The Solana (SOL) price could soon break out from its short-term pattern and make another attempt at breaking out from a long-term resistance line.

In Solana news, the volume of decentralized exchanges on the Solana protocol fell considerably from its Jan. highs. The main reason for this is waning interest in the Bonk (BONK) blockchain project, whose release caused a massive spike in interest last month.

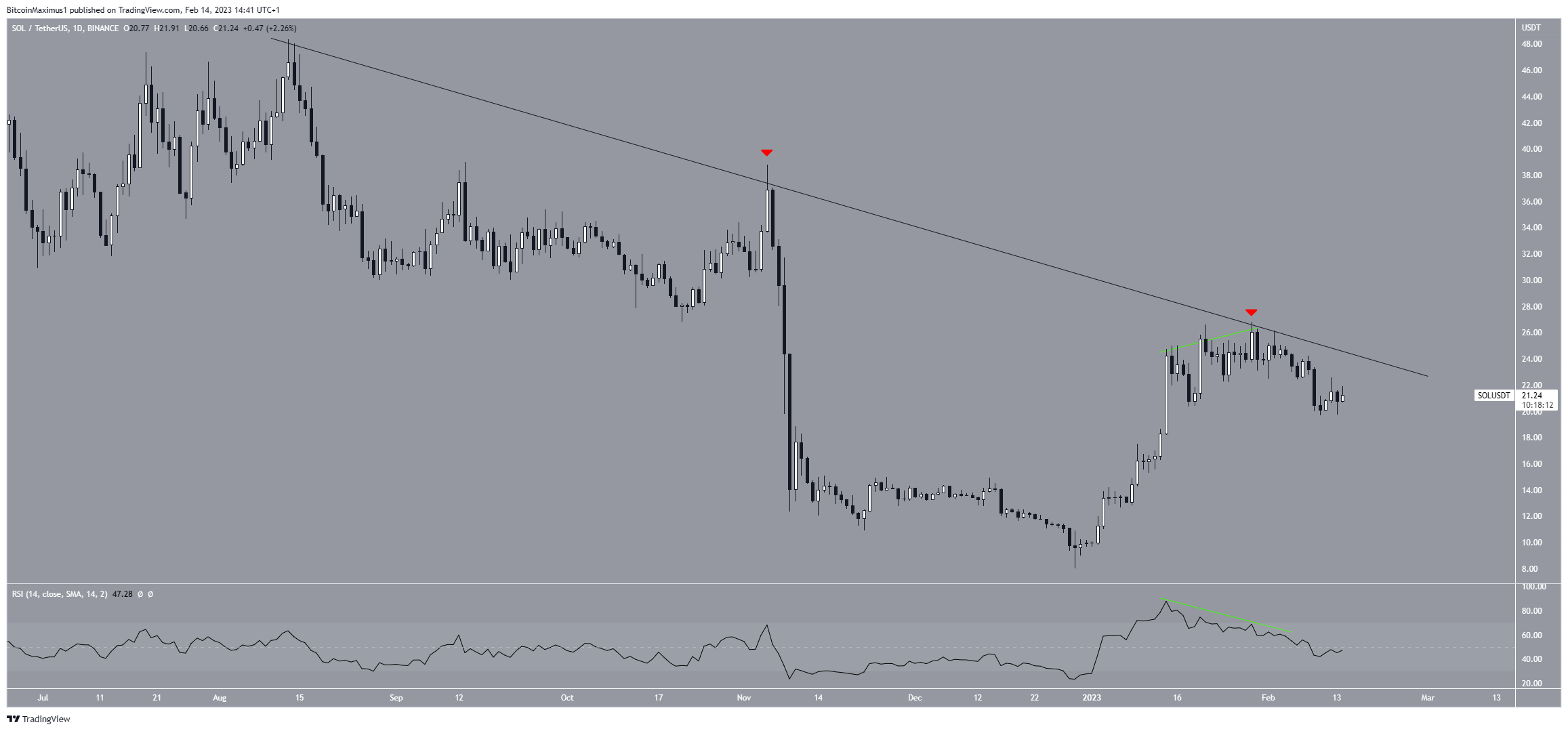

Solana Price Gets Rejected

The daily chart technical analysis shows that the SOL token price has fallen below a descending resistance line since Aug. 2022. The line has caused two rejections (red icons), most recently on Jan. 29. The rejection began the current downward movement.

The drop was preceded by a bearish divergence in the RSI (green line). Moreover, the indicator is now below 50, a sign of a bearish trend.

Therefore, the trend is considered bearish unless the Solana price breaks out from the resistance line. A breakout could lead to an upward movement toward $37. This would be an increase of 70%, measuring from the current price.

Solana Price Breaks Down From Support

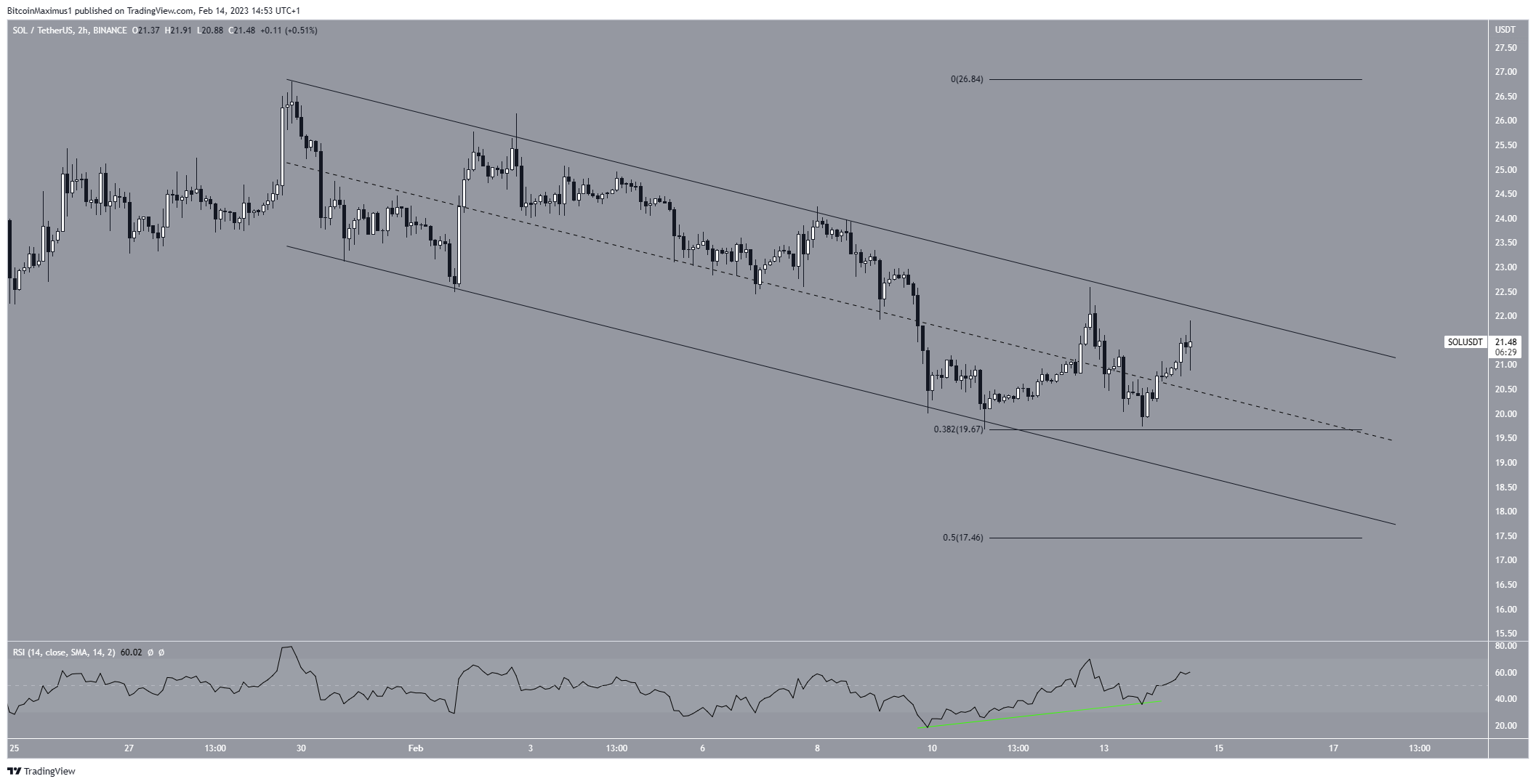

The short-term, six-hour chart shows that the SOL price broke down from an ascending support line on Jan. 30. Afterward, it validated it as resistance on Feb. 2 (red icon). The price has fallen since.

Over the past three days, the SOL token price has traded slightly above the 0.382 Fib retracement support level. Additionally, the six-hour RSI has generated bullish divergence. Similarly to how the daily RSI initiated a drop, the six-hour one can initiate a bounce.

Therefore, the SOL price may increase toward the resistance line once more. On the other hand, if it falls below $19.67, the digital currency could fall to $17.46.

Where Will Correction End?

Finally, the price history from the two-hour chart shows that the SOL price is trading inside a descending parallel channel. Such channels usually contain corrective patterns, meaning that an eventual breakout from it would be expected.

The fact that the price is trading in the upper portion of the channel and the bullish divergence from the six-hour chart support this possibility.

Since the channel is close to the long-term resistance line, a breakout above it could also trigger a breakout from the line. In that case, the SOL price could increase to $37.

While the Solana price could fall to the support line once more, validating the 0.5 Fib retracement support level at $17.46, this would still not invalidate the bullish forecast. However, a breakdown from the channel would do so and could lead to a drop toward $9.

To conclude, the most likely Solana price outlook is a breakout from the short-term channel and an attempt at breaking out from the long-term resistance line. On the other hand, a breakdown from the channel would invalidate this forecast and could lead to a significant fall toward $9.

For BeInCrypto’s latest crypto market analysis, click here.