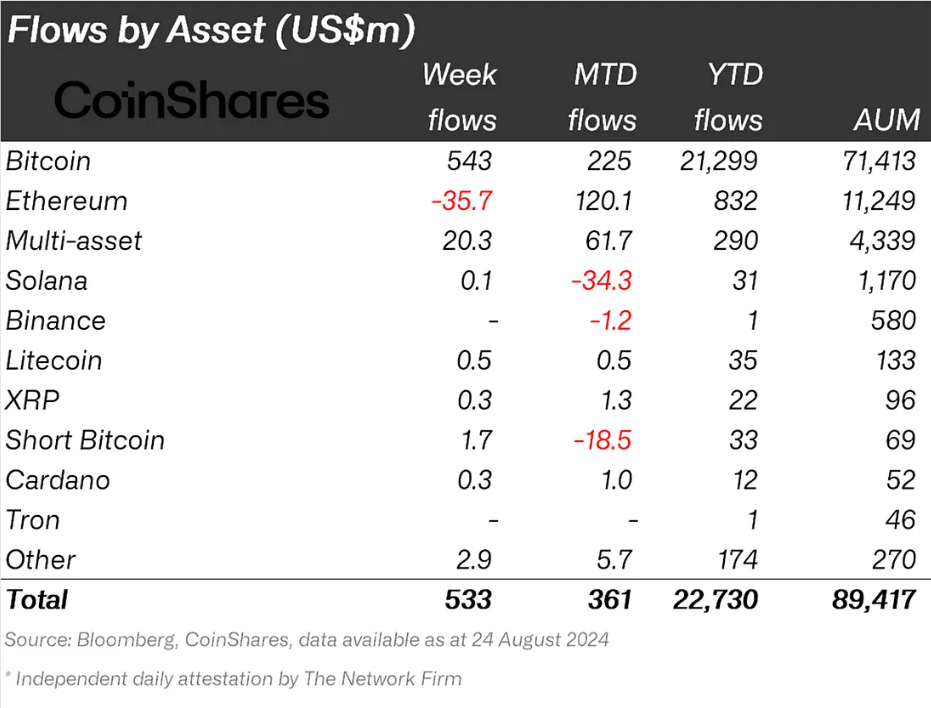

Further substantiating this outcome is the waning interest of the large wallet holders, i.e., the institutional investors. These mega investors had shown strong interest in the asset, but their interest has since declined.

According to the report from CoinShares, the week ending August 24 saw inflows of just $100,000 in SOL. This is the lowest of all the assets, with even Cardano noting $300,000 in inflows. As a result, SOL’s month-to-date outflows have reached $34 million.

If this continues, it could have a negative effect on Solana.

SOL Price Prediction: Barriers Ahead

Solana’s price has risen by 24% in the span of 20 days, bringing the altcoin to trade at $161. Currently holding above the support of $156, SOL is looking to breach the barrier of $175 in order to initiate recovery.

However, the aforementioned factors could hamper this rise, leaving Solana’s price stranded under $175. The consolidation between $175 and $126 would continue, leaving some of the losses from July’s 20$ crash unrecovered.

ad more: 11 Top Solana Meme Coins to Watch in August 2024

Sponsored

This could, however, change if $175 is flipped into support and the crypto asset continues its uptrend. Reaching $186 recovers the lost gains and, at the same time, invalidates the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.