Solana’s (SOL) price is failing to recover its recent losses, not just because of the broader market’s bearishness but also because of institutions’ bearishness.

This comes after Brazil approved yet another spot, SOL ETF, making the lack of confidence surprising.

Solana Institutional Investors Step Back

Solana’s price was expected to benefit from the second spot SOL ETF approval in Brazil this week. The approval could have triggered recovery, setting a precedent for the altcoin worldwide.

However, institutional investors have already been withdrawing from SOL heavily, which could further counter this bullishness. As a matter of fact, in terms of bearishness, Solana has outperformed even Bitcoin and Ethereum.

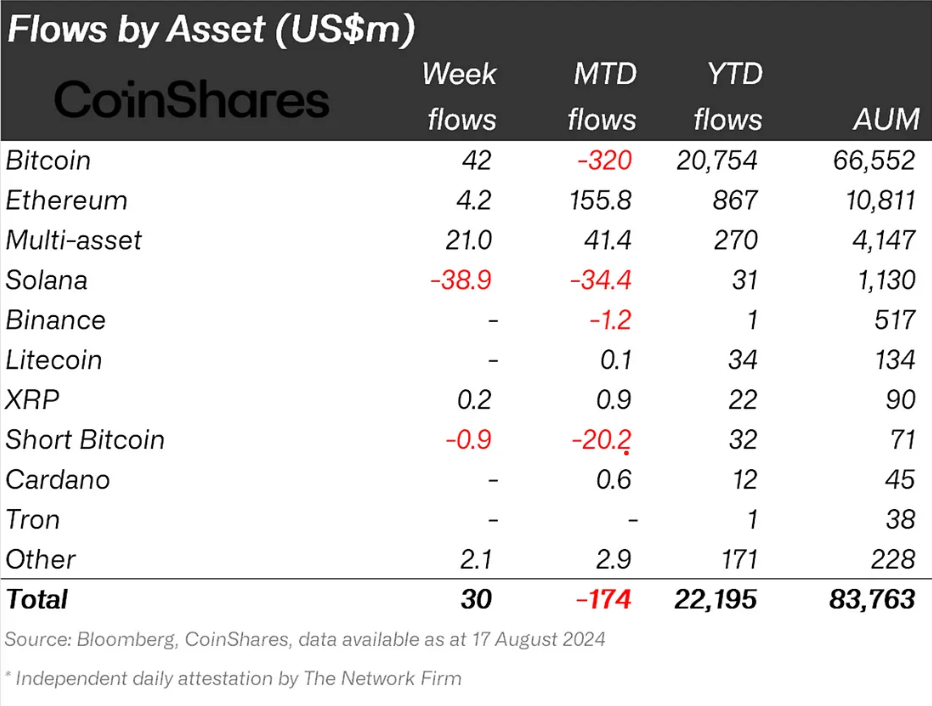

According to the report from CoinShares, for the week ending August 17, SOL noted outflows amounting to $38.9 million. This brought Solana’s year-to-date flows down to $31 million less than that of Litecoin.

Read more: 11 Top Solana Meme Coins to Watch in August 2024

This withdrawal could worsen the pessimistic atmosphere surrounding the altcoin’s price since the broader market cues are already negative. After breaching into the bullish zone, the Relative Strength Index (RSI) is back under the neutral line.

The drop suggests that the buying momentum was not sustainable and, as a result, waned. As long as RSI is below the neutral line, the possibility of a recovery remains bleak.

SOL Price Prediction: Keeping a Low Profile

Solana’s price is trading around the $150 mark at $142 at the time of writing, holding above the support of $137. The short-term recovery of SOL from $130 to $162 earlier this month has nearly failed. The crypto asset is likely set to consolidate under $156 as it has before.

Even if the support of $137 is invalidated, the altcoin will end up falling to $126, which is the critical support floor. A bounce back from this point will continue the macro consolidation within $186 and $126.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

However, the outlook could change if a gradual recovery helps Solana reclaim $156 as support. The SOL price could rise to $169, which, while it may not recover from the 30% crash from July, could still invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.